Arable Market Report - 24 November 2025

Monday, 24 November 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

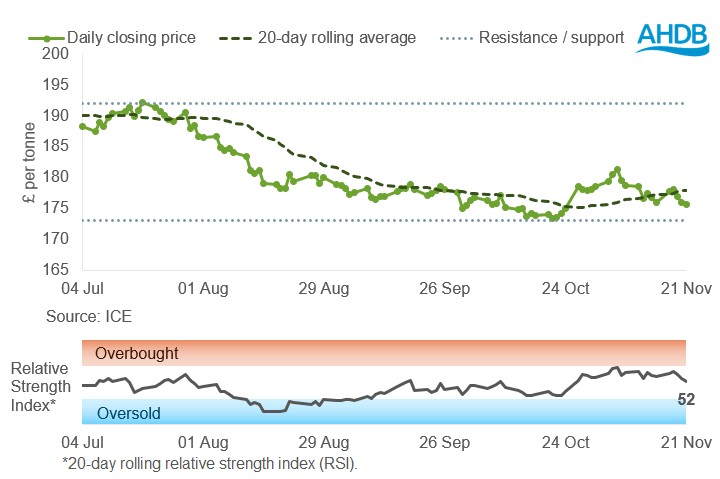

UK feed wheat futures (May-26)

UK feed wheat futures (May-26) closed below the 20-day simple moving average at the end of last week, but remained above the nearest support level of £173/t.

The relative strength index (RSI) eased to 52 from 56 the previous week, indicating a slowdown in market momentum.

Find out more about the graphs in this report and how to use them

Market drivers

UK feed wheat futures fell last week, with the May-26 contract closing at £175.60/t on Friday, down £0.40/t (0.2%) between 14 and 21 November.

Domestic feed wheat futures come under pressure as Chicago wheat and Paris milling wheat futures May-26 contracts decreased by 0.7% and 0.3% respectively. The ample global supply of wheat is putting downward pressure on prices.

The volatility of the euro against the US dollar remains an important factor influencing Paris futures due to the strong competition between major wheat exporters and EU origins. Last week, the weaker euro limited the fall in Paris futures wheat prices.

The International Grains Council (IGC) raised its 2025/26 global wheat production forecast to 830 Mt, up 3 Mt and maize to 1298 Mt, up 1Mt from its previous estimates in September.

There was no change in global stocks of wheat at the end of the 2025/26 season, while maize stocks increased by 1 Mt.

On the demand side, it seems like importers are trying to cover some requirements before the holidays. Saudi Arabia has issued a tender to purchase 300 Kt of hard milling wheat (LSEG).

In the week ending 16 November, 92% of winter wheat had been planted in the USA, which is 3% behind the five-year average.

US wheat crop conditions rated as 'good' or 'excellent' were 4% lower than in the previous year. The maize harvest was 91% complete, which was behind the five-year average of 94%.

At this time of year, market participants traditionally focus on weather risks for winter crops in the Northern Hemisphere. The next European crop monitor MARS and the US Crop Progress Report are due to be released later today (24 November).

The shorter US trading period this week, due to the US Thanksgiving holiday, may influence the Chicago futures market and the global market as a whole.

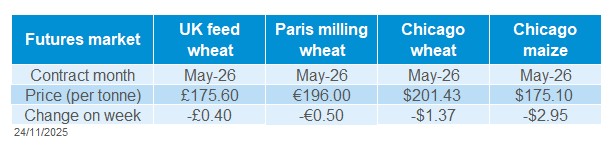

UK delivered cereal prices

Domestic delivered wheat prices were mixed in their response to the movement in UK feed wheat futures Thursday to Thursday, with some divergence between milling and feed quality.

Feed wheat delivered into East Anglia in November was quoted at £171.50/t, up £1.00/t on the week.

However, bread wheat for November delivery into Northamptonshire was quoted at £187.50/t, down £0.50/t on the week.

Biscuit wheat for November delivery into Northamptonshire was quoted at £179.50/t.

Rapeseed

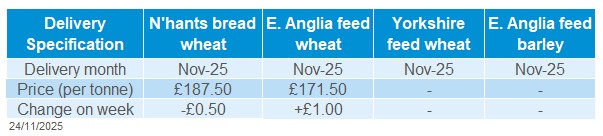

Paris rapeseed futures in £/t (May-26)

In £/t terms, May-26 Paris rapeseed futures decreased (14 November – 21 November), closing the week below the 20-day moving average near £418/t.

The relative strength index (RSI) fell from 76 to 57, moving out of the overbought zone and indicating a decrease in market momentum.

Market drivers

Oilseed markets were mixed over the week gaining midweek before falling by the close of trading on Friday. Subsiding optimism around US trade to China, as well as renewed activity for Russian oil exports and work on a potential peace deal weighed on oilseed markets.

Brent crude oil futures (nearby) were down 2.8% over the week (Friday to Friday). Paris rapeseed (May-26) fell €2.75/t (0.6%) to close at €475.00/t over the same period as the euro-US dollar exchange rate helped to limit the losses.

