Arable Market Report – 12 August 2024

Monday, 12 August 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

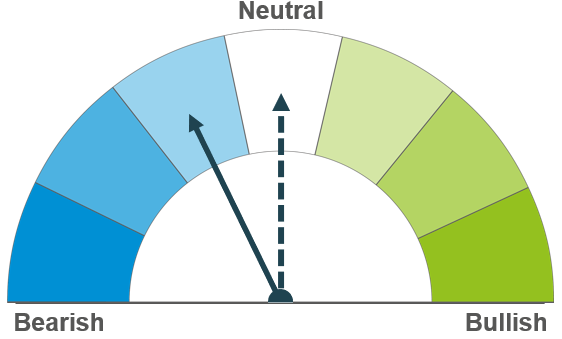

Improved demand and lower production estimates in Europe offer support to wheat prices, though ample Black Sea supply and positive US maize condition limits the outlook.

Benign weather forecast across the US Midwest continues to support US maize crops such that the market is expecting an increased yield from the USDA. However, the current low price of maize could encourage more demand.

Improved wheat demand in addition to production concerns in Europe offered support to wider cereals last week. However, in Europe, barley production is not believed to have been as negatively impacted as wheat, and so the better production outlook weighs.

Global grain markets

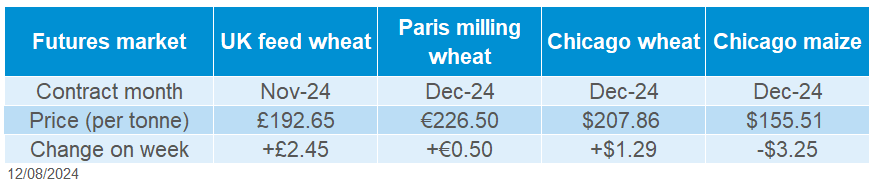

Global grain futures

Global wheat markets closed with a modest gain last week (Friday to Friday). Increased demand for wheat from key import origins and notably lower production forecasts for European wheat offered support. However, pressure from maize continues to cap gains for wheat as the market anticipates an increased US yield forecast in today’s USDA World Agricultural Supply and Demand Estimates (WASDE). The average analyst prediction is for a 0.6% increase to 182.1 bushels/acre (Refinitiv).

Wheat tenders from Egypt, and Jordan and Algeria last week, incentivised by relatively low prices of wheat, spurred European wheat markets. Egypt tendered for a record 3.8 Mt of wheat to cover imports from October 2024 to April 2025, while Jordan also issued a tender for wheat amounting to 120 Kt. Algeria purchased 600 Kt of wheat. The deadlines for Egypt and Jordan are today (12 August) and tomorrow (13 August) respectively. The result of these tenders is likely to influence the European market.

Cereals production for the EU-27 faced downward revisions last week by Stratégie Grains. EU soft wheat production was cut by 4.7% on the month to 116.5 Mt, the lowest production in six years. Grain quality is also a concern in many EU countries, particularly specific weights and protein levels. Furthermore, Stratégie Grains reduced the EU’s barley production by 1.4% on the month to 50.6 Mt and maize production by 3.2% to 60.0 Mt over the same period.

Argus Media forecasts French wheat production at 25.2 Mt, the lowest level since 1983 (24.5 Mt), attributing this to impact of rain on cropped area and yield. This is below France’s farm ministry at 26.3 Mt.

SovEcon forecasts Russian wheat production at 82.9 Mt, down from 84.7 Mt previously due to lower yields and a smaller cropped area. Meanwhile, IKAR increased its forecast by 0.6 Mt to 83.8 Mt.

