Arable Market Report – 09 December 2024

Monday, 9 December 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

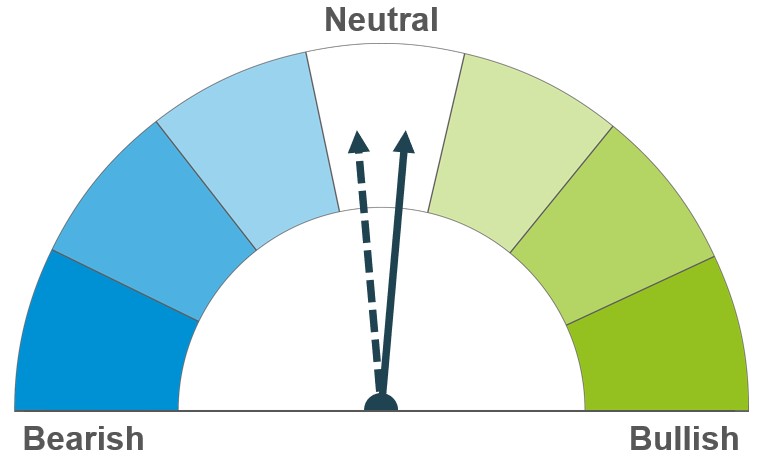

Wheat

Maize

Barley

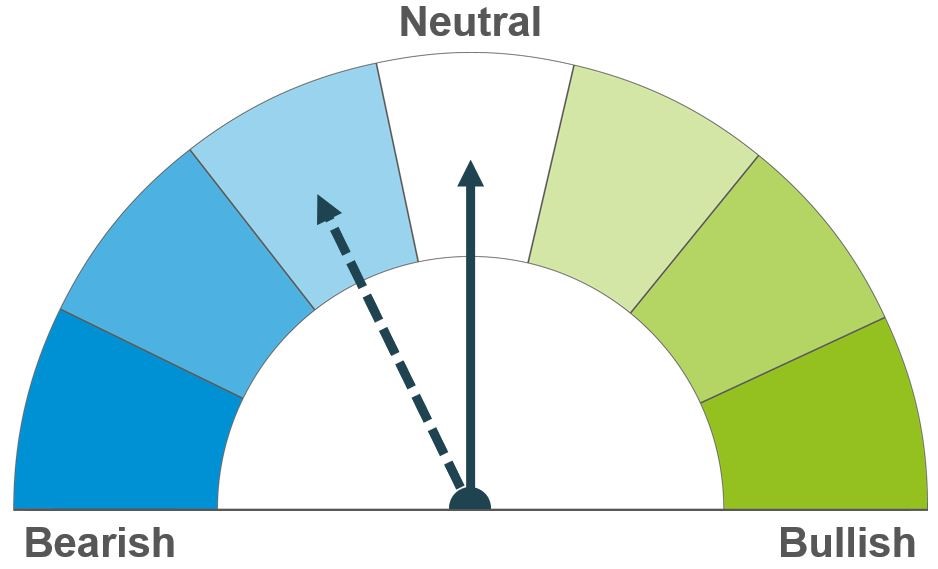

Continued competition from Black Sea origins seems set to continue to weigh on the market in the short-term, despite rises in maize. Longer-term, reports of poorer winter crop conditions in parts of the EU and Black Sea region could support prices.

The high level of exports from US and imports by EU and Mexico could provide short-term support. However, favourable weather in Brazil and Argentina could mean some pressure on prices in the long term, along with reduced maize imports from China.

Maize could support the barley market in the short term, but follows the more neutral outlook in the longer term due to low demand from importers.