The Grain Industry Association of Western Australia (GIWA) estimates Western Australia (WA) canola (rapeseed) production at 4.3Mt, up from pre‑harvest forecasts of 3.8Mt and 50% higher than 2024/25 output of 2.9Mt.

As WA typically accounts for nearly half of Australia’s canola, the report provides a good indication of national production potential.

S&P Global Energy has projected that US farmers will reduce maize plantings by 3.8% while soyabean plantings rise by 4% for harvest 2026. The fall follows poor prices in global maize markets with a year of strong supply. The forecasts were based on a survey of farmers and agribusinesses.

Chicago soyabeans traded mixed over the week amid speculation on Chinese demand. Current purchases stand at around 1.5Mt, well below the 12Mt target cited by the White House.

The market may have priced in expectations that sales will not reach that level. Also announced was a potential delay to cuts on US biofuel import credits, which was negative for prices.

The cuts are a policy aimed at boosting US biofuel production and soyabean demand in the country. Chicago soyabeans (May-26) closed 3.3% down over the week.

Brazilian soyabean plantings are said to be at 80% complete as of last Thursday (18 November), behind last year’s 83%. Rains have caused problems with field conditions and potentially could limit yields according to Brazilian consultancy Patria Agronegocios.

Rains have waterlogged soils and hampered soyabean plantings in Argentina, currently at 25% of the expected area (Buenos Aires Grain Exchange).

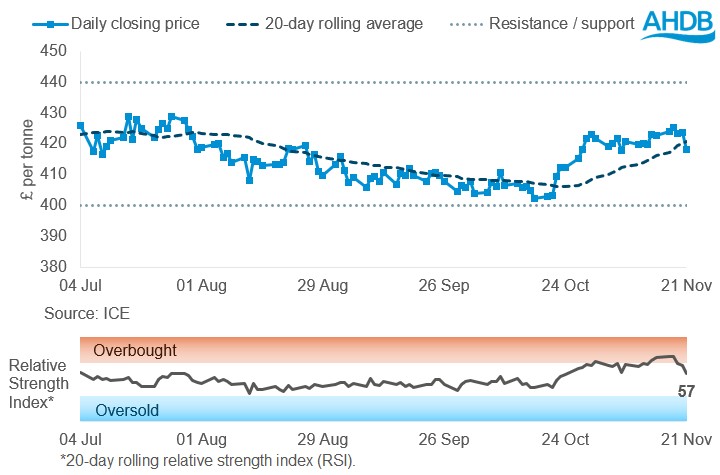

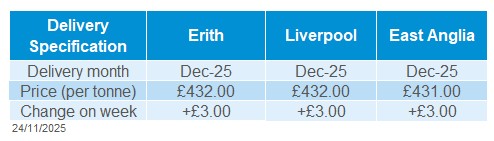

UK delivered rapeseed prices

Delivered rapeseed into Erith and Liverpool in December was quoted at £432.00/t, up £3.00/t from the previous week. While December delivery into East Anglia gained £3.00/t week-on-week to £431.00/t.

These prices are based on a survey typically carried out mid to late Friday morning, so they may not always reflect trends seen in the Paris futures by close of play. Paris rapeseed futures fell further on Friday after the AHDB delivered survey was conducted.

Extra information

UK wheat imports started 2025/26 more steadily than last year; July–September volumes were above average but below last year. While maize imports rose in September, they remain lower year-on-year with demand uncertain.

Read more in our latest Analyst insight from Gabriel Odiase.

UK supply and demand estimates will be released this Thursday (27 November), providing the first look at all major grains (wheat, barley, maize, and oats) for this season.

AHDB’s UK crop condition report is due to be released on Friday (28 November), offering the first insight into crop development for the 2026 harvest.

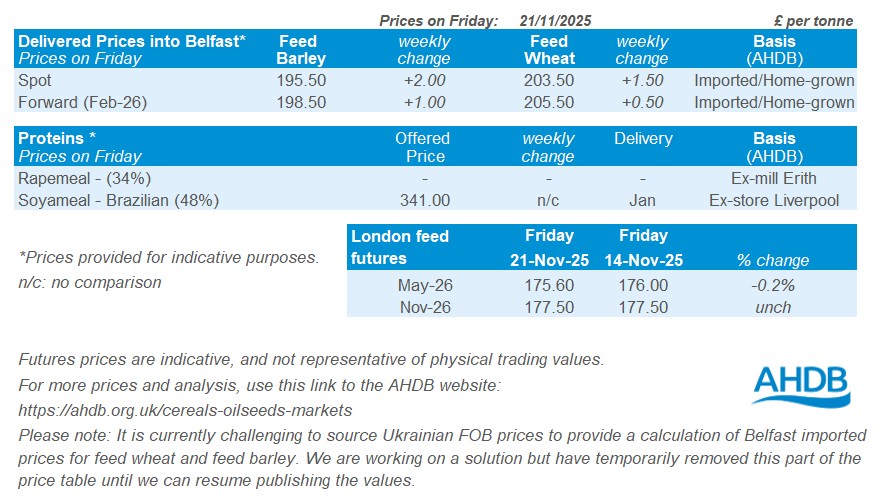

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.