Arable Market Report - 23 September 2024

Monday, 23 September 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

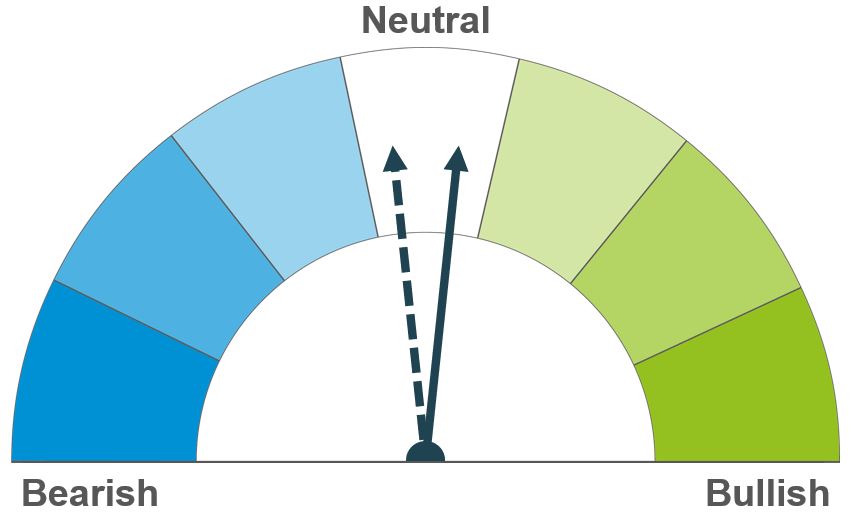

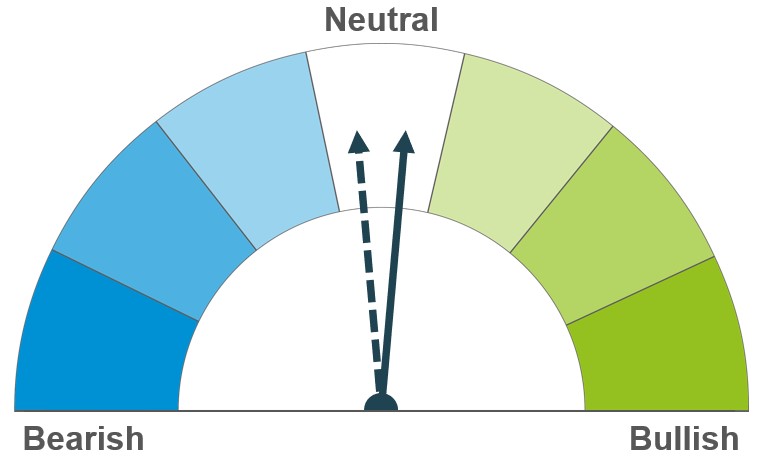

Wheat

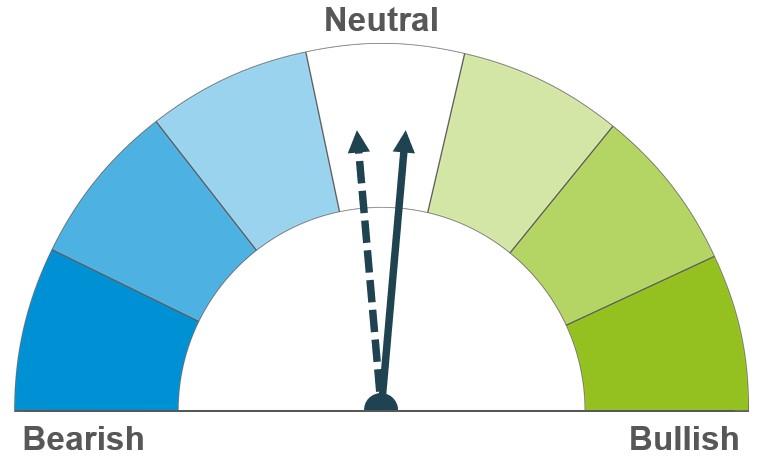

Maize

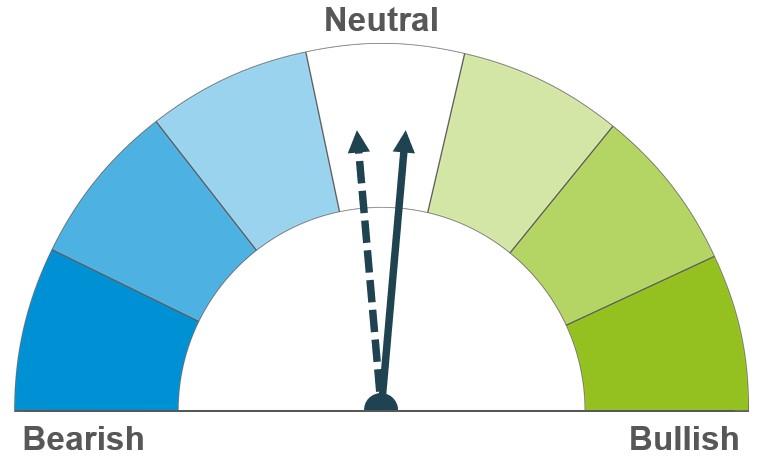

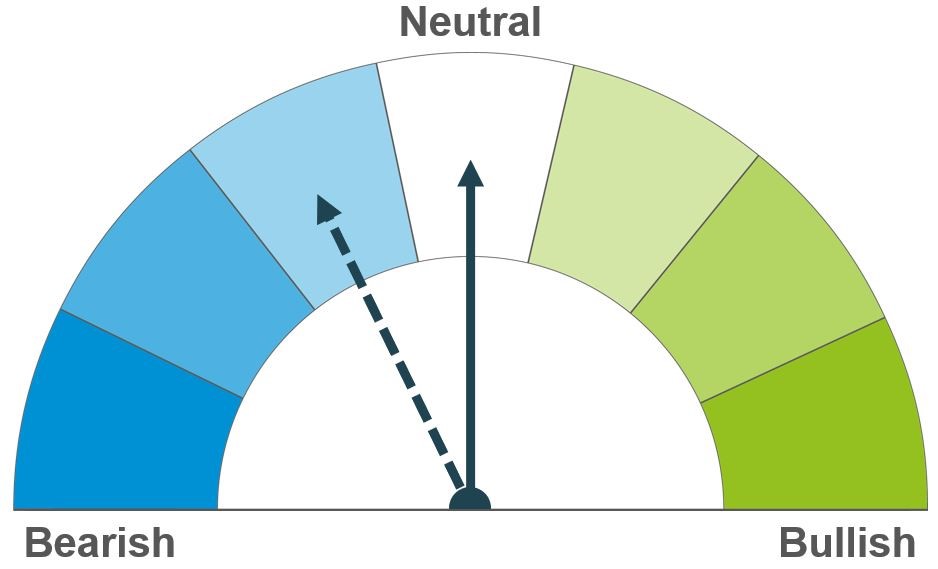

Barley

Recent further cuts to the European wheat crop could lead to some support for prices both short and longer-term. However, the continuation of competitive supplies from the Black Sea limits any gains.

With much of the US crop now maturing and harvest underway, adverse weather will have little impact and we could see some harvest pressure. Though poor conditions and cuts to European maize crop production will limit price losses.

Cuts to European production continue to be counterbalanced by higher production estimates in Australia. Barley will continue to follow price movement in the wider grains complex also.

Global grain markets

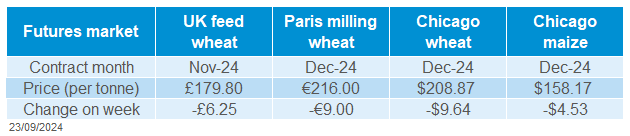

Global grain futures

Global grain markets were overall pressured last week. Dec-24 Chicago wheat futures were down 4.4% Friday-Friday, while Paris milling wheat futures (Nov-24) fell 4.0% over the same period. Pressure last week came largely from easing tensions in the Black Sea following a missile strike the week prior, with competitive exports continuing to flow from the region. Improved weather last week in the US Midwest, as well as an upwards revision to the Russian wheat crop also weighed. However, European harvest results remain something to watch.

The week before last saw concerns over escalation in the Black Sea region, as a Russian missile hit a ship carrying Ukrainian wheat. However, tensions have eased, and competitive supplies continue to flow. This morning, the Ukrainian agriculture ministry released data showing that the country’s grain exports this season to date (as at 23 Sep) had totalled 9.4 Mt. This is up from 6.2 Mt exported during the same period last season.

