Arable Market Report – 15 September 2025

Monday, 15 September 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (Nov-25)

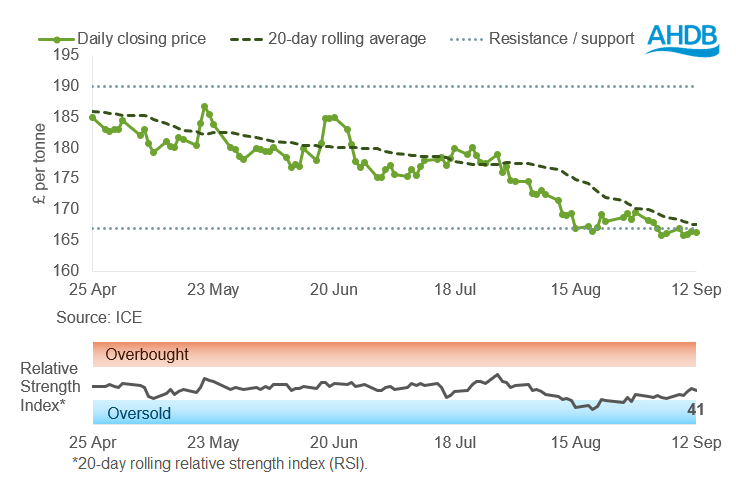

UK feed wheat futures saw a slight increase last week (Friday–Friday) and continued to trade near the support level of £167/t. The market is trying to determine the direction of future price movements.

The Relative Strength Index (RSI) increased from 32 to 41, showing further movement from the threshold of “oversold” conditions.

Find out more about the graphs in this report and how to use them.

Market drivers

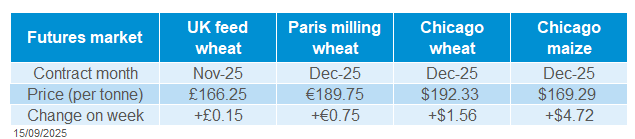

UK feed wheat futures (Nov-25) closed at £166.25/t on Friday, up £0.15/t (0.1%) on the week. Chicago wheat futures and Paris wheat futures (Dec-25) were up 0.8% and 0.4% respectively. Despite information about increasing supply, grain markets were up marginally last week largely on the back of technical buying.

The current week could see the value of currencies influencing commodity prices due to interest rate decisions by the US Federal Reserve (17 September) and the Bank of England (18 September).

Last Friday, the USDA's World Agricultural Supply and Demand Estimates (WASDE) report revealed mixed figures for grains. On the one hand, world wheat ending stocks increased to 264.1 Mt in 2025/26, which was at the upper end of traders' estimates. Conversely, world maize ending stocks decreased to 281.4 Mt, which was in line with average trade estimates.

Expana increased its forecast for EU common wheat production in 2025/26 by 3.3 Mt to a record high of 136.1 Mt, reflecting improved yield estimates. On the other hand, the maize harvest forecast has been revised downwards from 55.9 Mt to 55.7 Mt.

Russian 2025 wheat production estimates have been revised upwards, with IKAR now estimating the crop at 87.0 Mt (up from 86.0 Mt). Meanwhile, SovEcon increased its estimate to 87.2 Mt last week, up from 86.1 Mt.

On the demand side, importers are still inactive and waiting for prices to decrease further. In the EU, the export of common wheat in the 2025/26 season is well below last year's figures, while the export of barley is higher. Saudi Arabia is currently the top buyer of both wheat and barley.

Last Thursday, the US Weekly Export Sales Report revealed that net sales of wheat for the 2025/26 season had reached 305.4 Kt by 4 September. This was at the lower end of the estimated range.

The Rosario Grains Exchange has forecast a record maize production of 61 Mt for the 2025/26 season, provided that normal rainfall is experienced during its growth cycle. Argentina's previous record maize harvest was 52.5 Mt in 2023/24.

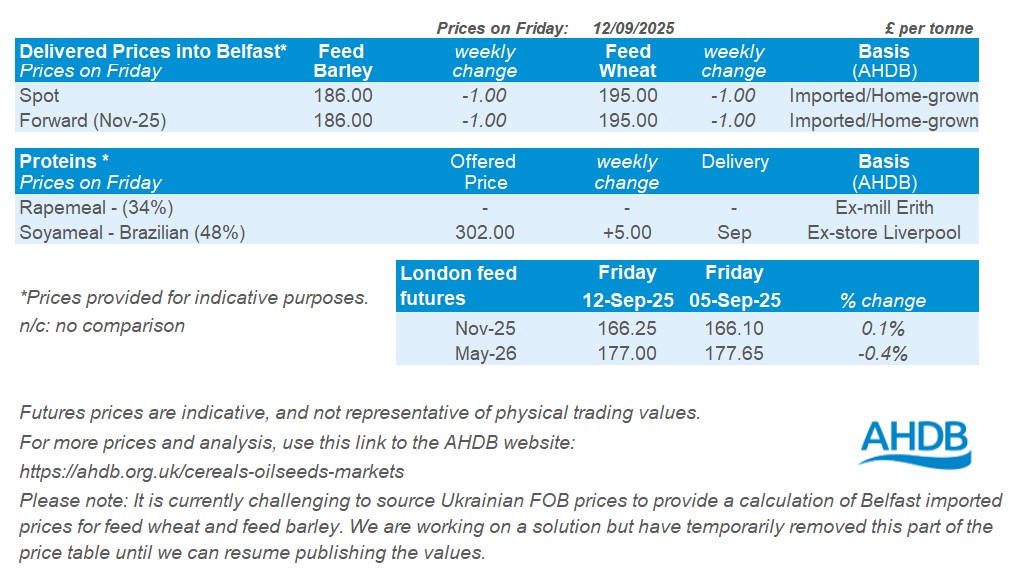

UK delivered cereal prices

Feed wheat delivered into East Anglia for September delivery was quoted at £166.50/t on Thursday, down £1.50/t from the previous week.

