Arable Market Report – 22 December 2025

Monday, 22 December 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

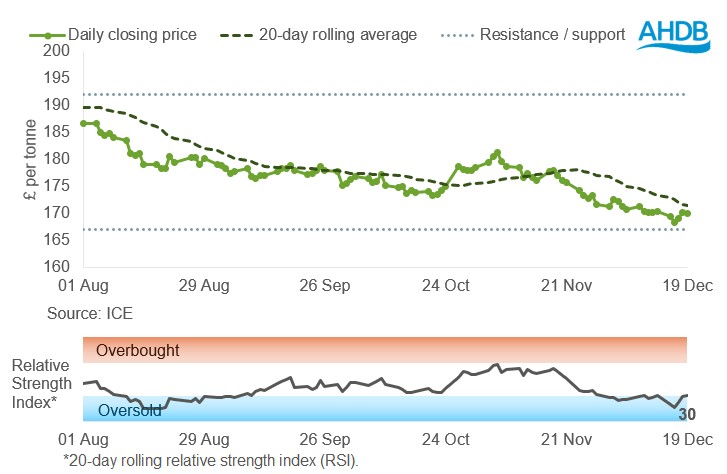

UK feed wheat futures (May-26)

Last week (12–19 December), UK feed wheat futures (May-26) fell as it approached the nearest support level of £167/t. However, the price finished slightly below the 20-day average, which is now the nearest potential resistance level.

The relative strength index (RSI) decreased to 30 from 31 the previous week, indicating that the market is in an oversold zone.

Market drivers

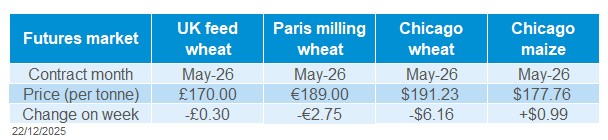

UK feed wheat futures eased last week, with the May-26 contract closing at £170.00/t on Friday, down £0.30/t (0.2%) on the week. Ample global wheat supply and strong competition between exporters put pressure on the wheat market last week. Chicago wheat and Paris milling wheat futures (May-26) fell by 3.1% and 1.4%, respectively. Domestic feed wheat futures showed more limited decreases last week partly due to support from maize market.

Due to the well-supplied global market, the Chicago wheat futures market has been in a downward trend recently. Last week, it reached a two-month low following news that China had cancelled purchases of wheat from the US. However, Paris milling wheat futures fell at half the rate of Chicago futures last week, due to the weaker euro and more competitive shipping costs from the EU. This made EU wheat more attractive than that from the Black Sea region (LSEG).

Wheat harvests are underway in Argentina and Australia, which increases the supply. Expected high wheat production in these two countries is putting pressure on the global wheat market.

In its monthly update, the EU Commission increased its forecast for EU common wheat production and ending stocks for the 2025/26 season to 134.4 Mt and 11.7 Mt, respectively. However, Expana's initial production forecasts for the 2026/27 season projected EU soft wheat output at 128.3 Mt, notably lower than the previous season's figure.

Compared to wheat, maize futures are showing some resistance to decreasing prices. Chicago maize futures May-26 increased by 0.6%, while Paris maize futures for June 2026 fell by 0.1% last week. A tighter global maize balance, increased import demand and limited supply from Ukraine are supporting maize prices.

Attacks by Russia on Black Sea ports and energy facilities have reduced Ukrainian grain and oilseed exports by forcing the closure of some export terminals.

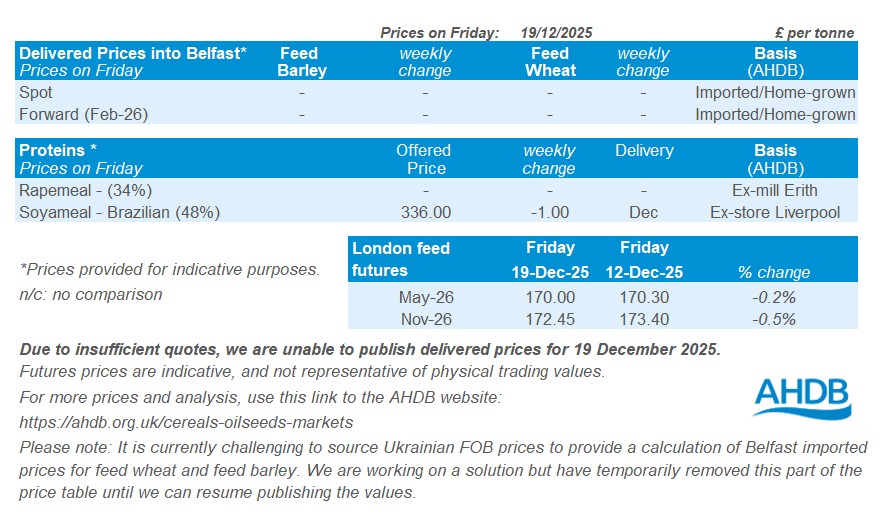

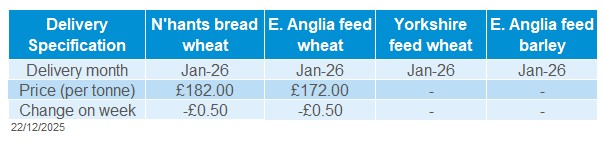

UK delivered cereal prices

Domestic delivered wheat prices decreased last week, following a fall in UK feed wheat futures from Thursday to Thursday.