Despite concern over drought conditions in the US maize belt, plentiful rain fell over key growing regions over the last few days. There is little rain forecast over the coming week and the proportion of the US maize area in drought conditions as at 17 September was 26%, up from 18% the week prior. However, given that much of the crop is now maturing and harvest is underway in some areas, any impact from these conditions will be minimal.

Revisions to European grain output continue to limit global grain price losses. On Friday, grain trade association Coceral cut its estimate for the EU-27+UK total grain crop to 280.3 Mt. This is down significantly from its previous estimate of 296.0 Mt made in June, and down from 294.2 Mt harvested in 2023.

UK focus

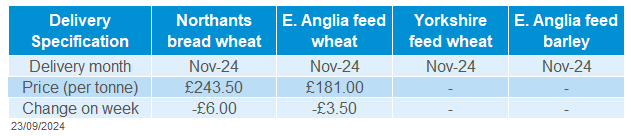

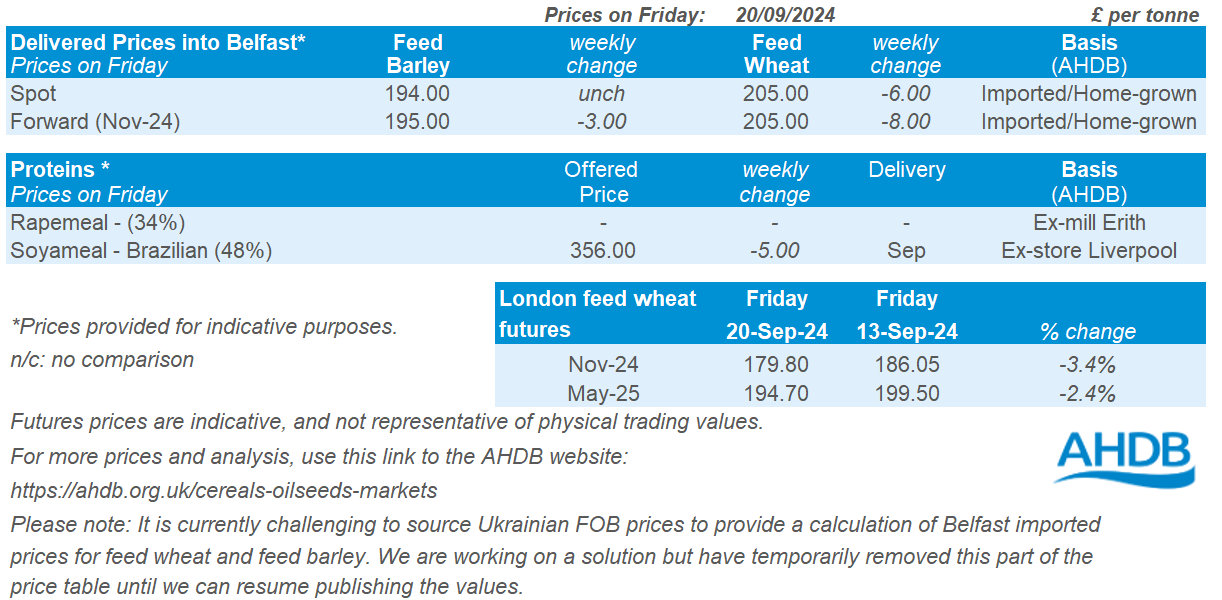

Delivered cereals

Domestic wheat futures followed global markets down last week. UK feed wheat futures (Nov-24) ended Friday’s session at £179.80/t, down £6.25/t on the week. The May-25 contract fell £4.80/t over the same period, to close at £194.70/t on Friday.

UK delivered prices followed downwards pressure in futures markets last week. Feed wheat into East Anglia for October delivery was quoted at £180.00/t on Thursday, down £3.50/t on the week. Meanwhile, bread wheat into Northamptonshire for October delivery was quoted at £242.00/t, down £6.00/t Thursday to Thursday.

On Thursday, sterling reached its highest level for over two and a half years against the US dollar. It also reached the third highest level against the euro since early August 2022. The rise followed the Bank of England’s decision to keep interest rates unchanged at 5.0%, while cuts were made by the US and Eurozone central banks. Find out more about how this could impact UK grain and oilseed markets here.

