Arable Market Report – 13 January 2025

Monday, 13 January 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

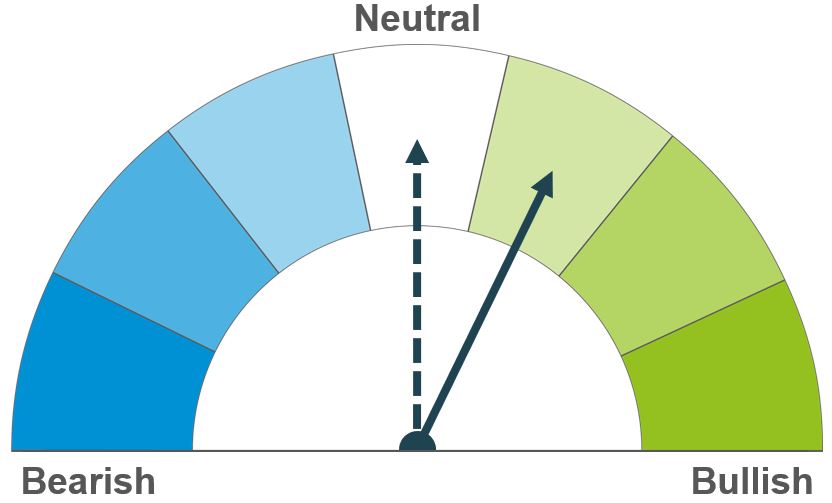

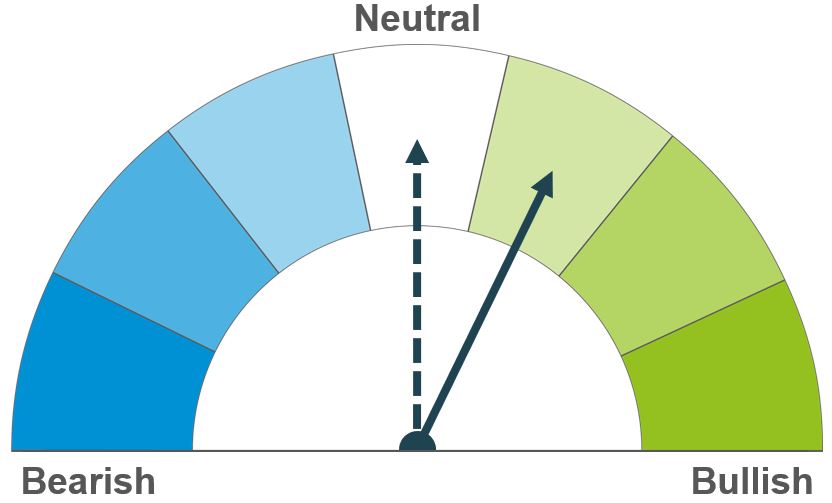

Wheat

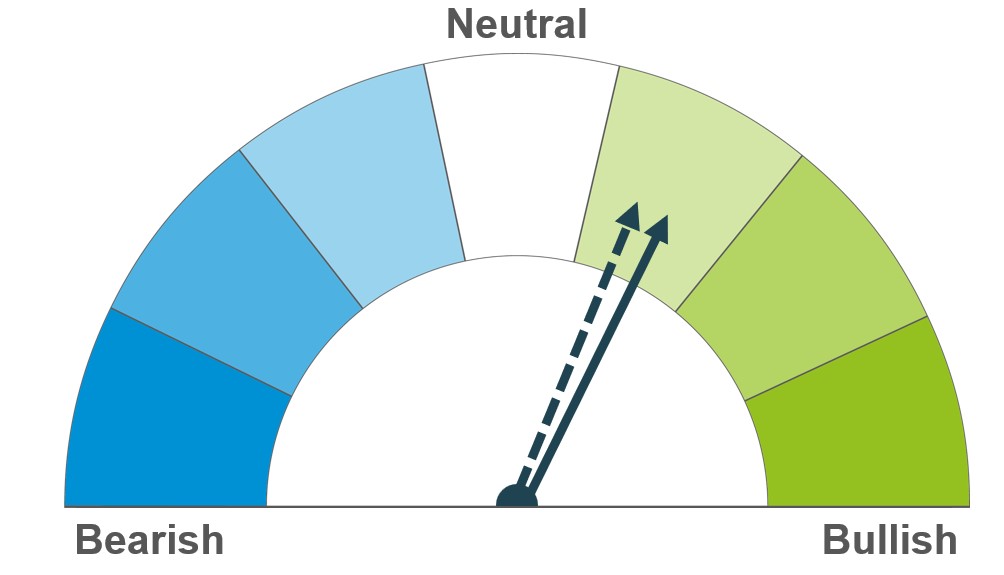

Maize

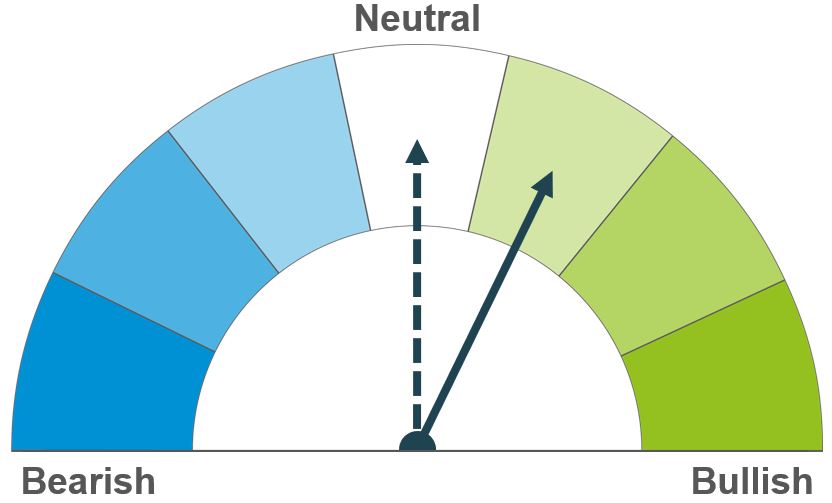

Barley

Weather risks for winter wheat in the northern hemisphere and lower Russian exports could provide short-term support. However, well balanced supply and demand may limit longer-term price gains.

Lower world ending stocks and unfavourable weather forecasts in Argentina support prices in the short and long term. New higher price levels could impact import activity in the near term.

Maize prices are supporting the barley market for now, but low buyer activity could limit upside potential.

Global grain markets

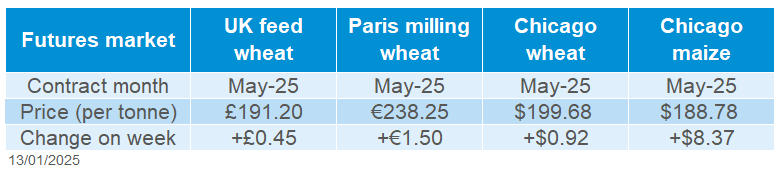

Global grain futures

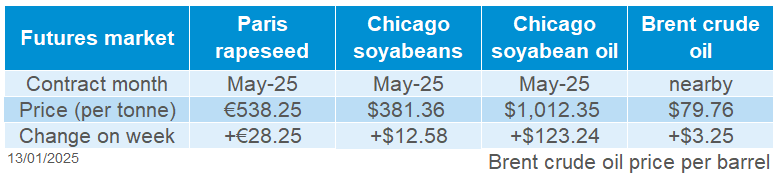

Grain markets rose last week (Friday to Friday). Chicago wheat and maize futures (May-25) gained 0.5% and 4.6% respectively. This was despite the US dollar index Mar-25 rising 0.6%. Maize prices are driving the global grain market due to fundamental factors and further acceleration following Friday’s USDA WASDE report.

The USDA’s WASDE report showed a rise in world wheat ending stocks for 2024/25 to 258.8 Mt, above average trade estimates and up 0.9 Mt from December data.

The USDA's weekly export sales report for the week ending 2 January, released on Friday, showed wheat net export sales of 111 Kt, a marketing year low and down 21% from the previous week. Projected US wheat 2024/25 ending stocks are now 15% higher than last year.

The US winter wheat planted area for the 2025 harvest is estimated at 13.5 Mha, up 2.2% from 2024, but down 7.0% from 2023. US winter wheat crop conditions are worth watching.

