Arable Market Report – 14 April 2025

Monday, 14 April 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

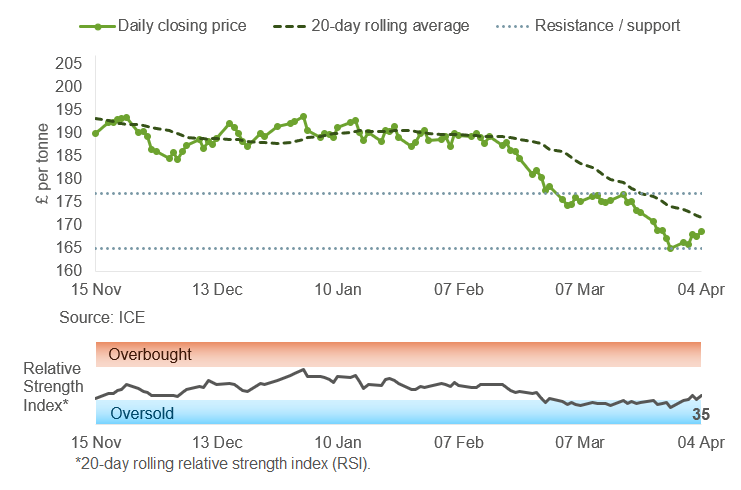

May-25 UK feed wheat futures remained range-bound below the 20-day moving average, showing weak momentum and a cautious mood in the market.

Find out more about the graphs in this report and how to use them here.

Market drivers

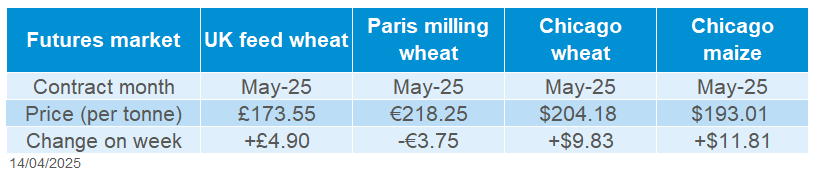

UK feed wheat futures (May-25) rose £4.90/t last week (Friday to Friday), ending at £173.55/t. The Nov-25 contract gained £0.25/t, settling at £186.75/t on Friday. The premium for Nov-25 over May-25 fell to £13.20/t.

Domestic wheat futures (old crop) generally followed Paris milling wheat futures, with weaker sterling against the euro having an impact. However, a stronger euro against the US dollar limited the upside potential of Paris milling wheat futures.

Strategie Grains raises forecast of EU soft wheat production in 2025/26 to 128.1 Mt from 127.5 Mt, 13% above this season. Maize and barley production are forecast at 60.1 Mt and 51.2 Mt, respectively, up 2% and 3% on the year.

FranceAgriMer estimates that 75% of soft wheat was in good or excellent condition as of 07 April, down from 76% the previous week.

US wheat export sales for the week ending 3 April were 107.3 Kt, lower than expected and 56% below the four-week average. Maize export sales also dropped to 785.6 Kt. Concerns about tariffs are making the market unpredictable.

Last week, wheat importers like Algeria and Jordan were active in the market. However, global wheat exports are still slow compared to last year’s levels.

As at 9 April, Ukraine's wheat exports were 8.4% lower than same time last season, according to the agriculture ministry. Maize exports were down 13.8%, while barley exports increased by 4.7%.

India has purchased 2.08 Mt of new-season wheat from domestic farmers since March 15, up 44.4% from last year, according to government sources. The latest forecast for India’s wheat production is a record 115.4 Mt.

Global maize ending stocks are at their lowest level in recent years, offering strong fundamental support for the old crop feed grain market.

The Buenos Aires Grain Exchange reported that Argentina's 2024/25 maize harvest reached 23.1% of the estimated area as at 9 April, 8.1% ahead of last year's pace.

UK delivered cereal prices

Domestic delivered wheat prices up in line with futures prices from Thursday to Thursday. Bread wheat delivered into Northamptonshire for May 2025 was quoted at £201.50/t, up £4.50/t. Feed wheat for delivery in East Anglia for May 2025 was quoted at £174.00/t. The milling wheat premium is still at a low level.