Global grain markets

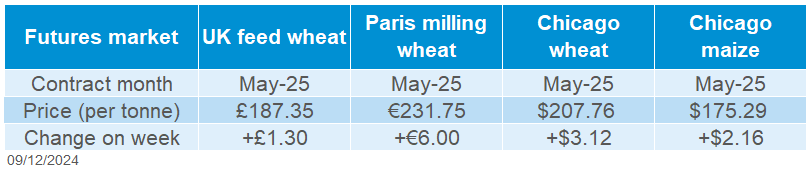

Global grain futures

Global grain markets were supported last week (Friday-Friday), with Paris milling wheat futures (May-25) up 2.7%. Grain prices fluctuated on supply information from major exporters, geopolitical risk and weather risk for the winter crops, particularly in Russia. Indeed, after reviewing weather forecast reports, there could be potential risks for winter wheat in south-eastern European countries.

Wheat export prices for France, US and Argentina, slightly increased last week and are a supportive factor for the near term.

In the US, the wheat and maize export pace is still at a strong level, which supported Chicago futures. However, US winter wheat crop conditions (good and excellent) were at the highest levels in the recent years at the end of November. Managed money also increased their net short position in Chicago wheat futures (SRW) as of 03 December, which may have limited gains.

Russia will increase its wheat export duty by almost 32% due to high inflation in the country and potential risk to winter crops (LSEG). The Crop Monitor for AMIS, published last Thursday shows Russia’s winter wheat crop in mixed conditions with the total sown area expected to decrease compared to last year. Despite rising export duty, Russian wheat export prices are favourable compared to other origins, pressuring grain markets.

In the Southern Hemisphere the wheat harvest continues under mixed conditions. In Australia, rains could result in lower quality of wheat. In the current marketing year Australian wheat export could be at a high level, with the government holding its production estimate almost unchanged.

For wheat demand, very important news has come from Egypt, where there could be change in grain purchases. Traditional GASC tenders could switch to Mostakbal Misr direct purchasing agreements in combinations with tenders.

Global barley trade still isn’t as active due to a lack of demand from major importers (e.g. China). In Canada, Statscan showed production of the 2024 barley crop up 0.5 Mt from its August forecast to 8.1 Mt, though still down 8.6% from 8.9 Mt in 2023. The Australian barley harvest is in its final stages, also adding competition to the market.

