Arable Market Report – 17 February 2025

Monday, 17 February 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

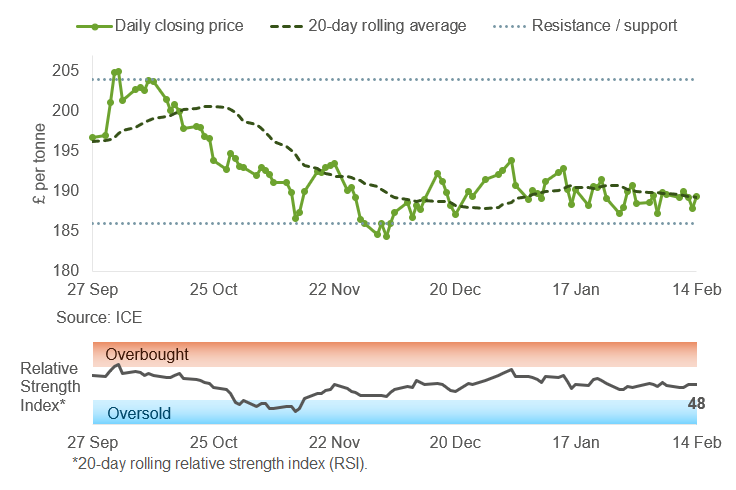

May-25 UK feed wheat futures are in line with the 20-day rolling average price. If the average price continues to drift lower, we could see the domestic market dip below the recent support level.

Find out more about the graphs in this report and how to use them here.

Market drivers

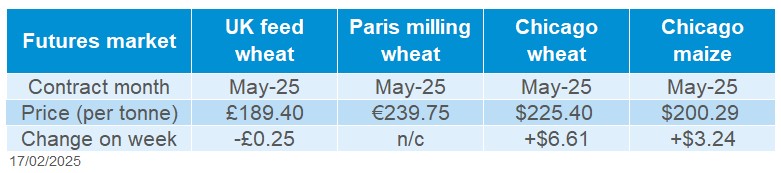

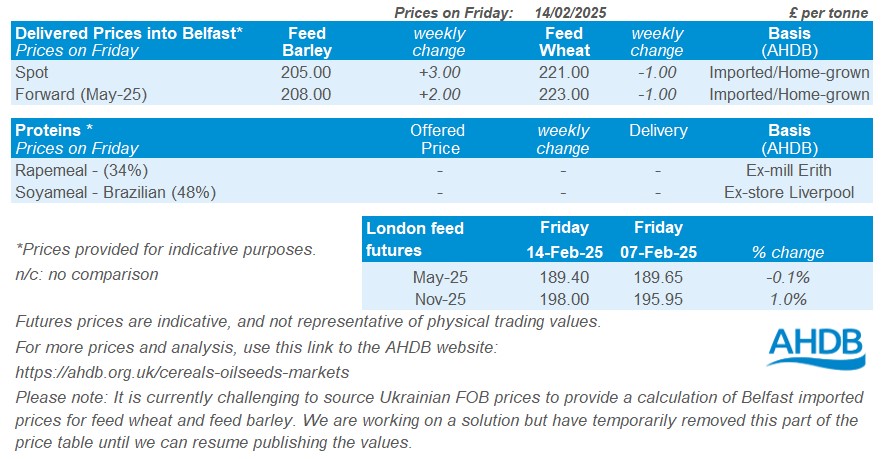

UK feed wheat futures (May-25) fell £0.25/t over the week (Friday-Friday) to close at £189.40/t. The Nov-25 contract gained £2.05/t, settling at £198.00/t. Domestic prices mainly followed Paris milling futures (May-25), which were flat over the week (Friday-Friday).

Weather risk continued to influence prices last week. On the one hand, low temperatures are forecast for Russia and the US next week, which could pose a risk to winter crops where snow cover is inadequate. On the other hand, recent rains in Argentina could improve maize crop conditions.

Saudi Arabia’s state purchasing agency the General Food Security Authority (GFSA) bought 920 Kt of 12.5% protein wheat, more than the planned 595 Kt. The wheat was purchased at an average price of $276.37/t cost and freight (LSEG). Romanian, Bulgarian and Russian wheat will account for the majority of the purchase.

The pace of wheat exports from Russia has slowed significantly over the past three months, providing some support to markets. The decline in exports is underpinned by export quotas and production losses.

The USDA export sales report for the week ending 6 February, showed net wheat export sales near the top of trade estimates at 569.6 Kt, up 45% from the previous four-week average. For maize, net export sales neared the top of trade estimates at 1.65 Mt up 20.0% from the prior four-week average.

Fundamentally, maize prices are supported by 10-year low global maize ending stocks (USDA). However, US tariffs remain a concern and the upside potential for maize is limited. The Chicago futures market is closed today due to the President's Day holiday in the US.