Rapeseed

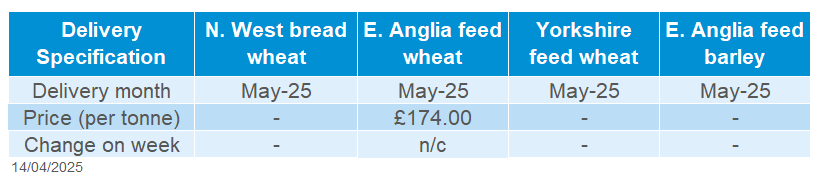

May-25 Paris rapeseed futures remained within a tight range, moving between the 20-day average and £452/t resistance point, with short-term gains likely capped by currency movements.

Find out more about the graphs in this report and how to use them here.

Market drivers

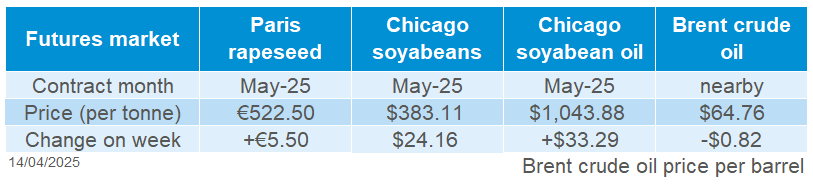

Paris rapeseed futures ended the week mixed (Friday to Friday), as a stronger euro against the US dollar and strength in Chicago soyabean futures provided contrasting pressures. Old crop (May-25) Paris contract gained €5.50/t to close at €522.50/t, while the new crop contract (Nov-25) slipped €2.25/t, finishing at €476.00/t.

Chicago soyabean prices were supported by the suspension of US tariff hikes for most countries, as well as USDA data showing lower US ending stocks. Both the May-25 and Nov-25 Chicago soyabean futures rose, gaining 6.7% and 4.2% respectively.

On Wednesday, President Trump announced a 90-day pause on tariff increases for most countries, but stepped-up pressure on China, its biggest soyabean export market, as trade tensions between the two countries intensify.

The USDA’s April report showed US soyabean ending stocks for 2024/25 dropped slightly, down to 10.21 Mt from 10.34 Mt in March, which helped push up soyabean futures in Chicago. Meanwhile, global ending stocks are expected to rise to 122.5 Mt, up 1.1 Mt, mainly due to higher stocks in Brazil and the EU.

US soyabean net export sales fell to 172.3 Kt for the week ending 3 April 2025, down 58% from the week before and 63% below the four-week average.

EU rapeseed imports have continued to rise this season due to lower domestic production. From 1 July to 6 April, imports reached 5.18 Mt, up from 4.55 Mt during the same period last year, according to the EU Commission.

Brazil's 2024/25 soyabean harvest is now 89.1% complete as at 11 April, up from 85.1% the previous week, according to Patria Agronegocios. At the same time, Conab raised its soyabean output forecast to 167.87 Mt, up from 167.37 Mt.

In Argentina, the Rosario Grain Exchange lowered its 2024/25 soyabeans production estimate to 45.5 Mt, down from 46.5 Mt.

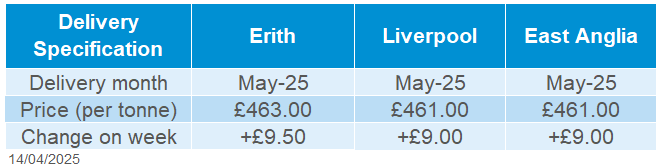

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in May was quoted at £463.00/t on Friday, up £9.50/t from the previous week. Delivery to East Anglia in May was quoted at £461.00/t, gaining £9.00/t.

Domestic delivered prices showed higher gains than Paris rapeseed futures due to currency fluctuations. Sterling hit a 15-month low against the euro on Friday, slipping to €1.1512, but gained ground against the US dollar as investors sold off US assets and moved to safer currencies like the euro amid rising global trade tensions (LSEG).

Extra information

Fertiliser prices rose in March, with UK-produced AN (34.5% N) averaging £380/t, up £13/t from February. Imported AN averaged £377/t in March, an increase of £7/t from February, marking the highest price since May 2023.

With Trump’s raft of tariffs coming into effect last week, AHDB took a closer look at how this can happen in today’s global trading world, and how the UK may be adversely affected, despite having some of the lowest tariffs around.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.