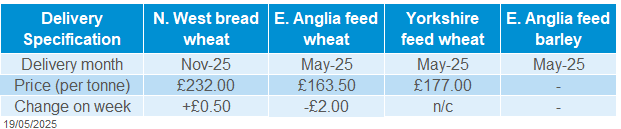

Arable Market Report – 19 May 2025

Monday, 19 May 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

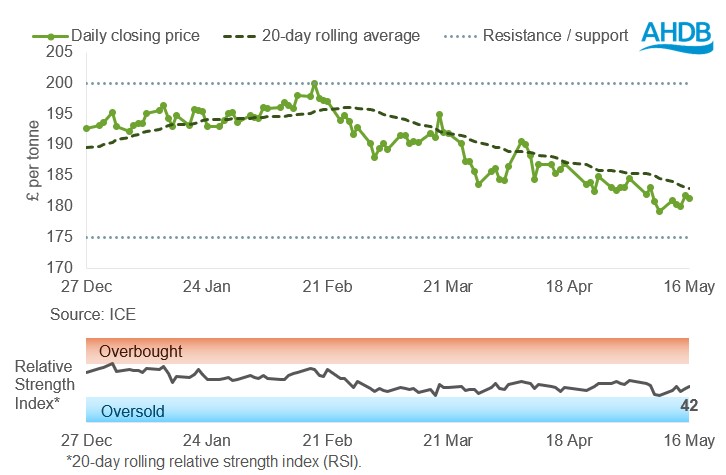

UK feed wheat futures (Nov-25)

Nov-25 futures gained last week (Friday–Friday), though remained just below the 20-day moving average. A relative strength index (RSI) at 42, up from 32 the previous week, suggests prices could find some relative stability.

Click here for more details on the graphs in this report, including how to use them.

Market drivers

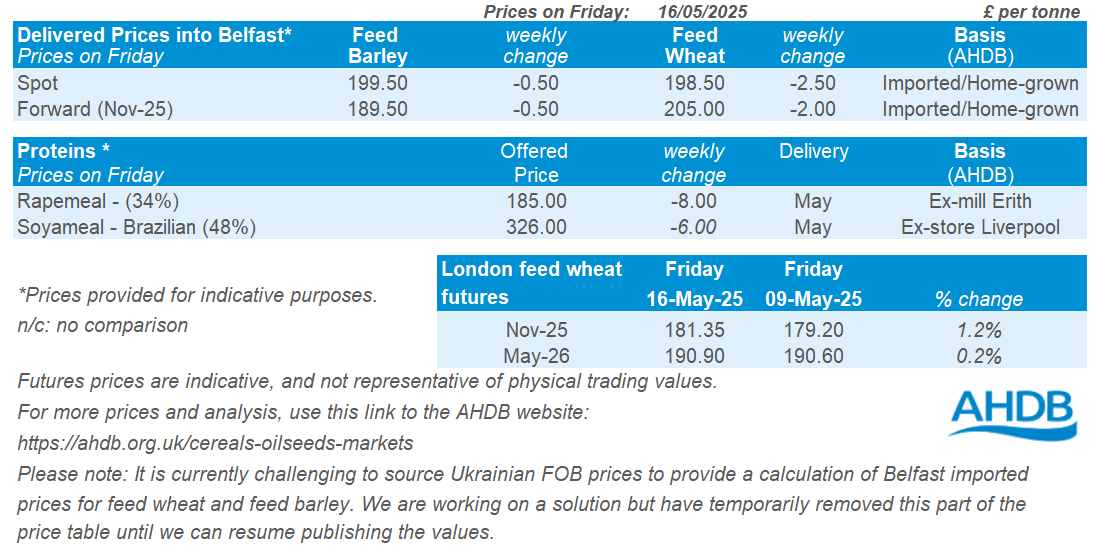

UK feed wheat futures (Nov-25) increased by £2.15/t (1.2%) last week (9–16 May), closing at £181.35/t on Friday. Domestic prices followed global markets, with Chicago wheat and Paris milling wheat futures (Dec-25) rising by 0.5% and 1.3% respectively.

