Arable Market Report – 17 November 2025

Monday, 17 November 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (May-26)

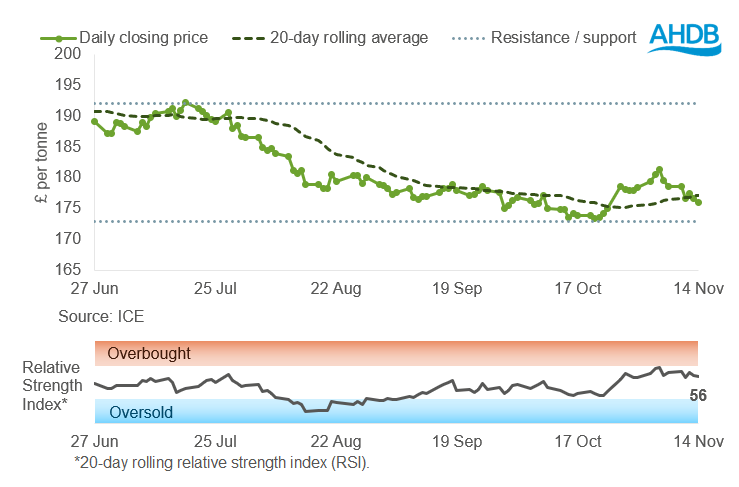

UK feed wheat futures (May-26) traded below the 20-day simple moving average last week (07–14 November), but held above the support level of £173/t.

The relative strength index (RSI) eased to 56 from 62 the previous week, indicating a slowdown in market momentum.

Find out more about the graphs in this report and how to use them.

Market drivers

UK feed wheat futures eased last week, with the May-26 contract closing at £176.00/t on Friday, down £2.65/t (1.5%). This mirrored declines in Paris milling wheat futures, with the May-26 contract decreasing by 1.6%. Pressure on European prices stemmed from continued strong competition from Black Sea origins, ongoing harvest progress in Argentina and Australia, and a firmer euro against the US dollar, which ended the week at €1 = $1.1620. Meanwhile, Chicago wheat futures (May-26) modestly gained 0.1%, likely driven by speculative positioning. Overall, global wheat prices remain under pressure amid expectations of abundant supply.

On Friday, the USDA released its first World Agricultural Supply and Demand Estimates (WASDE) report since September, following the end of the 43-day US government shutdown. The 2025 US maize yield was reduced slightly to approximately 11.7 t/ha, with production revised down to 425.5 Mt, above the average analyst estimate of 420.6 Mt. A Reuters poll of nine analysts estimated the US maize harvest at 92% complete, slightly behind the USDA’s figure of 95% at the same point last year. The USDA’s weekly export sales reporting has resumed, with two catch-up reports per week until 08 January to publish previous weeks data.

Globally, the WASDE report confirmed a more bearish outlook for wheat. World production is forecast at 828.9 Mt, up 12.7 Mt from September, led by increases in Argentine (+2.5 Mt) and the European Union (+2.2 Mt). The global wheat stocks-to-use ratio, excluding China, is at its highest level since 2021/22, highlighting ample supply and continued price pressure.

In South America, Argentina’s wheat harvest (to 12 Nov) is around 15% complete. The Rosario Grain exchange now forecasts a record 2025/26 crop of 24.5 Mt (+1.5 Mt from last month), while the Buenos Aires Stock Exchange has raised its estimate to 24.0 Mt, up from 22.0 Mt previously. In Brazil, planting of the first 2025/26 maize crop was 85% complete in the centre-south region as at last Thursday (AgRural). Conab projects total maize production at 138.8 Mt, well above the USDA’s 131.0 Mt, which remained unchanged from September.

In Europe, Expana raised its EU soft wheat forecast by 0.4 Mt to a record 136.8 Mt, up 21% on last season. Barley output was increased to 56.6 Mt, with strong yields in Romania, Bulgaria, Poland and Scandinavia. In France, 98% of soft wheat is rated good or excellent as sowing nears completion (FranceAgriMer).

