Arable Market Report - 22 April 2025

Tuesday, 22 April 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

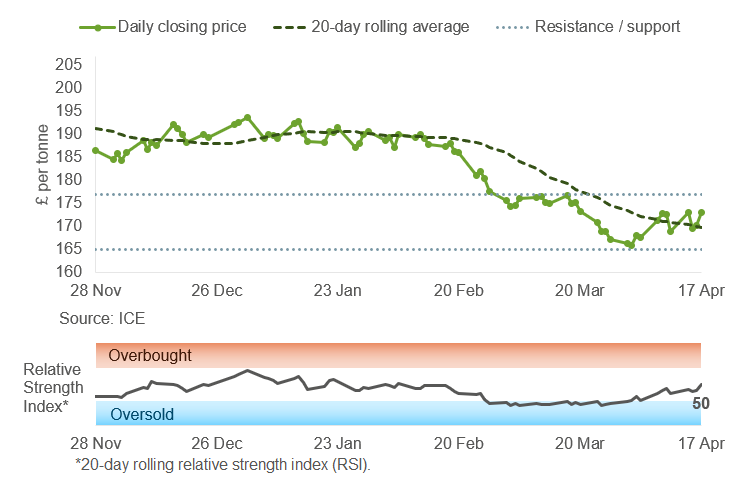

UK feed wheat futures (May-25) remained within range of support and resistance levels last week and are trading back above the 20-day rolling average. A stronger relative strength index compared to last week also shows a slight uptick in market momentum.

Click here for more details on the graphs in this report, including how to use them.

Market drivers

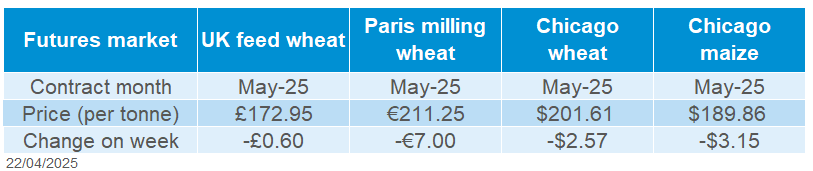

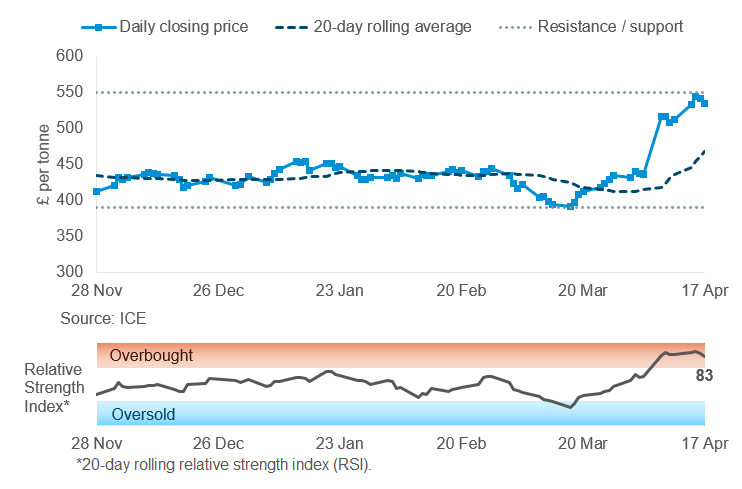

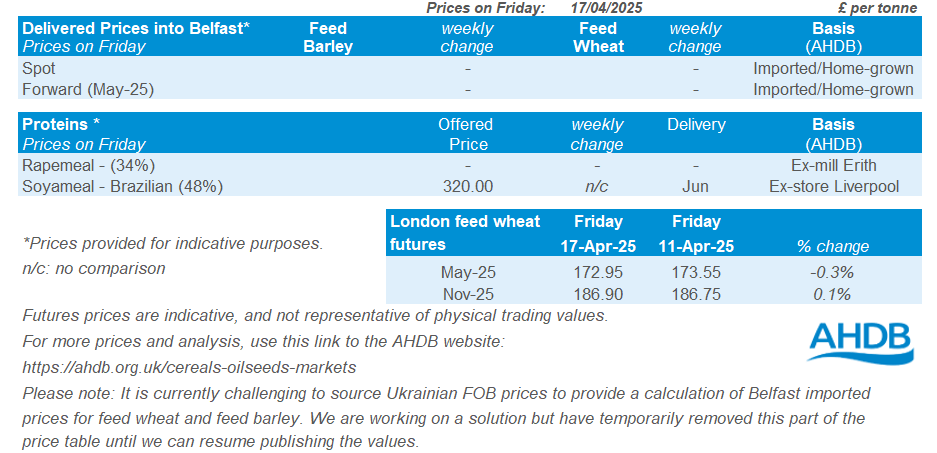

Last week, old crop (May-25) UK feed wheat futures fell £0.60/t (Friday – Thursday), to close at £172.95/t. While the new crop contract (Nov-25) gained £0.15/t over the same period, to end Thursday’s session at £186.90/t, extending its premium over old crop.

Old crop domestic prices followed bearish sentiment in the wider grains market last week. Chicago wheat (May-25) and Paris milling wheat (May-25) futures were down 1.3% and 3.2% respectively Friday to Thursday, with a strengthening euro against the US dollar and weak export demand contributing to greater pressure in European markets. New crop development driven by weather updates, currency fluctuations, and question marks over global export demand are in focus.

Following concern over dryness in the US, news of welcomed rain added bearish sentiment to US markets last week. However, while a proportion of the winter wheat crop benefitted from some rain, wet weather largely hit the US maize belt, leading to concern over delays in the planting of the spring crop. The impact of dry conditions for winter wheat remains in focus, with the USDA reporting 45% of the crop in good or excellent condition yesterday, down from 50% this time last year. With more rain forecast over the coming week, updates on winter crop conditions and spring plantings in the US could be a key price driver.