UK focus

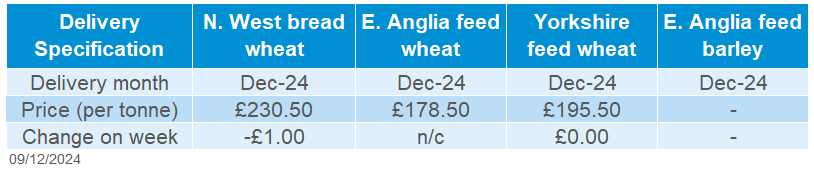

Delivered cereals

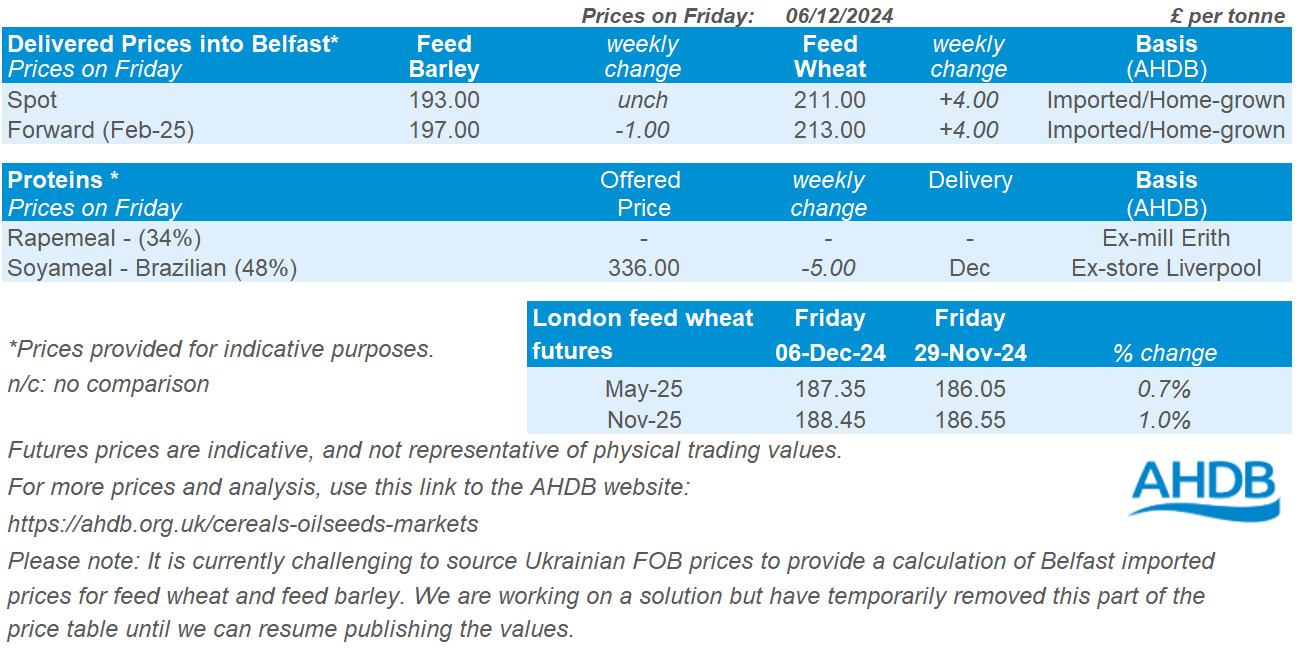

UK feed wheat futures tracked the direction of global wheat markets. The May-25 contract gained £1.30/t over the week (Friday-Friday) to close at £187.35/t, while the Nov-25 contact closed at £188.45/t, up £1.90/t over the same period. Last week domestic grains prices were weighed on by the strengthening of sterling against euro and US dollar. In UK feed wheat futures, speculators increased net short position by 277 lots to 1,167 lots as of 03 December.

Domestic delivered wheat prices fell across the week (Thursday-Thursday). Feed wheat delivered into Avonrange for December delivery was quoted at £181.50/t, £1.00/t less than the previous week. Bread wheat delivered to the North West for December delivery was quoted at £230.50/t £1.00/t less, while February delivery lost £1.50/t on the week to £234.00/t.

On Monday, AHDB published the online edition of the Recommended Lists for cereals and oilseeds 2025/26. The latest edition includes several eye-catching additions that will have wide appeal, as well as new varieties that target regional and niche situations.

On Thursday, AHDB published October data on GB animal feed production and UK human and industrial cereals usage. Updated data showed continued greater use of imported milling wheat by domestic flour millers and elevated use of maize for animal feed.

Official UK cereals and oilseeds production data for 2024/25 will be published by Defra on Thursday 12 December. Look out for analysis in Thursday’s Grain market daily.