Russian wheat exports in 2024/25 are forecast at 46.0 Mt (USDA), down 1.0 Mt from last month’s figure and 17.1 % below last year’s record of 55.5 Mt. According to Rusagrotrans, Russian wheat exports reached 29.4 Mt in the period Jul–Dec 2024, surpassing last season’s record of 27.7 Mt. It’s possible that the quota will ensure a decreasing pace in Russian wheat exports in the medium term.

The WASDE report also showed a decline in maize world ending stocks this season to 293.3 Mt, below average trade estimates and 3.1 Mt lower than December data. US maize net export sales for the week ending 2 January totalled 445 Kt , a marketing year low and down 43% on the week. However, total US maize exports for the first quarter of the current marketing year are the highest for the same period in the last 5 years. Maize export prices are rising, but the most competitive prices on 5 January were US offers.

Weather concerns in Argentina are also supporting maize prices. Brazilian maize prices are supported due to strong domestic demand for ethanol production.

China, the world's largest barley importer, is forecast to import 9.5 Mt in 2024/25, down 0.5 Mt from December figures, according to the USDA's January update. China's year-on-year change in barley imports is down 40.2%.

UK focus

Delivered cereals

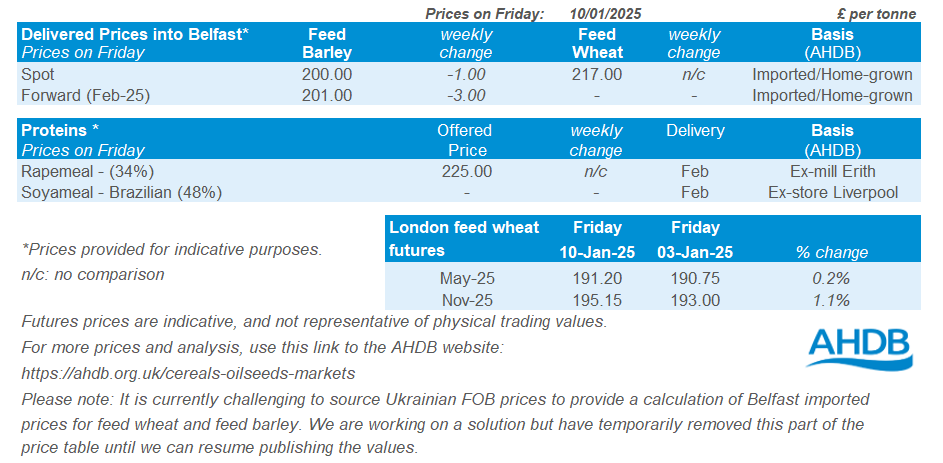

UK feed wheat futures (May-25) closed at £191.20/t on Friday, up £0.45/t on the week (Friday to Friday). New crop futures (Nov-25) gained £2.15/t, to close at £195.15/t over the same period. Domestic feed wheat futures were supported by the global grain complex, particularly the maize market. Additional support for UK feed wheat came from the weakening of sterling against the US dollar and euro. Feed wheat speculators (ICE) reduced their net short position as of 07 January, but it is too early to talk of a change in strategy.

Feed wheat delivered prices into Avonmouth for January delivery was quoted at £187.50/t. Bread wheat delivered to the North West for January delivery was quoted at £229.50/t, while May delivery was quoted at £237.50/t.

UK trade data for November produced by HMRC will be published on 16 January 2025.

