Arable Market Report – 12 January 2026

Monday, 12 January 2026

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

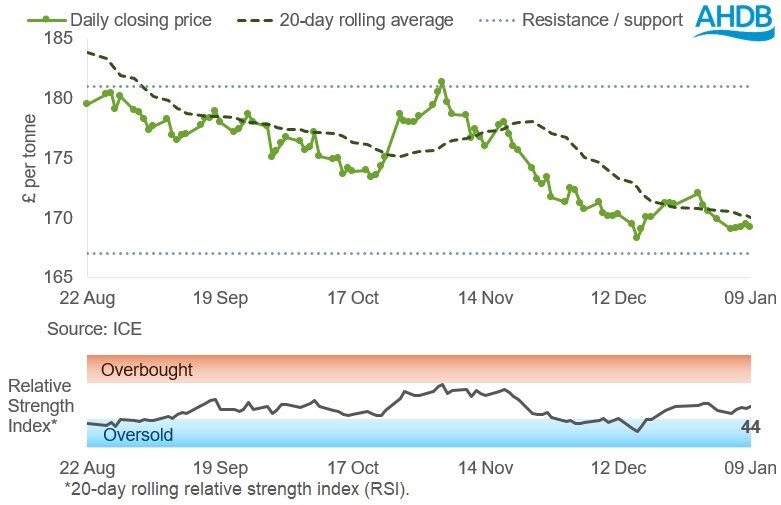

UK feed wheat futures (May-26)

UK feed wheat futures (May-26) closed again below the 20-day simple moving average at the end of last week, but remained above the nearest support level of £167/t.

The relative strength index (RSI) rose to 44 from 39 the previous week, suggesting that the price is consolidating before moving further.

Find out more about the graphs in this report and how to use them

Market drivers

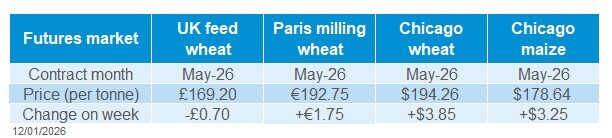

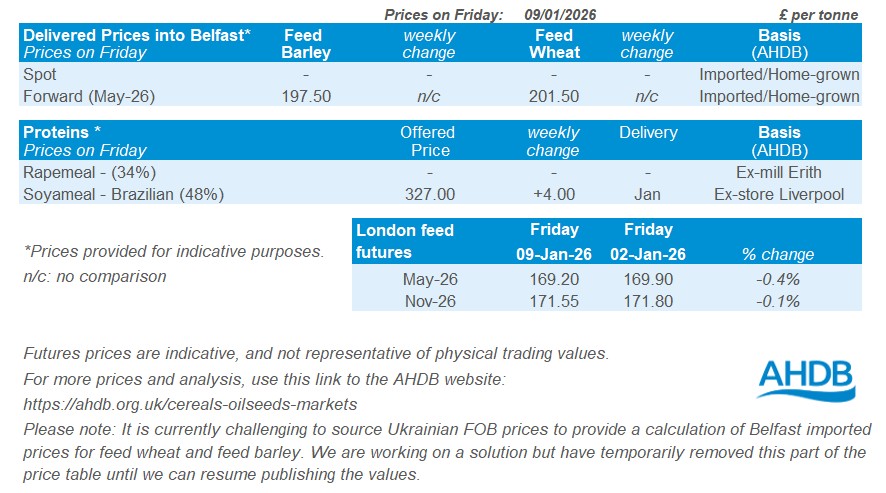

Despite firming global trends, UK feed wheat futures fell last week. Between 2 and 9 January, the May-26 contract fell by £0.70/t (0.4%) to close at £169.20/t. Meanwhile, Chicago wheat and Paris milling wheat futures (May-26) rose by 2.0% and 0.9% respectively. Last week, concerns about the dry weather affecting winter wheat in the US and Russia's attacks on Ukrainian infrastructure supported the global wheat market.

For the 2026 crop, UK feed wheat futures (Nov-26) fell by £0.25/t to £171.55/t from the previous week. This price is £2.35/t higher than the price of the 2025 crop (May-26). For comparison, the price of the new crop (Sep-26) in Chicago and Paris is £7.05/t and £3.04/t higher than the price of the old crop (May-26), respectively. The risk of adverse weather conditions for winter 2026 crops is currently higher due to lower temperatures in the Black Sea region.

The small price difference between Paris wheat and maize futures for the 2025 crop suggests that the EU maize balance sheet favours maize prices over wheat prices. In the UK domestic market, the premium for milling wheat remains low.

On 8 January, the USDA released export sales data for the week ending 1 January. Net wheat export sales were recorded at 118.7 Kt, which was lower than the trade had expected. Maize sales were also below trade estimates at 377.6 Kt. However, the current season's wheat and maize exports from the US are higher than last year and the five-year average at this point in time.

One potential future market driver is the USDA's World Agricultural Supply and Demand Estimates (WASDE), due to be published this evening alongside US grain stocks and winter wheat area data. An interesting question is how the pace of US wheat and maize exports could affect ending stocks.

