Arable Market Report –24 February 2025

Monday, 24 February 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

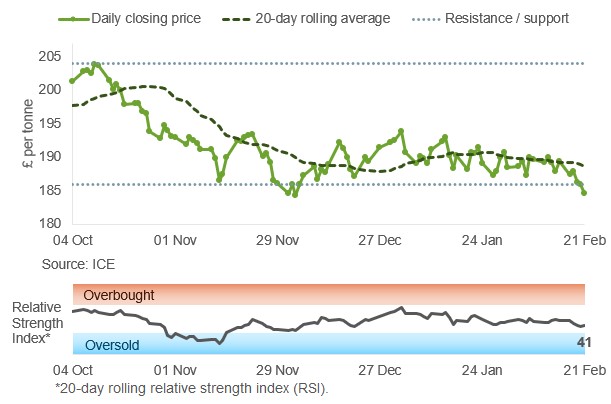

May-25 UK feed wheat futures are below the 20-day rolling average price and on Friday closed at the lowest point since 4 December. The domestic market has fallen below the recent support level (c£186/t), so could now face further downward pressure.

Find out more about the graphs in this report and how to use them here.

Market drivers

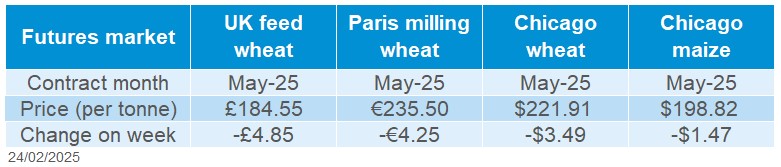

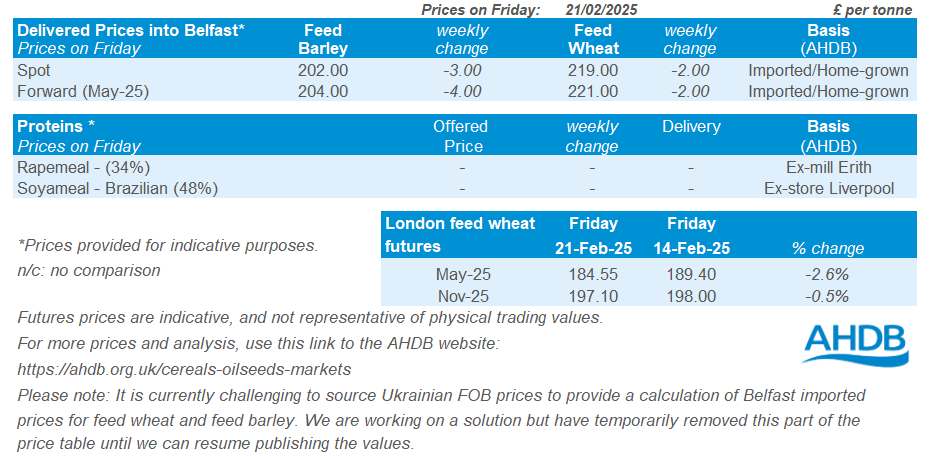

UK feed wheat futures (May-25) fell £4.85/t over the week (Friday-Friday) to close at £184.55/t. The Nov-25 contract reached a three-month high of £200/t at Tuesday’s close last week but Friday-Friday fell £0.90/t, settling at £197.10/t.

UK feed wheat old crop futures are under pressure due to falls in global wheat futures and the strengthening of sterling against the euro. Chicago wheat and Paris milling wheat futures May-25 were down 1.55% and 1.77% respectively over the week (Friday-Friday).

Weather conditions in major producing regions, particularly the USA, Argentina, Brazil and Russia, will continue to influence global markets. Forecasts for widespread rain across Argentina's farm belt this week could add to the pressure on futures.

FranceAgriMer showed that 74% of winter wheat and 69% of winter barley was in good or excellent condition on 17 February, up 1 % for both on the previous week.

The USDA export sales report for the week ending 13 February, showed net wheat export sales near the top of trade estimates for the third week in a row at 532.7 Kt. For maize, net export sales neared the top of trade estimates at 1.45 Mt. For both wheat and maize the main buyer was Mexico. But this week brings the deadline of postponed US imports tariffs for Mexico, Canada and China, which could bring unpredictability on the market at the nearest term.

Speculators raised their net long position in Chicago for maize futures in the week to 18 February. However, maize prices fell on Friday last week amid profit taking and expectations that the USDA will forecast higher US plantings for the 2025 crop at a conference this week due to the low level of the soyabean/maize price ratio. Also, US farmers are reportedly accelerating the physical sale of old crop maize.

The International Grains Council (IGC) projections for 2025/26 are for higher world wheat production and higher maize area compared to 2024/25. Barley planted area is also forecast to increase slightly from last year's historic lows.

