Arable Market Report – 13 October 2025

Monday, 13 October 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

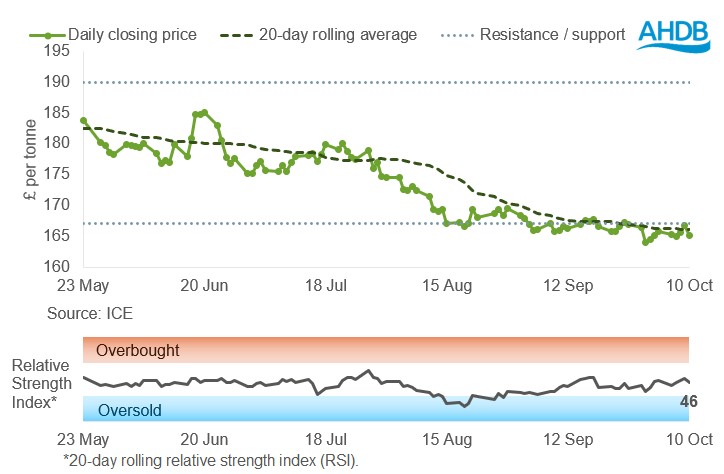

UK feed wheat futures (Nov-25)

November 2025 UK feed wheat futures remained below the support level of £167/t last week (03 October – 10 October). In technical terms, a support level represents a price point where markets often find it harder to fall much further.

The relative strength index (RSI) edged downwards from 49 to 46, suggesting momentum slowed slightly on the previous week.

Find out more about the graphs in this report and how to use them.

Market drivers

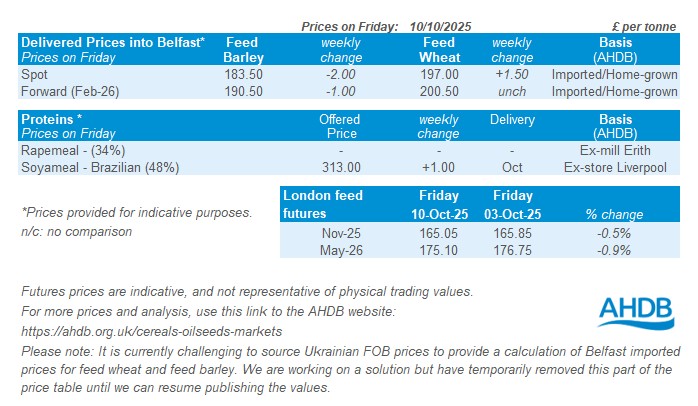

US and UK grain futures came under pressure again last week; ample supply and steady demand have damped market momentum and prices. UK feed wheat futures (Nov-25) finished the week at £165.05/t down £0.80/t (0.5%) on the week. Chicago wheat futures (Dec-25) closed 3.3% lower on the week. Broadly driving the pressure on global grain markets was on-going harvest pressure as U.S. maize harvest continues and beneficial rains in Brazil that will aid plantings for maize crops. The Paris milling wheat market marginally gained on the week as the euro weakened against the US dollar.

Due to the US government shutdown, the market was absent last week from receiving the USDA reports, notably the October World Agricultural Supply and Demand Estimates and the weekly Crop Progress report. With the absence of this data, in a Reuters poll of nine analysts estimated that the US maize crop was 29% harvested by Sunday (05 Oct), up from 18% the previous week but behind the year-ago pace of 30% (LSEG). It’s worth noting that this is just a poll and not official data, usually published by the USDA. Weather has been favourable over the main maize regions over the last week and looks to continue into the coming week suggesting progress will continue to move well.

In the EU, Expana raised its soft wheat output by 0.3 Mt from last month's forecast to 136.4 Mt, up 22.8 Mt from the rain-affected 2024/25 crop, projecting a record high wheat crop as well as 17-year high for the barley crop. The maize crop was also raised by 0.8 Mt to 56.5 Mt, after the harvest turned out slightly better than previously expected but is still the second lowest since 2007.

Russian consultancy group Sovecon raised its forecast for the country’s wheat crop in 2025 to 87.8 Mt, up from a previous forecast of 87.2 Mt, with record yields recorded in parts of Siberia. Export estimates have also been raised with September up by 0.3 Mt tons to 4.6 Mt with forecasts of 5 Mt in October.

Argentina’s Rosario grain exchange increased its wheat harvest estimates to 23 Mt, citing good moisture and higher than expected yields. This estimate comes in 1.0 Mt higher than estimates from Buenos Aires grain exchange (22.0 Mt) reported in last week’s arable market report.

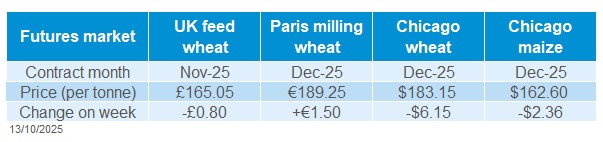

UK delivered cereal prices

Feed wheat delivered into East Anglia for November delivery was quoted at £170.00/t on Thursday, with no comparison from the previous week.

May delivery into the North West for bread wheat was quoted at £211.00/t on Thursday.

December delivery of bread wheat into the Northamptonshire was quoted at £190.50/t, up £0.50/t from the previous week. May delivery was quoted at £200.00/t with the basis to futures (May-26) this week at £23.00/t the lowest since 2020 for the comparative week.

Trading was again quiet last week, as weather conditions across much of the country kept farmers focused on drilling, with grain marketing taking a lower priority while fieldwork is ongoing.