UK focus

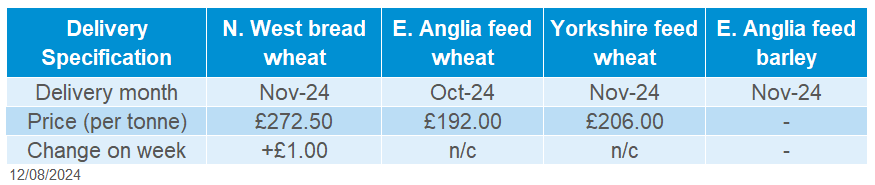

Delivered cereals

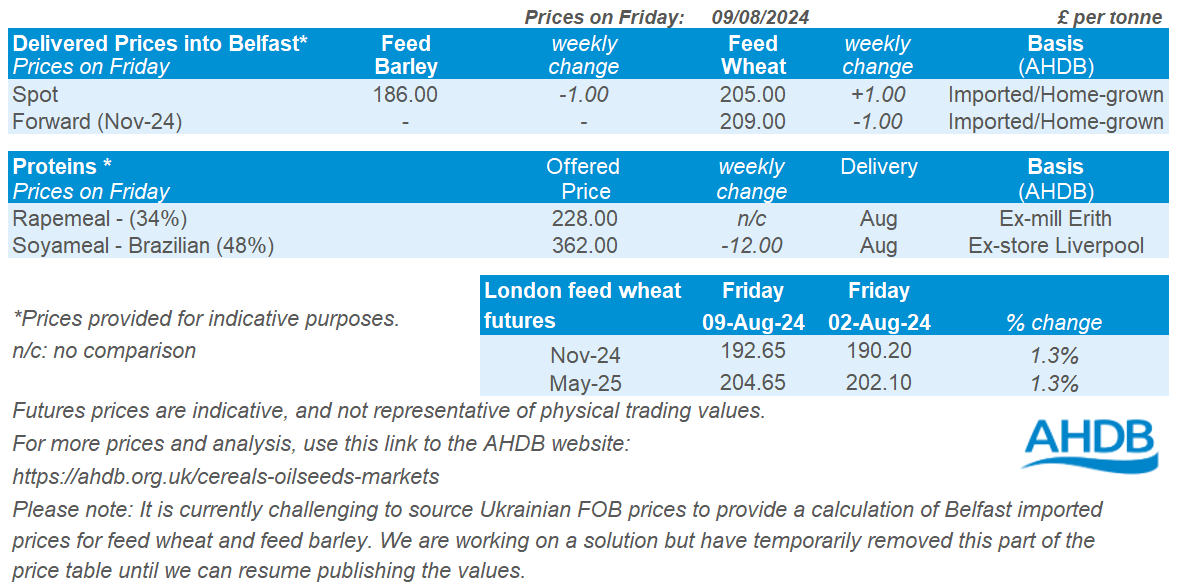

UK wheat futures followed global markets up last week (Friday to Friday). Nov-24 UK feed wheat futures closed on Friday at £192.65/t, up £2.45/t on the week. The May-25 contract gained £2.55/t over the same period, ending Friday’s session at £204.65/t.

Domestic delivered feed wheat prices followed futures up across the week (Thursday – Thursday). Feed wheat delivered into Avonrange for November delivery was quoted at £194.50/t on Thursday, up £1.00/t on the week. Bread wheat delivered into the North West for November delivery was quoted at £272.50/t, up £1.00/t on the week.

AHDB’s UK human and industrial cereal usage was published last week. Total wheat milled was down 4.1% from June 2023, but still up 2.8% for the total 2023/24 marketing year. Imported wheat usage remained elevated in June, up 40.5% in comparison to last year.

AHDB’s GB animal feed production data for June was also published. Total compound feed production for the 2023/24 marketing year was reported at 11.16 Mt, up just 0.2% from the previous season. In contrast, production for GB integrated poultry units from July 2023 to June 2024 saw a notable increase of 10.4% in comparison to the 2022/23 marketing year, totalling 2.28 Mt.

Updated results from AHDB’s Recommended List trials for winter barley have been released, showing fungicide-treated yields are still running slightly above the five-year average yield of control varieties. For winter oats trials, there’s a notable difference between control varieties in the treated trials and some of the fungicide-untreated trials.

Oilseeds

Rapeseed

Soyabeans

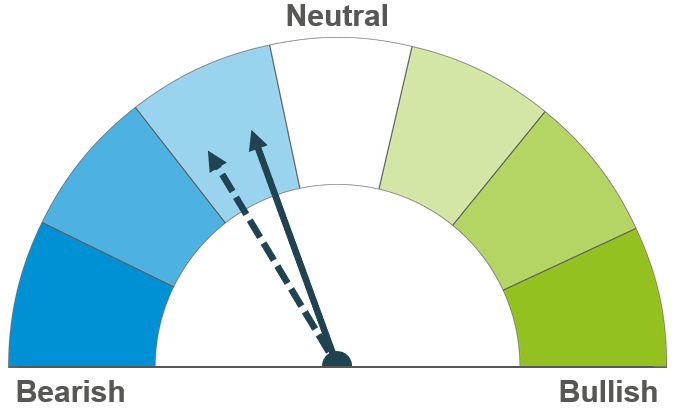

Short term, rapeseed prices look likely to continue to track the sentiment of the bearish soyabean market. However, smaller harvests in some major producing countries, especially in Europe, might help to cap losses in the long term.