Oilseeds

Rapeseed

Soyabeans

China’s anti-dumping investigation on Canadian rapeseed will continue to limit rapeseed prices. However, the overall tight global balance, primarily due to reduced production in the EU and Canada, provides support.

Dry weather in Brazil and increased imports from China may help to stabilize prices in the short term. However, there is potential for price pressure due to the US harvest and anticipated beneficial rains in Brazil in October.

Global oilseed markets

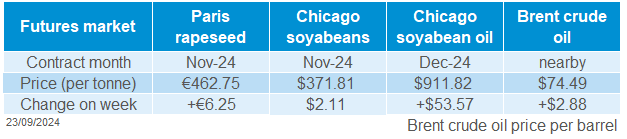

Global oilseed futures

Global oilseed prices were generally up last week (Friday to Friday). Nov-24 Chicago soyabean futures gained $2.11/t to close at $371.81/t. Support for prices came from the ongoing drought in Brazil and strong demand from Chinese buyers. However, harvest pressure from the US, where larger crop is expected this year, has limited further price climbs.

Soyabeans import by the world’s largest buyer, China remains firm, with import from the US increasing by 70% in August compared to a year earlier. The surge in import is attributed to lower prices and concerns over possible trade restrictions, if Republican candidate, Donald Trump wins the November US elections. Additionally, China’s soybean imports from Brazil reached 53.8 Mt from January to August, up 217% from the same period last year.

The soyabeans harvest is in the US is making good progress. According to USDA’s crop progress report, 6% of soyabeans had been harvested by 15 September, which is ahead of last year’s 4%.

The International Grains Council (IGC) kept its global soyabeans production and consumption estimates for the 2024/25 marketing year at 419 Mt and 406 Mt, respectively, in September. Trade is projected to increase by 0.6% to 178 Mt in the 2024/25 marketing year, marking the third consecutive year of growth with China playing a central role.

In Brazil, the pace of soyabean planting has been slow due to ongoing drought. According to the consultancy firm Safras & Mercado, only 0.5% of the expected area for the 2024/25 season have so far been planted, compared to 1.6% a year earlier. Despite this, the firm raised its Brazil 2024/25 soyabeans crop to 171.78 Mt, up from 171.54 Mt in its previous forecast, as weather models show rainfall in October.

The National Oilseed Processor Association (NOPA) reported that the soybeans crushed in the US August was 13.6% lower than July and 3.5% below the 5-year average. This decline is mainly due to slowdown in demand from the biofuel industry.

Rapeseed focus

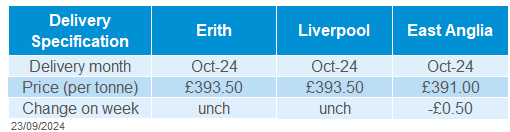

UK delivered oilseed prices

Paris rapeseed futures (Nov-24) gained €6.25 over the week (Friday – Friday) to close at €462.75/t. The European futures found support from the gains in Chicago soyabeans futures and the general strengthening of the vegetable oils complex.

Delivered rapeseed prices into Erith for November was quoted at £395.00/t on Friday, gaining £0.50/t on the week. Meanwhile, delivery for May was quoted at £402.00/t rising £1.00/t over the same period. The weekly price change partly reflects the time the survey was carried out (late-morning), but also a rise in the strength of sterling.

The Economic intelligence unit (EIU) in its monthly rapeseed oil outlook lowered its forecasts for the global rapeseed harvest in 2024/25, most notably in the EU and Canada. The agency expects high carryover stocks of rapeseed to partially offset the deteriorating harvest outlook. With most of the northern hemisphere harvest now completed, attention is now focused on the crop prospects in Canada. The forecast for rapeseed oil production in 2024/25 was also reduced to 30.9 Mt.

In Canada, canola (rapeseed) yields have been disappointing. Statistics Canada estimates a 1.1% year-on-year reduction in production to 19.0 Mt in 2024. This decrease is attributed 0.8% drop in yields and 0.4% decline in harvested area. Saskatchewan, the largest crop region where harvest is at 47% complete as of 16 September, could see a 0.4% reduction in production in 2024 compared to 2023.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.