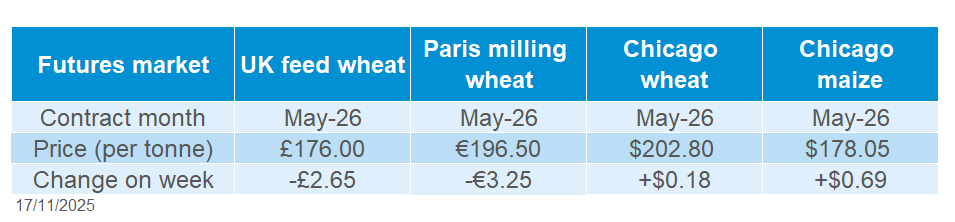

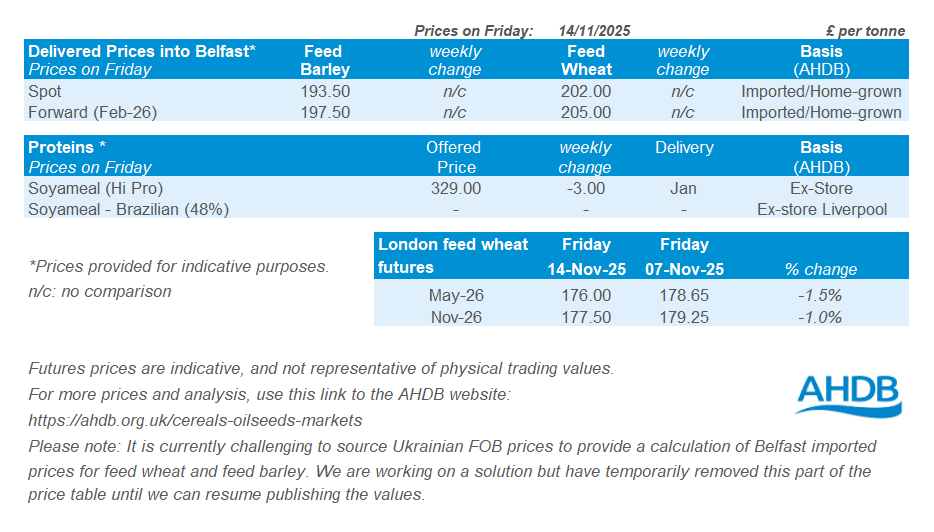

UK delivered cereal prices

Domestic delivered wheat prices broadly followed the movement in UK feed wheat futures Thursday to Thursday.

Feed wheat delivered into East Anglia for November was quoted at £170.50t, down £0.50/t on the week.

Bread wheat for November delivery into the Northwest was quoted at £198.00/t, down £3.00/t on the week. Bread wheat for November delivery into Northamptonshire was quoted at £188.00/t, down £2.50/t on the week.

Rapeseed

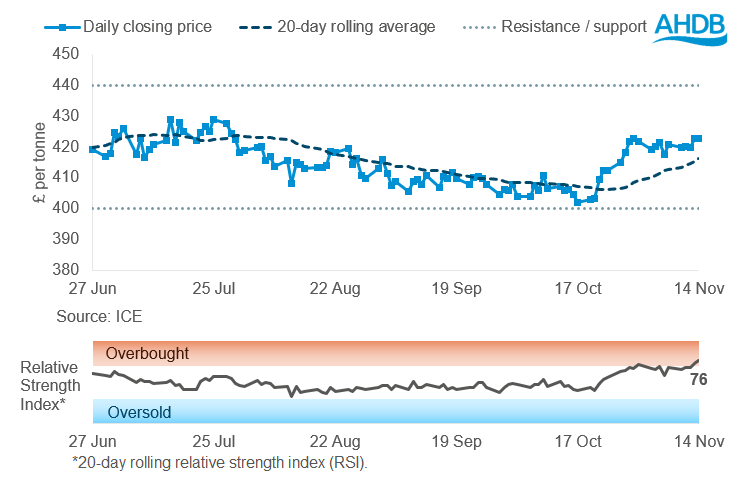

Paris rapeseed futures in £/t (May-26)

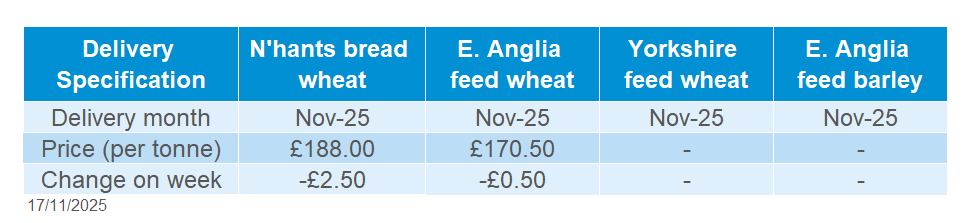

In £/t terms, May-26 Paris rapeseed futures increased (7 November – 14 November), closing again above the 20-day moving average near £422/t. The 20-day moving average could be the nearest potential support price level.

The relative strength index (RSI) rose from 68 to 76, indicating an increase in market momentum and signalling a move back into the overbought zone, attention must be paid to the markets at this time.

Find out more about the graphs in this report and how to use them.