Oilseeds

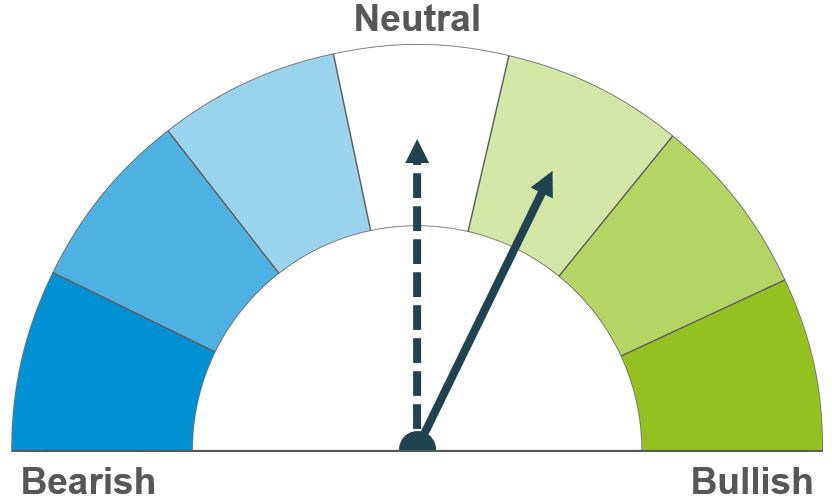

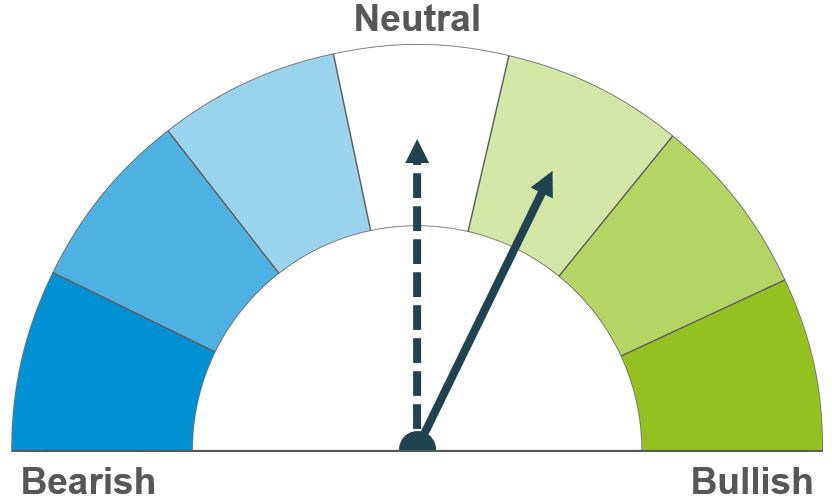

Rapeseed

Soyabeans

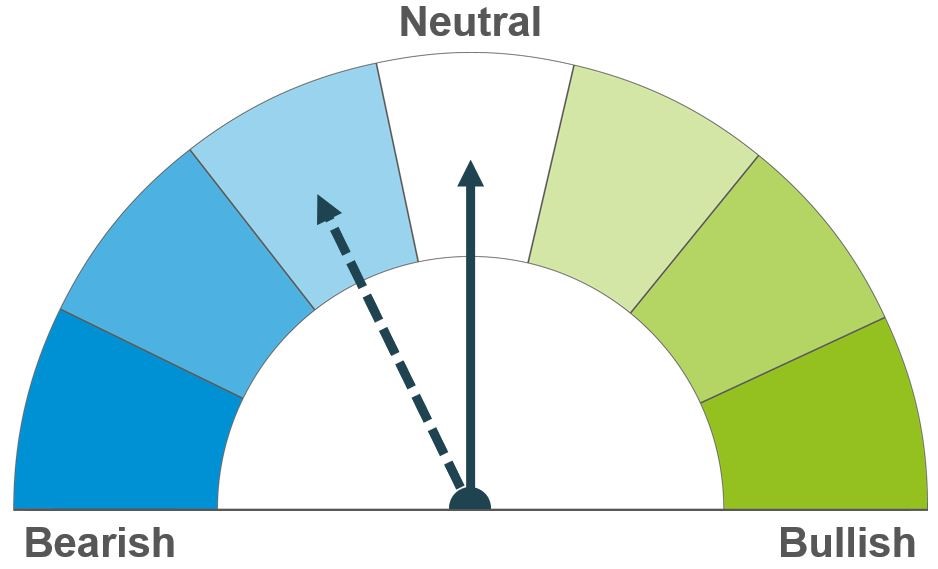

Lower rapeseed production in Canada and Australia offers some support to rapeseed prices both short and longer term. However, the anticipation of a record soyabean crop in Brazil weighs on the oilseed complex into 2025.