FranceAgriMer showed that 73% of winter wheat was in good or excellent condition on 10 February, slightly above the historic low level of 68% a year ago. For winter barley, 68% is in good or excellent condition, down from 71% in the same week last year. For spring barley, 23% was planted by 10 February, up from 20% last year, and in line with the five-year average of 24%.

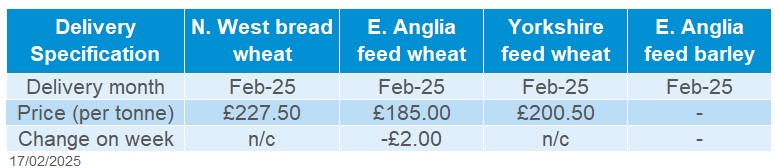

UK delivered cereal prices

The feed wheat price for delivery into East Anglia in May was quoted at £191.50/t on Thursday, down £1.00/t on the week. Delivery into East Anglia in July 2025 (harvest 2025) was quoted at £189.00/t on Thursday, down £0.50/t on the week.

The basis for East Anglia delivered prices for old crop (over May futures), remains stronger than for harvest 2025 (over November futures).

Rapeseed

.png)

May-25 Paris rapeseed futures continued to trade within recent resistance and support levels last week, suggesting a chance to ease back market focus. Upside potential seems limited, with Brazil’s record soyabean harvest underway, and uncertainty surrounding further US tariff announcements.

Find out more about the graphs in this report and how to use them here.

Market drivers

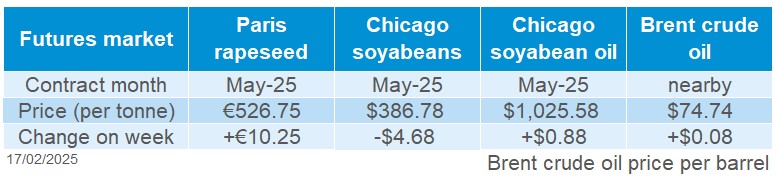

Old crop (May-25) Paris rapeseed futures ended the week at £438.34/t, rising £7.82/t from the previous Friday. The Nov-25 contract saw smaller gains, up £3.07/t, finishing Friday at £411.08/t. Paris rapeseed futures showed a divergence from Chicago soybean futures last week, underpinned by lower production in the EU.

Last week, France's Agricultural Ministry reported a reduction in winter rapeseed area for the 2025 harvest to 1.27 Mha, down from 1.34 Mha, adding some support to European prices.

LSEG maintained its Ukrainian rapeseed production forecast at 3.2 Mt. However, warm and dry conditions over the past two weeks, have led to the lowest soil moisture levels in six years. Due to limited snow cover, this also leaves the crop exposed to upcoming cold spells.

In its monthly WASDE report, the USDA maintained its US soybean stock forecast at 10.3 Mt, slightly above analysts' average estimate of 10.1 Mt, putting downward pressure on prices, and likely limiting support for rapeseed. US soybean exports were also weak, with net sales of 185.5 Kt for the week ending 6 February, 74% below the four-week average and outside trade estimates (300-800 Kt), according to Reuters.

Conab slightly reduced Brazil's soybean production forecast to 166.01 Mt, from 166.32 Mt previously, due to crop losses caused by dry weather. ABIOVE expects Brazil's soybean crush to rise to 57.5 Mt in February, up from 57.1 Mt in January, while maintaining the production forecast at 171.7 Mt.

Heavy rains in Argentina this February are expected to limit further crop losses, according to the Rosario Grains Exchange. Dry conditions in recent months across the country have underpinned the market. The exchange estimates Argentina’s 2024/25 soybean production at 47.5 Mt, compared to the USDA’s estimate of 49.0 Mt.

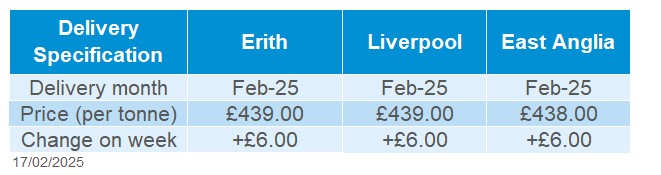

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in February was quoted at £439.00/t on Thursday, up £6.00/t from the previous week. Delivery to East Anglia in February was quoted at £438.00/t, also rising £6.00/t. Please note the survey is usually conducted mid-late morning on Friday, so can show differences from Paris futures closing prices.

Extra information

Last Monday, nearby UK natural gas futures reached their highest point in over two years, at 141.25 p/therm. The reason for this increase in price is largely due to diminishing stocks, colder than normal temperatures, and supply uncertainties with reduced renewable power generation. Read further analysis on what this could mean for UK fertiliser markets

There is continued concern around tariffs President Trump could implement on the EU, Canada and Mexico. Although the tariffs have been delayed, negotiations continue, and the 10% levy on China has already been implemented. AHDB explored the potential impact on global trade and the economy, as well as the knock on effects to the UK.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.