UK delivered cereal prices

The feed wheat price for delivery into East Anglia in May was quoted at £189.00/t on Thursday, down £2.50/t on the week. Delivery into East Anglia in August 2025 (harvest 2025) was quoted at £191.00/t on Thursday, up £2.00/t on the week.

While new crop UK feed futures have strengthened over old crop, physical prices don’t fully reflect this. The basis for East Anglia delivered prices for old crop (over May futures), remains stronger than for harvest 2025 (over November futures).

Rapeseed

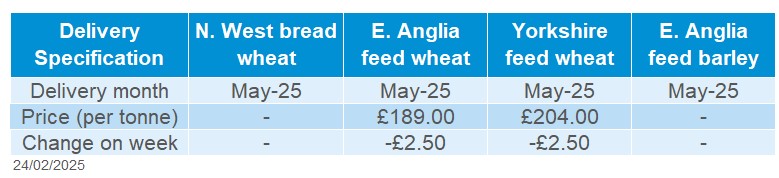

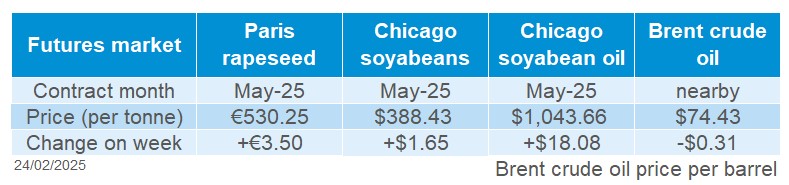

May-25 Paris rapeseed futures traded around the 20-day rolling average last week, staying within established resistance and support levels. This suggests the market may drift or ease back, as upside potential appears limited, at least short-term, with Brazil’s record soyabean harvest underway.

Find out more about the graphs in this report and how to use them here.

Market drivers

May-25 Paris rapeseed futures closed the week at £530.25/t (Friday to Friday), up £3.50/t from the previous Friday. The new crop (Nov-25) contract saw bigger gains, rising £6.75/t to finish Friday at £500.75/t. Strong demand and a tighter supply in the EU are driving prices.

Rapeseed imports into the EU reached 4.22 Mt this season to date (1 July to 16 February), up from 3.74 Mt last year. Soyabean imports have also increased to 8.62 Mt, compared with 7.78 Mt at this stage last season due to higher crushing demand.

The Paris rapeseed futures prices followed the Chicago soyabeans complex, which gained on solid US export demand and ongoing weather concerns in South America. However, expectations of a larger crop in Brazil continued to limit price gains. May-25 Chicago soyabeans and soyabean oil futures increased by 0.43% and 1.76% respectively (Friday-Friday).

Weather risks in South America were a key focus during the week, with Argentina facing drier conditions that have put the soybean crop under pressure, despite rains recently. Heavy rainfall in Brazil also slowed the soybean harvest, adding to the uncertainty. The International Grains Council (IGC) lowered its global 2024/25 soybean production forecast to 417.5 Mt in February, down 2.0 Mt from last month, reflecting weaker expectations for South America.

The latest harvest reports by Patria Agronegocios show Brazil’s soybean harvest is 27.2% complete, up 10.5% from last week but still behind last year’s 30.7%. In Argentina, soybean crop conditions have slightly improved, with the percentage rated as poor/very poor dropping by 2% to 34%, though still higher than 18% at the same time in 2024. The weather forecast predicts more rain for Argentina and drier conditions in central Brazil over the coming week. This could help improve crop prospects in both countries.

UK delivered rapeseed prices

Rapeseed to be delivered into Erith in February was quoted at £444.00/t on Thursday, up £5.00/t from the previous week. Delivery to East Anglia in February was quoted at £442.50/t, also rising £4.50/t. Please note the survey is usually conducted mid-late morning on Friday, so can show differences from Paris futures closing prices.

Extra information

Updated UK trade data, showing figures up to the end of December 2024, confirmed that while wheat and maize imports remained strong, the pace dropped back in the month of December. Though overall exports are still low, UK barley, wheat and oat exports picked up pace slightly.

Tight straw supplies from 2023 carried over into 2024, with reduced cropping areas adding further strain on the market. A break in the weather allowed 88% of wheat to be harvested by August, creating a favourable window for baling and alleviating some of the supply pressure. Read more on the AHDB’s straw market outlook. Also, look out for the fertiliser outlook due out tomorrow.

The USDA's 101st Annual Agriculture Outlook Forum (AOF) will be held on 27-28 February 2025. Traditionally, this forum is used to present the first forecasts for the US spring crops. This could have an impact on wheat, maize and soyabean prices for the 2025 crop.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.