Soyabean markets find some support from record US crush volumes and continued strong US exports short-term. However, favourable conditions for and larger estimations of Brazil’s soyabean crop caps gains and weighs on the longer-term outlook.

Global oilseed markets

Global oilseed futures

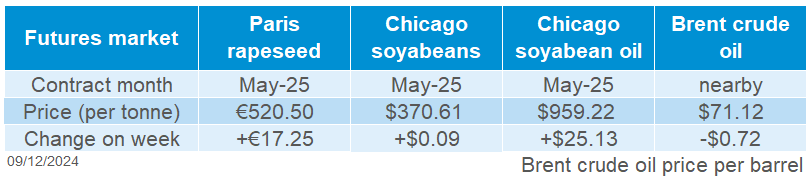

Despite facing headwinds from anticipation of a record Brazilian soyabean crop, oilseed markets found support last week following a strengthening in vegetable oils prices. Paris rapeseed futures (May-25) recovered from losses two weeks ago, rising 3.4% over the week to close at €520.50/t. Chicago soyabean futures (May-25) gained 0.02% across the week, to close at $370.61/t.

Vegetable oil prices found strength from India’s vegetable oil imports during November reaching a four-month high. Indian imports rose as refiners sought to replenish inventories after firm demand during the festival season. There was also support from a Reuters poll forecasting Malaysian palm oil stocks tightening by 5.1% on the month in November to 1.79 Mt due to heavy rainfall impacting production. The Malaysian Palm Oil Board release palm oil figures for November tomorrow (10 Dec). However, the Indonesian Palm Oil Association reported that stocks rose 23.3% in October to 3.02 Mt as exports fell back.

US soyabean sales for 22-28 November totalled 2.3 Mt, towards the upper-end of analyst estimates (LSEG). The period when US soyabean exports typically peak (Sep – Dec) is nearing its end, and the Southern Hemisphere harvests approach. US soyabean exports so far total 21.7 Mt. This is 44% of the USDA’s forecast (49.7 Mt), ahead of the five-year average for this time of year (38%). US soyabean crush for October totalled 6.5 Mt, the largest monthly crush on electronic records back to May 2015 (USDA).

Conab reported that planting of Brazil’s soyabean crop reached 90% complete as at 01 Dec, ahead of last year’s 83%. For most states, development is considered favourable due to benign weather conditions. Celeres and StoneX forecasted the crop at 170.8 Mt and 166.2 Mt respectively last week.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures (May-25) gained €17.25/t across the week (Friday-Friday) to close at €520.50/t, while the Aug-25 contract gained €6.25/t to close at €474.25/t. While also tracking support in the wider vegetable oils complex, lower year-on-year production estimates for Australia and Canada offered support.

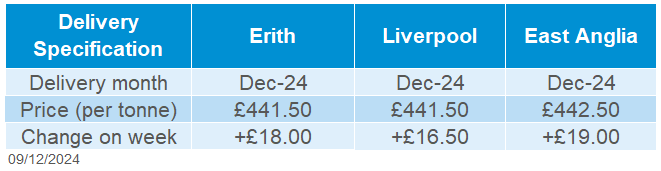

Rapeseed delivered to Erith for December 2024 delivery rose £18.00/t across the week (Friday-Friday), quoted at £441.50/t. Delivered prices for the new year rose by a slightly lesser extent, with May-25 delivery up £15.50/t, quoted at £444.50/t.

On Thursday (05 Dec), Statistics Canada reported Canada’s rapeseed harvest for 2024 at 17.8 Mt, lower than the 19.0 Mt estimate released in November and the 2023 harvest of 19.2 Mt, supporting Paris rapeseed futures. Lower production in 2024 was due to both lower yields and planted area.

On Monday (02 Dec), The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) left canola (rapeseed) production relatively unchanged from September’s estimate (+0.1 Mt). At 5.6 Mt, the crop still falls 8% lower than production last year (6.1 Mt) and 1% below the five-year average (5.8 Mt).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.