Arable Market Report - 11 August 2025

Monday, 11 August 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

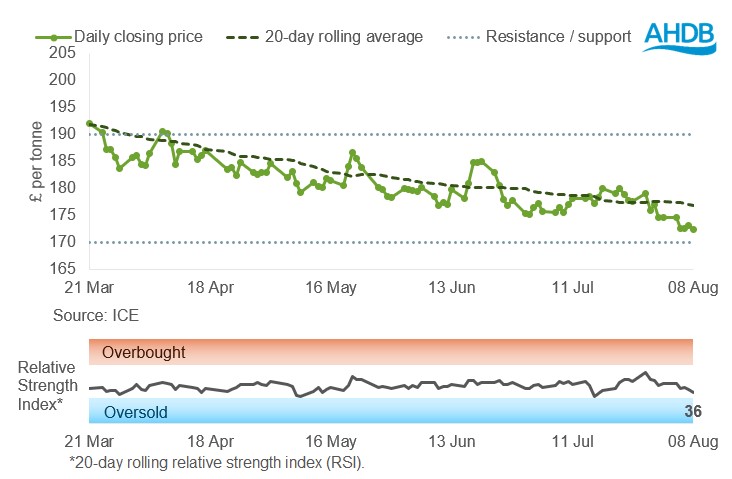

UK feed wheat futures (Nov-25)

UK feed wheat futures continued to move lower last week (Friday to Friday), closing not far above the support level of £170/t. The relative strength index (RSI) eased from 47 to 36, reflecting a slowdown in market momentum.

Find out more about the graphs in this report and how to use them

UK Harvest Progress

After this Market Report (11 August 2025) was written, we discovered an error in the harvest progress data published on Friday 08 August. For more information on this, please see our Harvest progress webpage.

Market drivers

UK feed wheat futures (Nov-25) continued to fall last week, finishing at a contract low of £172.40/t on Friday and down £2.15/t (-1.2%) on the week.

Domestic feed wheat futures followed global markets, which were pressured by strong supply prospects, harvest progress and lacklustre export demand. Paris milling wheat and Chicago milling wheat (Dec-25) fell by 0.6% and 0.4% respectively.

Expana (formerly Strategie Grains) has raised its EU-27 soft wheat crop estimate by 2.1 Mt to 132.8 Mt for this season sighting good yield and quality for southern Europe. Prospects also remain positive in northern Europe despite concerns about grain quality.

With Paris wheat futures hitting contract lows last week financial investors trimmed their net short position. As these positions can be used to profit from falling markets, this suggests they’re slightly less convinced prices will keep falling.

In the US, harvest progress is weighing on markets amid ample global supply. Chicago Dec-25 wheat futures hit a new contract low last Tuesday, along with multiple other contracts. The fall in prices has stimulated demand though, with higher-than-expected weekly export sales.

As of the 03 August 86% of the winter wheat had been harvested in the US, down 1 percentage point compared to five-year average.

In Ukraine, APK-Inform cut its wheat harvest forecast by 900 Kt to 19.7 Mt, citing dry weather during key growth stages. Meanwhile, maize output has been revised upwards by 2.4 Mt to 27.1 Mt, thanks to improved yields in central and southern regions.

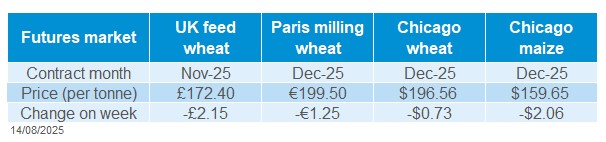

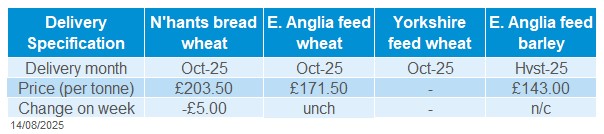

UK delivered cereal prices

Feed wheat delivered into East Anglia (September delivery) was quoted at £170.00/t at Thursday’s close.

Bread wheat delivered into the Northamptonshire in October was quoted at £203.50/t, down £5.00/t on the week.

Rapeseed

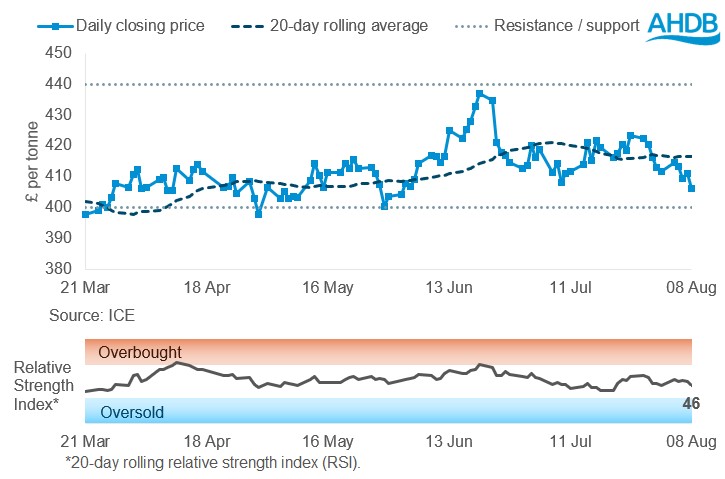

Paris rapeseed futures in £/t (Nov-25)

Last week (Friday–Friday), Paris rapeseed futures (in £/t) finished below the 20-day moving average again. However, the £400/t support level remains valid.

