Arable Market Report – 19 January 2026

Monday, 19 January 2026

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

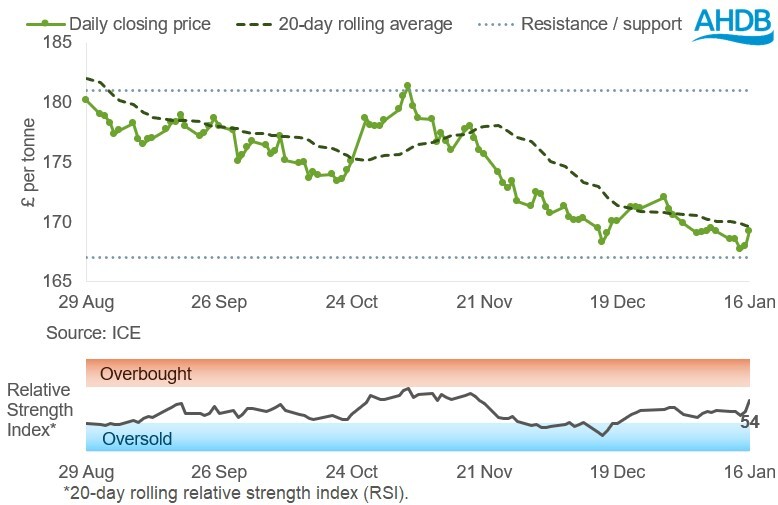

UK feed wheat futures (May-26)

UK feed wheat futures (May-26) closed near the 20-day simple moving average at the end of last week and remained above the nearest support level of £167/t.

The relative strength index (RSI) rose to 54 on Friday from 44 the previous week, indicating a slight increase in market momentum.

Find out more about the graphs in this report and how to use them

Market drivers

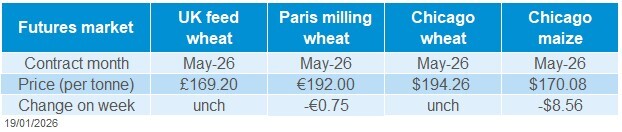

May-26 UK feed wheat futures prices ended last week unchanged (9–16 January) at £169.20/t. The price of Chicago wheat futures (May-26) was also unchanged, while Paris milling wheat futures decreased by 0.4% over the week. After decreasing at the start of last week following the USDA reports, prices increased again towards the end of the week, encouraged buying by wheat importers.

The USDA's World Agricultural Supply and Demand Estimates (WASDE) report showed increased global wheat supplies and consumption in 2025/26 compared to the previous report, as well as higher ending stocks. Projected global ending stocks increased by 3.4 Mt from December’s report to reach 278.3 Mt, primarily due to increases in Russia and Argentina.

During last week, global grain futures came under pressure from Chicago maize futures (May-26), which fell by 4.8% over the week. Last Monday, the USDA's WASDE report showed an 11.76 Mt (China + 6Mt, US +5Mt) increase in world maize ending stocks for 2025/26 compared to December figures. However, Paris maize futures (Jun-26) fell by just 0.7% Friday to Friday, partly due to the weaker euro against the US dollar.

Recently, we have seen some activity from wheat importers. The Saudi Arabian state grains agency, the General Food Security Authority, announced that it had purchased an estimated 907 Kt of hard wheat in an international tender (LSEG).

Looking at the 2026 wheat crop prospects, market participants are paying close attention to dry weather in the US and severe frosts in parts of Ukraine. However, Expana slightly increased its forecast for the EU 2026 soft wheat crop, raising it from 128.3 Mt in December to 128.6 Mt. The company noted that growing conditions remain favourable for winter crops across most EU countries.

According to the latest forecast from the Rosario Grains Exchange, the 2025/26 Argentinian crop could reach a record 62.0 Mt due to increased planting areas. Meanwhile, planting of the second crop in Brazil, the Safrinha crop, has begun.

UK delivered cereal prices

Feed wheat delivered into East Anglia and Yorkshire in February was quoted at £171.00/t and £180.50/t, respectively. Meanwhile, bread wheat for delivery in February to the North West and Northamptonshire was quoted at £193.50/t and £182.50/t, respectively.

Rapeseed

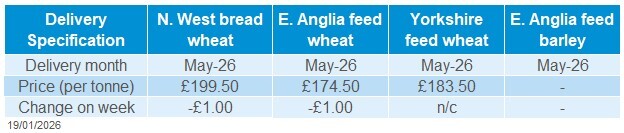

Paris rapeseed futures in £/t (May-26)

In £/t, May-26 Paris rapeseed futures again held above the 20-day moving average last week with the market pausing after volatility in previous weeks. The May-26 contract ended last week slightly higher at just under £405/t.