The USDA could declare larger harvest in the US in its WASDE report, due out today. With the already high global supply, the current bearish pressure on soybean prices is likely to persist.

Global oilseed markets

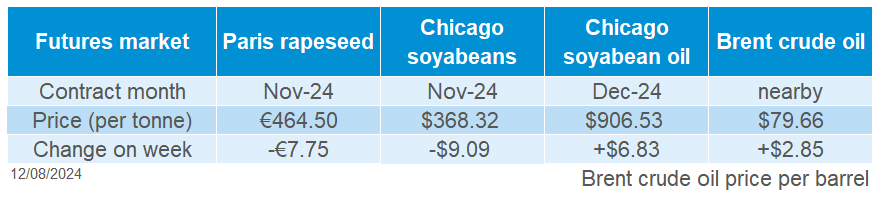

Global oilseed futures

Chicago soyabean futures (Nov-24) continued their downward trend last week (Friday-Friday), dropping by 2.4%. Soyabean prices have faced bearish pressure in the last couple of months due to several factors, including weak global demand and the prospect of a plentiful harvest this year. The slight supports from bargain buying and weakening of the dollar during last week were outweighed by these ongoing challenges.

Repositioning ahead of the USDA’s WASDE report, which is expected later today, also added pressure on prices during the week. The USDA is expected to forecast a larger soyabean harvest in the US, following favourable weather conditions (Refinitiv).

Brazil's soyabean exports reached 11.3 Mt in July 2024, up 16.0% compared to the same period last year. This growth was driven by increased exports to China, higher stock levels at the start of the season, which allowed for stronger start to exports, and favourable port conditions.

The president of the Brazilian Association of Soybean Growers (Aprosoja Brasil) expects the growth of soybean planting in Brazil will slow down for the 2024/25 season. The ongoing lower price environment is a significant challenge, and the flooding earlier this year may have reduced the amount of land available for planting.

A strike by Argentina’s oilseed unions is affecting shipments from key ports with soyabean processing plants. The disruption at the port is slowing down exports and might offer some support to soybean prices this week.

Malaysian palm oil futures (September-24) dropped by 4.3% over last week, continuing the downward trend observed in recent weeks. The Malaysian Palm Oil Board (MPOB) released its monthly report today. According to the report, crude palm oil production reached 1.84 Mt in July, up 13.5% from June (1.62 Mt). This is slightly above the market’s expected 12.7% increase.

Rapeseed focus

UK delivered oilseed prices

Rapeseed futures followed soyabean prices down last week (Friday-Friday). Paris rapeseed futures (Nov-24) fell €7.75/t to close at €464.50/t. The May-25 contract also declined by €9.25/t to close at €464.00/t.

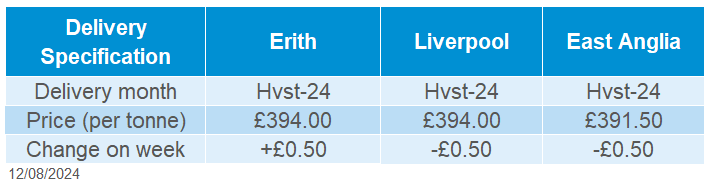

Delivered rapeseed prices were mixed. Rapeseed delivered into Erith for August delivery was quoted at £394.00/t on Friday, rising £0.50/t on the week. The delivery into East Anglia for November was quoted at £400.50/t, down £1.00/t on the week. Please note, the delivered prices survey was undertaken on Friday morning, and therefore will not take into account the price movement for Paris rapeseed futures across the whole day on Friday.

The European Union import of rapeseed for the new season 2024/25 has reached 0.35 Mt as at 4 July, compared to 0.23 Mt a year earlier. The key rapeseed imports origins remain Australia, Ukraine and Moldova.

Rapeseed (canola) crop is maturing quickly in Saskatchewan, the top producing province of Canada. Farmers are also observing sclerotinia stem rot emerging in their fields along with aborted pod development due to the extreme heat encountered during flowering.

LSEG maintained its forecast for Canada’s 2024/25 rapeseed crop at 18.6 Mt, which is below the USDA’s July estimate of 20.0 Mt. However, weather conditions into August remain crucial.

AHDB’s first Recommended List winter oilseed rape yield results from six trial sites: Wiltshire, Hampshire, Cambridgeshire (2), Northumberland and the Scottish Borders have been published. Yields are variable, ranging from 3.94 t/ha for the controls in the Hampshire trial to 6.08 t/ha in both the Cambridgeshire trials. Get more details here.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.