The relative strength index (RSI) increased from 45 to 46 during the week, indicating some price consolidation.

Find out more about the graphs in this report and how to use them

Market drivers

Paris rapeseed futures (Nov-25) fell last week to finish at €468.25/t down €6.75/t (1.4%) on the week (Friday-to-Friday). Winnipeg canola and Chicago soyabean futures (Nov-25) also fell during the week, by 1.9% and 0.2% respectively.

The global oilseed complex came under pressure due to favourable weather conditions in the US and Canada, high crop conditions scores for US soyabeans and falling crude oil prices. Furthermore, concerns over China's lack of purchases from the 2025 US soyabean crop so far put additional pressure on the market last week.

EU rapeseed imports in the 2025/26 season (which started on 1 July) had reached 0.26 Mt by 3 August, against 0.43 Mt a year earlier. Meanwhile, soyabean imports in the same period reached 0.97 Mt, compared with 1.30 Mt a year earlier.

APK-Inform has revised its forecast for Ukrainian rapeseed production in 2025 down from 3.2 Mt to 3.0 Mt. Sunflower seed production in 2025 was also cut by 5.5%, from 14.6 Mt to 13.8 Mt, due to poor weather conditions in the southern regions of the country.

As of 07 August, US net export sales for 2024/25 were 467.8 Kt, which was up 71% from the previous week and 63% from the prior four-week average. However, speculators increased their net short position in Chicago soyabeans in the week ending 5 August, which is putting pressure on the market in general.

China's soyabean imports reached a record high for July. Data from the General Administration of Customs showed that the world's largest soyabean importer brought in 11.7 Mt in July, up 18.5% from 9.9 Mt a year earlier (LSEG). Brazil actively exported soyabeans to China, while US soyabean exports were at risk due to concerns about unpredictability of tariffs.

Malaysian palm oil futures came under pressure due to concerns about rising production and stock levels. Weak export demand also had a negative impact on the market.

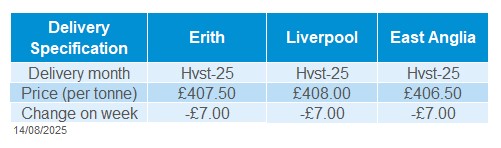

UK delivered rapeseed prices

Rapeseed to be delivered into Erith on the harvest contract was quoted at £407.50/t on Friday, down £7.00/t on the week.

Liverpool and East Anglia (same contract) delivery were quoted at £408.00/t and £406.50/t respectively, also both down £7.00/t on the week.

Extra information

New analysis from AHDB looks at whether we could see increased demand for British oats in future seasons; read more here.

New insights from AHDB’s 2025 Planting and Variety Survey reveal how farmers are responding to the evolving landscape of agricultural support as the UK continues its transition away from the Basic Payment Scheme (BPS).

On Thursday 07 August, AHDB released the latest UK human and industrial cereal usage and GB animal feed production, covering the period to the end of June. This means data for the full 2024/25 season is now available.

UK trade data for June 2025 will be released on Thursday (14 August), detailing cereal and oilseed import and export figures by country.

GB fertiliser prices will be released later this week (w/c 11 August) offering insight into input cost trends at a pivotal point in the season.

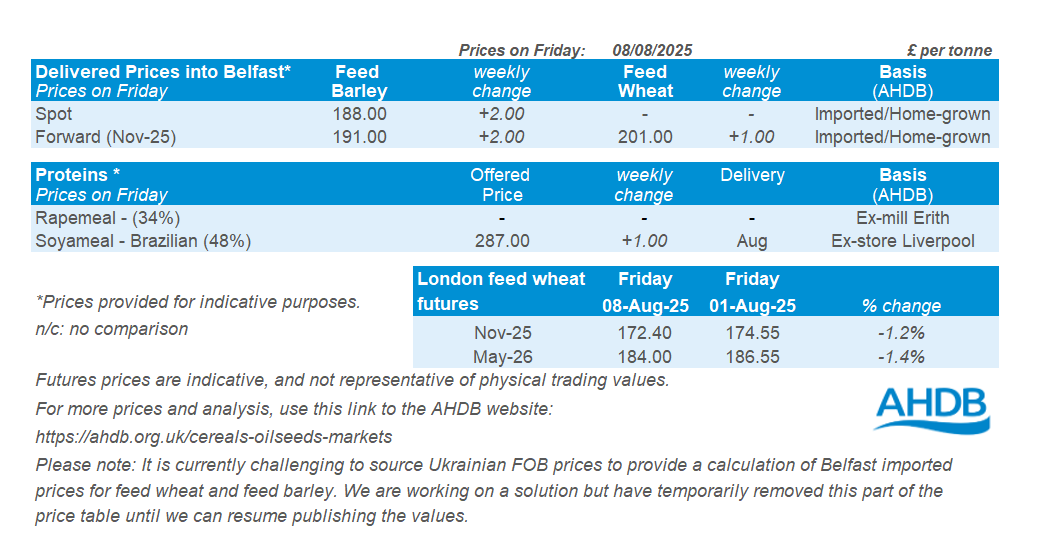

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.