Last week, increased purchasing activity by wheat importers and concerns about weather risks supported global wheat futures prices. However, favourable conditions in the US capped gains. Attention is now turning to northern Europe, where dry conditions could have a negative impact on potential grain yields.

The USDA's initial forecast for the 2025/26 season showed world wheat ending stocks at 265.7 Mt. This figure represents a slight increase of 0.2% compared to the 2024/25 season, and is higher than the average trade estimate of 261.2 Mt.

Last week, the USDA reported an improvement in winter wheat conditions in the US, with 54% rated as being in good or excellent condition as of 11 May, compared to 51% the previous week. Additionally, the percentage of spring wheat and maize planted is higher than last year’s figure and the five-year average.

Stratégie Grains updated its forecast for EU-27 soft wheat production in the 2025/26 season to 129.8 Mt, an increase of 1.7 Mt from last month due to improved prospects in Southern Europe. The consultancy also increased its estimate for the barley harvest by 1.2 Mt to 52.4 Mt. However, it lowered its estimate for the 2025 maize crop to 59.9 Mt, down from 60.1 Mt in the April report.

For July shipment, Algeria bought an estimated 0.66 Mt of milling wheat mostly sourced from the Black Sea region (primarily Russia and Romania). Saudi Arabia also bought 0.62 Mt of wheat for delivery between August and October.

Conab has estimated Brazilian maize production for the 2024/25 season at 126.87 Mt, which is almost 10% higher than last year's production. However, Brazilian market participants are forecasting increased use of maize by the ethanol industry.

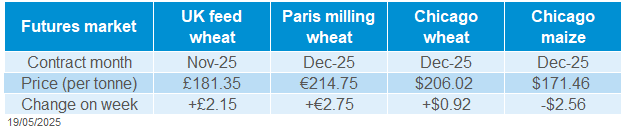

UK delivered cereal prices

Domestic delivered wheat prices had mixed changes Thursday to Thursday. Bread wheat delivered into Northamptonshire for November 2025 was quoted at £222.00/t, up £0.50/t. Meanwhile, feed wheat for delivery in East Anglia for May 2025 was quoted at £163.50/t, down £2.00/t.

For factors that could impact UK new crop feed wheat futures, follow this link.

Rapeseed

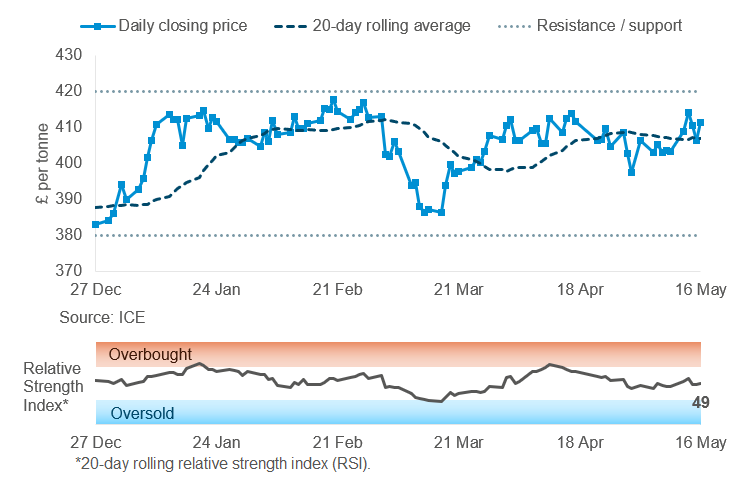

Paris rapeseed futures in £/t (Nov-25)

Nov-25 Paris rapeseed futures (in £/t) remained within recent resistance and support levels last week, though the contract is now back above the 20-day average. A slightly stronger RSI week-on-week (49 vs 45) points to a slight boost in momentum.