Feed wheat delivered into East Anglia for January was quoted at £172.00/t, down £0.50/t on the week. Bread wheat for January delivery into Northamptonshire also was down £0.50/t, at £182.00/t.

Rapeseed

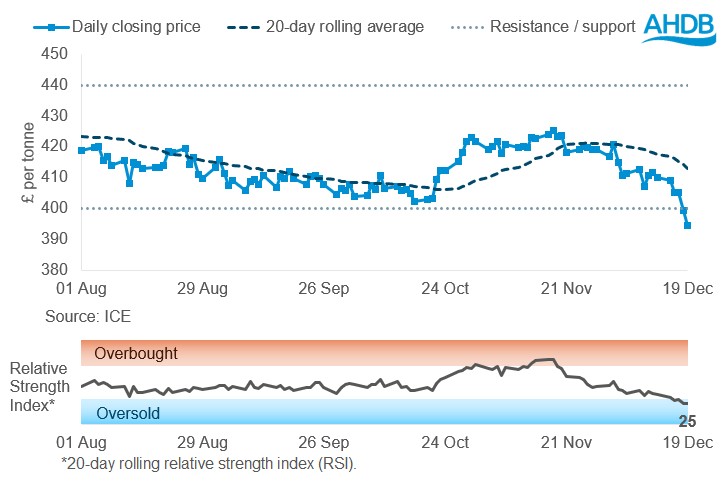

Paris rapeseed futures in £/t (May-26)

In £/t terms, May-26 Paris rapeseed futures decreased last week (12 – 19 December) and closed again below the 20-day moving average. It also unfortunately broke through the previous current level of support at £400/t. When analysing price trends, a ‘support line’ is seen as a level that it may be harder for prices to fall below.

The RSI fell from 36 to 25, signalling weaker momentum as it moved to the oversold zone. This indicates a point when it’s important to watch markets more closely to see if the recent downward trend could pause.

Market drivers

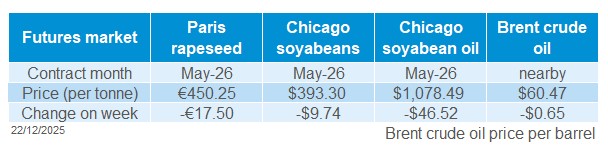

Paris rapeseed futures (May-26) closed down €17.50/t (3.7%) last week to finish at €450.25/t. Global oilseeds were pressured by a fall in the value of crude oil, as well as ample global supplies reported due to the Australian canola harvest and encouraging soyabean crop development in Brazil.

Brent crude oil futures (nearby) fell 1.1% on the week. Prices fell significantly at the beginning of the week as progression around peace talks in Ukraine could see fewer sanctions on Russian oil. As the talks yielded little progress, prices rose from midweek but remained lower than the previous week. This pressured global oilseeds as biodiesel becomes less competitive as crude oil prices decline, so demand for oilseeds could fall.

Following trade talks in October, China has since purchased 7 Mt tonnes of US soyabeans of the 12 Mt target stated by the White House. The 134 Kt purchased by Chinse buyers on Friday is the latest sale, but doubt remains about whether the 12 Mt figure will be met.

Pressure also comes from a record South American soyabean crop with 223.5 Mt expected from Argentina and Brazil, up 0.9 Mt on 2024/25 (USDA). The crop continues to develop well, with forecast light rains over the coming week continuing to be beneficial as harvest approaches in early 2026.

China’s near‑halt in Canadian canola (rapeseed) imports has reportedly stopped crushing activity, and shifts all market attention to the ongoing Australian canola harvest. This leaves Canada with a large crop (21.8 Mt, StatsCan) but slow export sales, adding to pressure on the market.

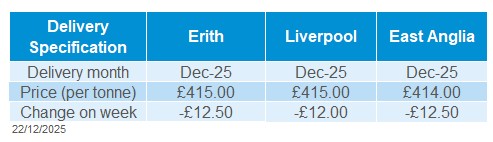

UK delivered rapeseed prices

UK delivered rapeseed prices fell across Dec-25 and 2026 delivery months last week.

December delivery into Erith was quoted at £415.00/t, down £12.50/t from the previous week. Meanwhile, harvest-26 was quoted at £395.00/t, £20.00/t lower than the spot price and down £10.50/t on the week.

The price for December delivery into Liverpool fell £12.00/t to £415.00/t, while the price into East Anglia fell £12.50/t compared to the previous week to £414.00/t.

These values are based on a survey conducted mid to late Friday morning and may not fully capture movements in Paris futures by the close of trading.

Grain Market Daily is changing - find out how

We’re making some changes to our Grain Market Daily email. Instead of daily market commentary, you'll get key market analysis when new data is released. This means the email name will change to Grain Market Update and you’ll get it less often, but it will still contain all the relevant market information that’s important to your business.

For up-to-date trusted market information, including our weekly Arable Market Report, visit our website or subscribe to any of our other sector emails to get it delivered straight to your inbox.

Extra information

The final UK area forecasts for 2026 from AHDB’s Early Bird Survey (EBS) were released last Thursday 18 December. It shows only small changes from the provisional figures for wheat, barley, oats and oilseed rape. Find out more in this Analyst Insight.

Northern Ireland

Christmas publications

This is the last AHDB Grain and oilseed weekly market report of 2025; our next report will be on Monday 5 January 2026. So, we would like to take the chance to wish you a very happy Christmas and a prosperous 2026.

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.