For maize market, the weather situation in Brazil and Argentina is an important factor. According to Brazil government data, maize exports in December 2025 reached 6.13 Mt, compared to 4.26 Mt in December 2024.

EU barley exports from 1 July - 4 January reached 5.29 Mt, which is significantly higher than the 2.34 Mt recorded at the same time last season. Also, EU barley imports so far in the current season stand at 0.27 Mt (compared to 0.71 Mt last season), 0.21 Mt of which is from the UK.

UK delivered cereal prices

Feed wheat delivered into East Anglia and Yorkshire for January was quoted at £170.50/t and £180.50/t, respectively. Meanwhile, bread wheat for delivery in January to the North West and Northamptonshire was quoted at £192.50/t and £182.00/t, respectively.

Rapeseed

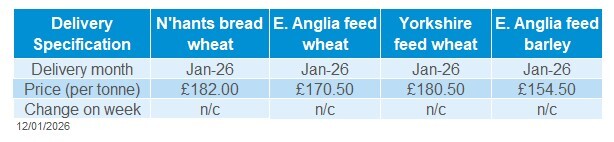

Paris rapeseed futures in £/t (May-26)

May-26 Paris rapeseed futures rose last week and in £/t terms closed both above the 20-day moving average and the psychological threshold of £400/t. The next resistance point and/or target is likely to come from the 50-day moving average, which was above £411/t on Friday.

The 20-day Relative Strength Index (RSI) rose from 19 to 46 (Friday-Friday), reflecting the reversal in market direction.

The lift in £/t terms was slightly less than the rise in euros (see below) due to sterling strengthening against the euro. This will need to be monitored going forward.

Find out more about the graphs in this report and how to use them

Market drivers

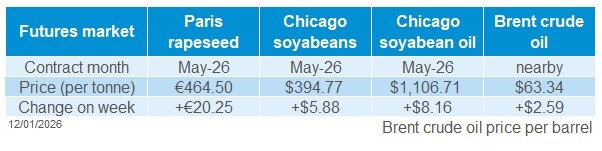

Paris rapeseed futures rose last week due to currency shifts, stronger crude oil prices and optimism over Canadian-Chinese relations. May-26 Paris rapeseed futures rose €20.25/t (4.6%) last week to close at €464.50/t. Prices for the Feb-26 contract are still higher than those for May-26, at €471.00/t on Friday, partly influenced by technical factors as the contract approaches its last trading day on 30 January.

The euro fell to a four-week low against the US dollar last Friday (ECB) and helped European prices rise, while a weaker Canadian dollar boosted Winnipeg futures.

Geo-politics, including the ongoing uncertainty over the situation in Venezuela, the unrest in Iran and Russian airstrikes in Ukraine, lifted Brent crude oil futures. The nearby contract rose $2.59/barrel (4.3%) last week (Friday-Friday) to $63.34/barrel. Higher crude oil prices can improve the attractiveness of biodiesel, so this gain also offered support to vegetable oil and oilseed prices.

Expectations that Indonesia will increase its tax on palm oil exports to fund a higher biodiesel blend (B50) later this year, pushed up Malaysian palm oil futures last week (LSEG). This also offered wider support to vegetable oil prices.

The announcement that the Canadian Prime Minister will visit China this week triggered hope of an improvement in their countries' trade relationship and support for prices. The slow pace of Canadian canola (rapeseed) exports since China introduced a prohibitive tariff on imports from Canada in the autumn has been weighing on rapeseed markets.

Sunflower seed prices also lifted following damage from Russian airstrikes in Ukraine, though strong Argentine exports could limit gains going forward.

However, optimism over 2025/26 South American soyabean production continues to limit market gains. In tonight’s World Agricultural Supply and Demand Estimates (WASDE), the market expects the USDA to increase its forecasts for the Argentinian and Brazilian crops, according to a poll by Reuters. The market also expects the USDA to increase its forecasts global soyabean stocks.

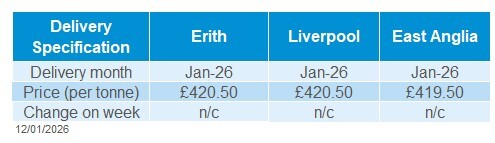

UK delivered rapeseed prices

In Friday’s survey, rapeseed delivered to Erith in January was reported at £420.50/t, up £4.50/t for the same delivery from our previous survey (Friday 19 December). Prices for Feb-26 delivery were £1.50/t higher than those for January.

Meanwhile, it’s important to note that prices for delivery in this season (2025/26) continue to show a premium compared to those for new crop delivery. For example, Harvest delivery into Erith was quoted at £396.50/t in Friday’s survey. This is something to keep in mind for those with 2025 crop still to market.

Extra information

This Thursday (15 January), AHDB will publish the statistics on human and industrial usage of cereals, plus the volume of animal feed produced by manufacturers in GB in November 2025. You can sign up to receive an alert when this is published in our Preference Centre.

Defra is due to release statistics on poultry placings and poultry meat production on Thursday 15 January.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.