Ongoing peace talks between Russia and Ukraine remain a watchpoint. Sovecon analysts said this morning that market optimism over a potential settlement of the war in Ukraine had seen Russian wheat export prices fall last week. Sovecon also increased its export estimate for April by 0.1 Mt to 2.0 Mt, though this stays considerably lower than April 2024 when Russian wheat exports totalled 5.0 Mt.

As Northern Hemisphere winter crops progress through their key development phase, updates on European crops are a key factor. FranceAgriMer said on Friday that 75% of the country’s wheat crop was in good or excellent condition by 14 April, up from 64% a year earlier. It is also estimated that 39% of France’s maize crop was planted by 14 April, versus 15% a week earlier.

UK delivered cereal prices

Domestic delivered feed wheat prices moved in line with futures price movement last week. The delivered cereals price survey was carried out a day earlier than usual, due to the bank holiday on Friday. As such, prices shown are as at 16 April.

Bread wheat delivered into Northampton for July delivery was quoted at £211.00/t on Wednesday. Feed wheat delivered into East Anglia for the same month was quoted at £178.00/t, down £0.50/t from the previous Thursday.

Rapeseed

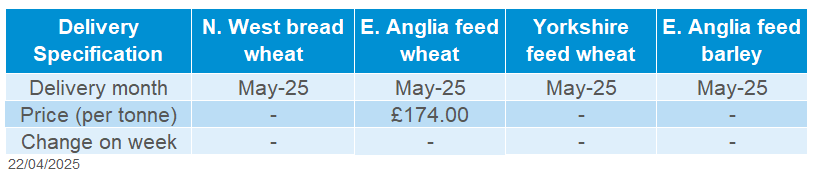

May-25 Paris rapeseed futures continued to trade above the 20-day moving average, following a strong rise from Friday to Thursday. The price chart has found a new resistance level at £550/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

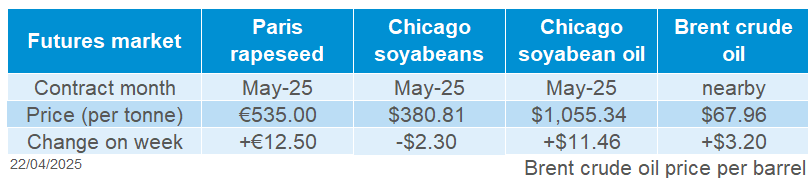

Paris rapeseed futures ended the week higher (Friday to Thursday) despite a stronger euro. The old crop (May-25) contract rose €12.50/t to €535.00/t, while new crop (Nov-25) gained €3.50/t to €479.50/t. The old crop premium to new crop extended to €55.50/t. Gains largely came from strength in the wider vegetable oil complex, with Chicago soyaoil and Winnipeg canola futures (May-25) both up 1.1%, alongside rising crude oil prices.

The National Oilseed Processors Association (NOPA) reported lower-than-expected soyaoil stocks as of 31 March. Stocks among NOPA members declined by 0.3% since the end of February, the first drop in six months, and were down 19.1% compared to the same time last year (LSEG).

Strong canola exports in Canada, despite trade tensions, are driving stocks lower and supporting prices. Last week, the Canadian Grain Commission reported season-to-date exports at 7.4 Mt, with 16 weeks left in the current marketing year. Currently, the USDA estimates total 2024/25 canola exports at 8.3 Mt.

Strong demand for rapeseed on the continent is also supporting markets. With a smaller EU supply this season, imports have been higher. As of 13 April, the EU Commission reported imports since July had reached 5.3 Mt, up from 4.6 Mt during the same period last year.

LSEG kept its 2025/26 rapeseed production forecast for the EU-27 + UK at 19.9 Mt. However, soil moisture levels remain low in key producing areas such as Poland and Germany.

Consultancy, APK-Inform, estimates that Ukraine’s 2025 rapeseed crop will fall to 3.39 Mt (USDA: 3.8Mt), down from 3.70 Mt in 2024, with exports likely to drop to 2.72 Mt from 3.14 Mt. However, the 2025 sunflower harvest is projected to rise by 14% to 15.2 Mt.

The French Farm Ministry raised its 2025 rapeseed area estimate to 1.29 Mha, up from 1.27 Mha, following improved crop conditions and strong prices earlier in the year.

UK delivered rapeseed prices

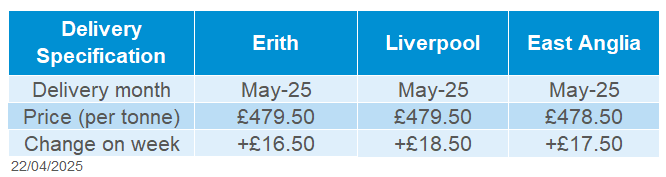

Rapeseed to be delivered into Erith in May was quoted at £479.50/t on Friday, up £16.50/t from the previous week. Delivery to East Anglia in May was quoted at £478.50/t, gaining £17.50/t. Domestic delivered prices followed gains in Paris rapeseed futures with a weaker sterling compared to recent weeks adding further support.

Extra information

The most recent trade data, including figures up to the end of February show wheat imports are slowing, though remain at record levels this season to date. From July to February, wheat imports (including durum) totalled 2.16 Mt, up 50% on the same period last year, and 78% on the five-year average. However, for the first time this season, monthly imports fell below 200 Kt, at 194.6 Kt in February. This is well below the average monthly pace of 269.7 Kt for this season so far.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.