The Relative Strength Index (RSI) also rose slightly (from 46 to 50) between 9 and 16 January, reflecting the pause in momentum.

Find out more about the graphs in this report and how to use them

Market drivers

After falling on Monday, May-26 Paris rapeseed futures ended last week up €2.50/t at €467.00/t. Most of the gain happened on Friday after Canada and China announced a trade deal, which included reduced tariffs for Canadian canola (rapeseed) and Chinese electric vehicles (EVs).

China introduced a tariff of almost 76% on Canadian canola last autumn, which stopped exports to China and weighed on rapeseed prices. The new rate, around 15%, sparked optimism that trade would resume and lifted prices. This morning (19 January), Reuters reported that China has since bought 60 Kt of Canadian canola.

The USDA increased several of its key supply and demand estimates on Monday night by more than the market had expected, which triggered price falls. The USDA’s 2025/26 forecasts include US soyabean end of season stocks at 9.5 Mt, up 1.6 Mt from December and global end of season stocks at 124.4 Mt, up 2.0 Mt.

There was some support mid-week from a weaker euro against the US dollar, plus positivity on demand for US soyabeans on Thursday. The US government announced it will aim to finalise biofuel quotas by March, which could support soy oil, and so soyabean, demand. The US National Oilseed Processors Association also announced strong crush data for December, while net US soyabean export sales in the week ending 8 January for 2025/26 exceeded trade estimates (USDA, LSEG).

However, early harvesting of the soyabean crop in Brazil (around 1% complete), and the expected size of the crop kept a limit on prices. While the Brazilian government agency, Conab, trimmed its estimate by 1.0 Mt last week to 176.1 Mt, it is still a new record. The USDA forecasts the crop even higher at 178.0 Mt (+3.0 Mt vs December), with private forecasters Safras & Mercado at 179.3 Mt.

UK delivered rapeseed prices

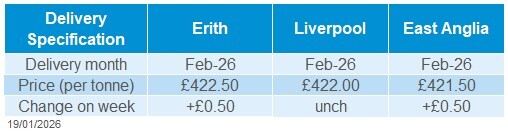

Rapeseed to be delivered to Erith in February was reported at £422.50/t in Friday’s survey, up £0.50/t from the previous week. In contrast to the futures market, the reported price for May delivery (£424.50/t) is higher than the February price.

There were stronger rises for new crop delivery points. Harvest 2026 delivery into Erith was up by £3.00/t Friday-Friday to 399.50/t, with November 2026 delivery up £2.50/t to £408.00/t.

A year ago (17/01/25), harvest 2025 delivery into Erith was reported at £410.00/t, with November 2025 at £419.50/t.

Extra information

On Thursday 15 January, AHDB published UK cereal usage data for November, covering human and industrial consumption, as well as GB animal feed production. Compared to the previous season, the volume of home-grown and imported wheat milled from July to November (including for bioethanol production) decreased by 4.1% and 24.5%, respectively. Brewers, maltsters and distillers’ barley usage for the season to date (July – November) is down 14.8% on the same period in 2024/25.

The latest trade data from HMRC, published on Thursday, shows wheat (including durum) imports from July to November reached 1.06 Mt, down 27% on the same period last year. Maize imports fell 27% to 862.5 Kt over the same period, while barley exports declined 2% to 185.9 Kt.

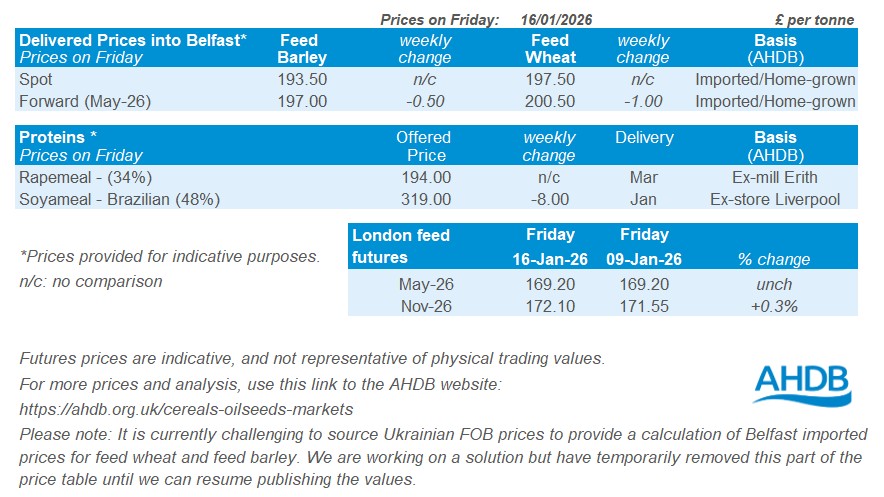

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.