Find out more about the graphs in this report and how to use them.

Market drivers

Last week (Friday-Friday), global oilseeds markets saw mixed movements, with early gains easing to varying extents later in the week.

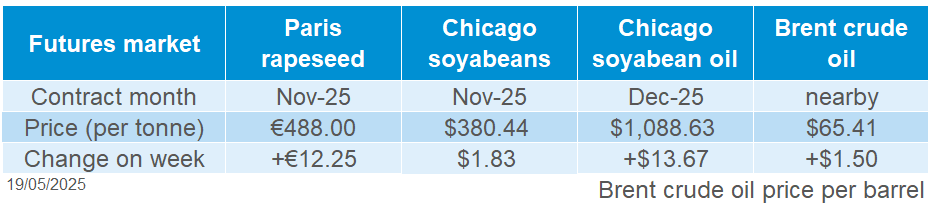

Paris rapeseed futures (Nov-25) gained €12.25/t (2.6%) over the week, to close at €488.00/t on Friday, supported by strength in the wider oilseeds complex. A weaker euro and rising crude oil prices helped rapeseed resist pressure in the soyabean market later in the week. Nov-25 Chicago soyabean and Dec-25 Chicago soyabean oil futures rose 0.5% and 0.6% respectively.

At the start of the week, markets reacted positively to news that the US and China had agreed to temporarily ease high tariffs, raising hopes of increased Chinese demand for US soyabeans. Further support came from the USDA’s May supply and demand report, which showed the US 2024/25 and global 2025/26 soyabean stock estimates slightly below market expectations. However, by mid-week, sentiment shifted due to growing concerns over the future of US biodiesel tax credits. This followed reports that suggest next year’s volume targets could fall short of industry expectations.

Indonesia raised its export duty on crude palm oil to between 4.75% and 10%, effective from 17 May, as part of its B40 biodiesel program. Nearby Malaysian palm oil futures jumped 1.3% over the week, as the policy is expected to reduce the competitiveness of Indonesian exports and tighten global supply.

In the EU, rapeseed imports remained firm due to tighter domestic supply, reaching 5.9 Mt as at 11 May 2025, up from 5.1 Mt last year. The outlook for 2025/26 appears more positive, with the USDA projecting a 2.3 Mt year-on-year rise in EU rapeseed production to 19.2 Mt.

Argentina and Brazil both revised their 2024/25 soyabean crop estimates upward, due to improved yields.

UK delivered rapeseed prices

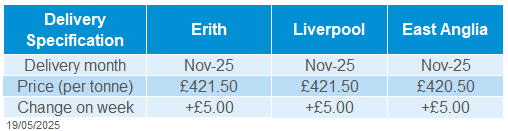

Rapeseed to be delivered into Erith in November was quoted at £421.50/t on Thursday, up £5.00/t from the previous week. Delivery to East Anglia in November was quoted at £420.50/t, also gaining £5.00/t. Domestic delivered prices followed the upward movement in Paris rapeseed futures, but gains were limited by the stronger pound against the euro.

Extra information

AHDB’s economics team released an article assessing the impact of the UK-US deal on UK agriculture. More specifically, it highlights how the deal likely poses more threats than opportunities for the UK ethanol market. In turn, the threat to UK ethanol production has notable implications for UK cereal prices and trade.

The latest trade figures from HMRC show maize and wheat imports remained strong throughout March. This is despite the rising cost of maize.

This spring has delivered extremely dry conditions across most of the UK. AHDB’s Emma Willis examines how a lack of soil moisture can impact nitrogen uptake in winter wheat.

Most GB fertiliser prices for April crept up, with UK produced AN rising to £383/t (+£3/t) on the month and up £46/t year-on-year. This follows rises in natural gas prices through late 2024 and into early 2025. Keep up to date with GB fertiliser prices on the AHDB website.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.