Rapeseed

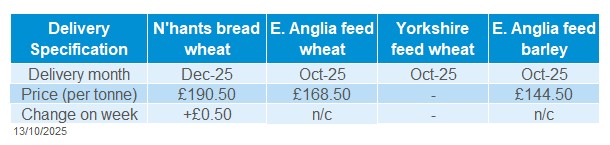

Paris rapeseed futures in £/t (Nov-25)

Over the last week (03 – 10 October), Paris rapeseed futures (in £/t) bounced off the support level of £400/t, finishing slightly below the 20-day moving average.

The relative strength index (RSI) showed a fall in market momentum fell from 51 to 47 over the week. However, there is no clear indication of the direction of future price movements.

Find out more about the graphs in this report and how to use them.

Market drivers

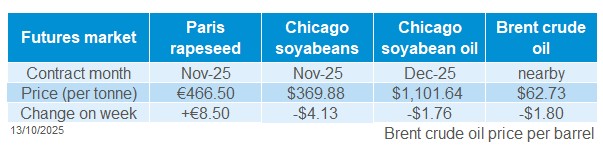

The oilseed market has been volatile over the past week due to the weaker euro against the US dollar, as well as unpredictable demand for US soyabeans from China. Paris rapeseed futures (Nov-25) rose by €8.50/t (1.9%) to €466.50/t on the week. However, the futures market of the 2026 crop (Aug-26) was limited, only increasing by only 0.3% to €456.50/t. Consequently, the price difference between the 2025 and 2026 contracts is €10.00/t from nearby to harvest.

The European Commission published that, by 05 October, rapeseed imports for the 2025/26 season, which began in July, had reached 1.03 Mt, against 1.46 Mt a year earlier. The main countries from which the EU imports rapeseed in the current season are Ukraine (58%), Moldova (19%), Australia (13%) and Serbia (8%).

Chicago soyabeans futures (Nov-25) fell by 1.1%, while Winnipeg canola futures (Nov-25) slightly rose 0.4% on the week.

Chicago soyabean futures started last week strong amid optimism about the US-China trade deal. However, after President Trump posted on Friday in response to China's export controls on rare earth minerals, he suggested that he may not meet with President Xi in South Korea later this month.

According to China's General Administration of Customs, the world's top soybean buyer imported 12.87 Mt in September, up 13.2% from 11.37 Mt a year earlier. Most of these imports in September are expected to have come from Brazil.

Brent crude oil futures (Dec-25) dropped by 2.8% over the course of the week. Global oil prices fell after Israel and Hamas announced the first phase of a ceasefire plan in the Gaza Strip. The news eased geopolitical tensions in the Middle East, reducing the "risk premium" in the underlying price of oil and turning markets' attention to other factors.

Indonesia will implement its B50 biodiesel programme in the second half of 2026. The world's largest producer of palm oil, Indonesia, has a programme that blends biodiesel produced from palm oil with diesel to reduce its reliance on fuel imports. The programme is currently at the B40 stage, using 40% palm oil-based fuel blend (LSEG). However, this factor will have a greater influence on the oilseed market in the long term.

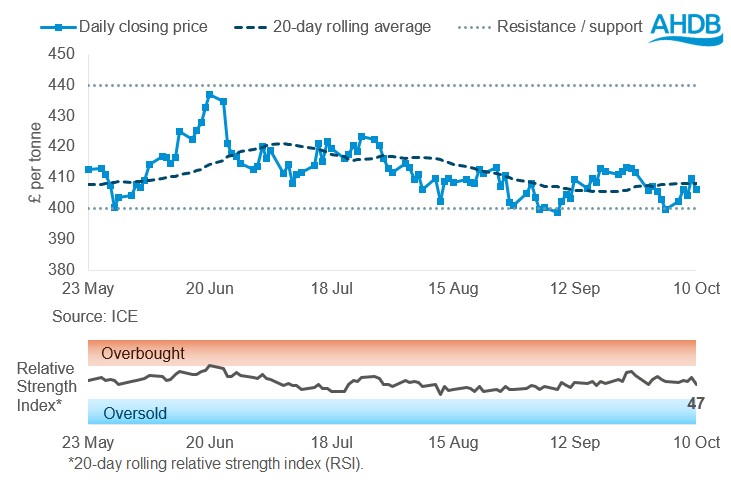

UK delivered rapeseed prices

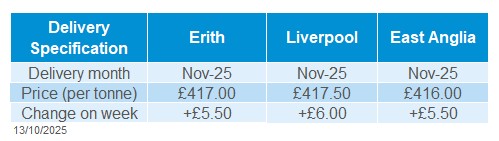

Delivered rapeseed prices rose last week. These prices are based on a survey typically carried out mid to late Friday morning, so they may not always reflect trends seen in the Paris futures by close of play.

Rapeseed for November delivery into Erith was quoted at £417.00/t on Friday, up £5.50/t on the week. In East Anglia, November delivery was quoted at £416.00/t, marking a £5.50/t increase week-on-week.

The price difference between the 2025 (delivery into Erith in Nov-25) and 2026 (delivery into Erith in Aug-26) harvest was £12.00/t last week.

Extra information

Defra released provisional English crop production estimates on Thursday 09 October. The production of wheat and oilseed rape increased compared to 2024, while the harvest of barley and oats fell. Full details and analysis are available on analyst insight page.

Figures for Scotland are expected from the Scottish Government in this week (16 October), while those for Northern Ireland and Wales will follow in December, when Defra also publishes the UK totals.

UK trade data for August 2025 will be released this Thursday (16 October). It will provide details of cereal and oilseed import and export figures by country.

AHDB released last week the latest GB fertiliser figures, showing that UK produced and imported prices of Ammonium nitrate (AN) had increased month-on-month.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.