Market drivers

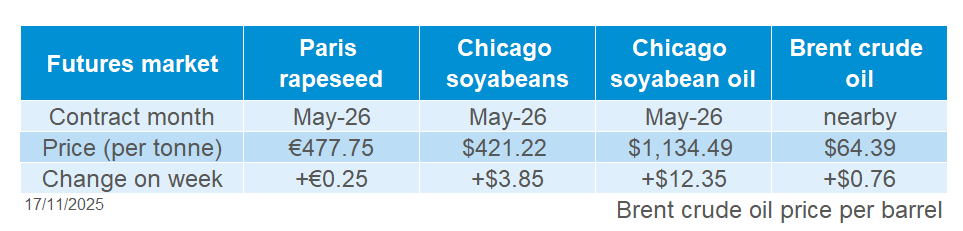

There was marginal gains in the oilseed complex over the last week. Paris rapeseed futures (May-26) gained €0.25/t week-on-week, closing Friday at €477.25/t. The market digested the latest USDA World Agricultural Supply and Demand Estimate (WASDE) report last Friday, after the longest government shutdown in US history, key oilseed insights from the reports include:

- Total world production of oilseeds has been revised down 3.5Mt for 2025/26 to 688Mt, but still above last year’s figure. Driving some of this was reduction to US’ output.

- US soyabean production is estimated at 1.3 Mt lower than projected in September at 115.8 Mt, this is from lowered yields, this drop was higher than market expectations.

- There were reductions to US soyabean exports (-1.4Mt) due to lower supplies and higher exports from Brazil (+500Kt) and Argentina (+2.25Mt).

- Increases in global production for rapeseed at 92.3Mt (+1.3Mt), with increases to EU-27 (+500Kt), Ukraine (+300kt) and Australia (+300Kt) largely contributing to the increase. Although this is offset by lower opening stocks at 9.8 Mt (-0.5Mt), leaving ending stocks for 2025/26 near unchanged.

After months of large Chinese soyabean imports, this could have weakened demand for the US-origin. Despite it being reported that China was expected to purchase 12 Mt of soyabeans before the end of 2025, demand from China has been lacklustre. It was reported by the USDA that 323Kt of US-origin soyabeans were booked by China between the period of 01 October to 12 November. With the market pricing in the potential for this China demand, if it falls short there could be a correction.

In Brazil (to 13 Nov), soyabean planting reached 71% of the expected area, up from 61% from the previous week, but behind the 80% seen on the same date in 2024 this is due to irregular rainfall (Agrural). Weather forecasts suggest between 1.5 to 3 inches of rain over the next week, which could aid planting progression towards the end of the campaign.

Focus for the oilseed market is on Australia due to their rapeseed harvest. LSEG analysts forecast Australia’s rapeseed production remains at 6.3 Mt (0.6Mt below ABARES estimates), supported by cooler weather and above-average rainfall across Western Australia (WA), Southern Australia (SA), and Victoria (VIC). Satellite imagery shows above-average vegetation density in WA and VIC, though moderate rain may delay harvests in WA while boosting late grain-fill in New South Wales. More information will be released in the Grain Industry Association of Western Australia (GIWA) report released this Friday.

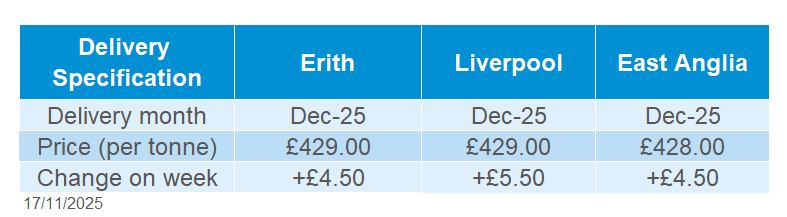

UK delivered rapeseed prices

Delivered rapeseed into Erith for December delivery was quoted at £429.00/t, up £4.50/t from the previous week. While December into Liverpool gained £5.50/t to £429.00 and East Anglia at £428.00/t, gaining £4.50/t week-on-week.

These prices are based on a survey typically carried out mid to late Friday morning, so they may not always reflect trends seen in the Paris futures by close of play. The week-on-week gain is greater in the delivered prices due to Paris rapeseed futures falling on Friday after the AHDB delivered survey was conducted.

Extra information

AHDB’s Early Bird Survey, released last week, forecasts a slight rise in UK wheat (+1%) and a considerable rise in oilseed rape (+30%) areas for harvest 2026 after the recent years of decline. Smaller areas are expected for spring barley down 15%, oats (-14%), and pulses (-12%). Winter barley is down 2% and uncropped arable land is set to rise by 8%.

Join our experts online on Tuesday 2 December 10:00am–11:00am as they share their perspective on the effect of extreme weather on this year’s cereals and oilseeds crop, the latest on contaminants monitoring and what potential production might be for the 2026/27 marketing year. With crop quality in sharp focus, this session is designed to help you make smarter decisions for the year ahead.

UK trade data was released last week up to September wheat imports and exports have fallen month on month. Stay tuned for Fridays Grain market daily for full analysis.

A reminder that the last trading day for the UK wheat futures November 2025 contract is this Friday.

We’ll be at AgriScot presenting the latest Grain Market Outlook from 12:15 to 1:15pm. If you’re attending, please do come and say hello, we’d love to see you there.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.