October delivery of bread wheat into Northamptonshire was quoted at £189.00/t, up £0.50/t from the previous week.

Rapeseed

Paris rapeseed futures in £/t (Nov-25)

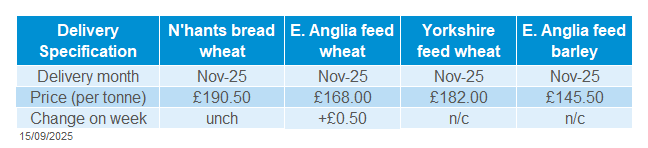

Last week (5–12 September), Paris rapeseed futures (in £/t) closed just above the 20-day moving average, finishing at slightly over £409/t.

Technical indicators signalled strengthening momentum, with the relative strength index (RSI) rising from 46 to 50 over the week.

Find out more about the graphs in this report and how to use them.

Market drivers

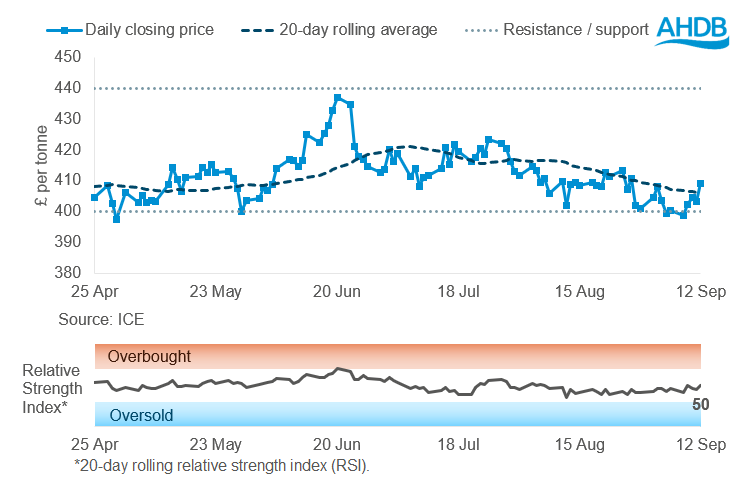

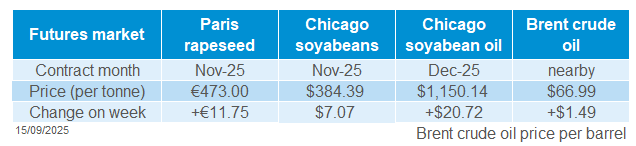

The oilseed complex found support from tightening global stocks and firmer crude oil prices. However, expectations of ample supply continued to cap gains. Paris rapeseed futures (Nov-25) rose by €11.75/t (Friday–Friday) to €473.00/t. Winnipeg canola and Chicago soyabean futures (Nov-25) also gained 4% and 2% respectively.

Statistics Canada reported the country’s canola (rapeseed) stocks for 2024/25 at 1.6 Mt in July, down 50.5% year-on-year and well below trade expectations of 2.27 Mt. The sharp decline is due to stronger export demand.

In the USA, 64% of the soyabean crop was rated good or excellent as of 7 September, slightly down from the previous week but above expectations. Weekly export sales totalled 541.1 Kt, falling short of market forecasts. Subdued Chinese demand continues to outweigh concerns over declining crop conditions.

Argentina’s Buenos Aires Grain Exchange has forecast a 4.3% year-on-year decline in soyabean planted area for 2025/26 to 17.6 Mha, while the Rosario Grains Exchange projects a steeper fall of 7% to 16.4 Mha. Soyabean planting is expected to begin in late September.

Meanwhile, Brazil’s crop agency Conab raised its 2024/25 soyabean crop estimate to 171.47 Mt (USDA:169.0 Mt) in September, up from 169.65 Mt in August.

The USDA’s September WASDE report, released on Friday, lowered global soyabean ending stocks for 2025/26 to124.0 Mt, down from 124.9 Mt in August and below average trade expectations of 124.8 Mt. Global production was also cut by 0.5 Mt on the month to 425.9 Mt. Despite the monthly decline, output is still above last season’s level, reinforcing expectations of ample supply this season.

Vegetable oil markets also drew support from firmer crude oil prices. Brent crude rose by 2.3% (5–12 September), driven by tensions in the Middle East.

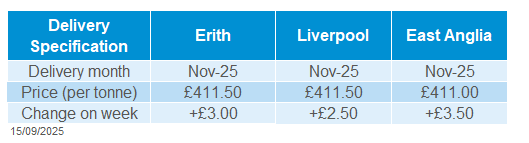

UK delivered rapeseed prices

Delivered rapeseed prices firmed last week, broadly tracking movements in Paris futures.

Rapeseed for November delivery into Liverpool was quoted at £411.50/t on Friday, up £2.50/t on the week. In East Anglia, November delivery was quoted at £411.00/t, marking a £3.50 increase week-on-week.

Extra information

UK trade data for July 2025 released last Friday (12 September), details cereal and oilseed import and export figures by country. Compared to the previous season, July's UK wheat and maize imports were 26% and 52% lower respectively in the current 2025/26 season.

Our latest Analyst insight takes a look at last season’s wheat demand from the bioethanol sector, and what the closure of Vivergo could mean for UK supply and demand this season.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.