Oilseeds

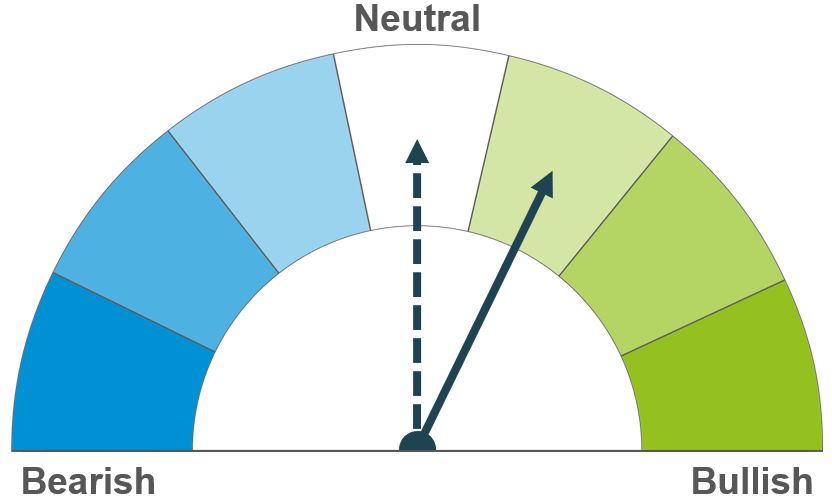

Rapeseed

Soyabeans

Firmness in vegetable oils and forecast lower global production this season provides short-term support. However, expectations of a record soybean crop in Brazil limits price rises.

Lower-than-expected production and stock estimates in the US, along with weather concerns in South America, are keeping prices up in the short term. However, the expected bumper harvest in Brazil is putting pressure on the longer-term outlook.

Global oilseed markets

Global oilseed futures

Chicago soyabean futures were supported last week (Friday-Friday), as the May-25 contract rose $12.58/t, to close on Friday at $381.36/t. The Nov-25 contract ended Friday’s session at $378.79/t, up $8.36/t across the week. Much of the support came from ongoing weather concerns in South America, traders adjusting positions before the USDA report, and bullish USDA data released on Friday.

The USDA’s latest WASDE report showed lower-than-expected US soybean production due to a cut in expected yield, and smaller ending stocks. US 2024/25 soybean yields were cut by 1.9%, contributing to a 2.1% drop in production, now estimated at 118.8 Mt. This was below analysts' expectations of 120.0 Mt to 123.5 Mt. As a result, the 2024/25 US soybean ending stocks are down to 10.3 Mt, compared to December's estimate of 12.8 Mt and analysts' average of 12.4 Mt.

Globally, the USDA reduced the 2024/25 soybean ending stocks by 2.7% to 128.37 Mt, also below analysts' expectations of 130.0 Mt to 134.0 Mt. Production estimates for other top exporters, including Brazil, Paraguay and Argentina stayed the same, despite ongoing weather challenges.

Rain forecast for Argentina in mid-January has eased some dry weather concerns, which had been supporting soyabean prices. However, dry conditions are now affecting soybean growth in southern Brazil, and heavy rains might disrupt early harvests in central regions. Despite these challenges, Brazil's 2024/25 soybean production is forecast to hit 171.4 Mt, a 14.4% increase from last season, according to StoneX.

Soyabean imports have surged in the EU on increased crushing. According to latest data from the EU Commission, soyabean imports into the EU for the 2024/25 season (from July) had reached 7.0 Mt as at 05 January, up 0.7 Mt compared to a year earlier.

Malaysian palm oil futures gained last week with the May-25 contract rising by 1.2% on the week. This increase was driven by tighter supply, higher demand, and stronger crude oil prices following tougher US sanctions on Russia.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures gained on the week (Friday-Friday), buoyed by gains in Chicago soyabeans and a moderate weakening of the euro against the US dollar. The May-25 and Nov-25 contracts rose by €28.25/t and €21.00/t, ending at €538.25/t and €491.00/t respectively.

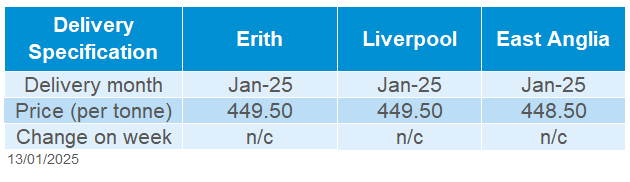

Rapeseed delivered into East Anglia for January 2025 delivery was quoted at £448.50/t. Delivery into Erith for May 2025 was quoted at £456.50/t. Since this is the first published price of the year, there is no weekly comparison available.

LSEG maintains its 2025/26 rapeseed production (EU-27+UK) forecast at 19.8 Mt, attributed to recent mild weather across Europe. The forward weather outlook predicts cooler temperatures in western Europe and warmer conditions in the UK and Poland, indicating no risk of damage to the winter crops.

Rapeseed imports in the EU remain robust due to reduced domestic output. According to the EU Commission, rapeseed imports for the 2024/25 season (July to date) reached 3.1 Mt as at 05 January, up from 3.0 Mt the previous year.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.