Arable Market Report – 27 October 2025

Monday, 27 October 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (Nov-25)

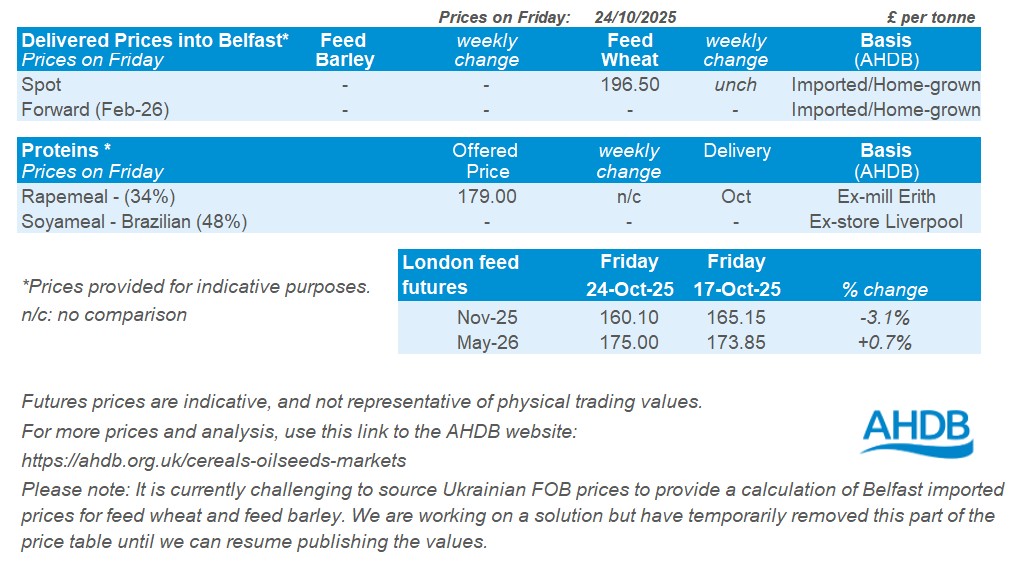

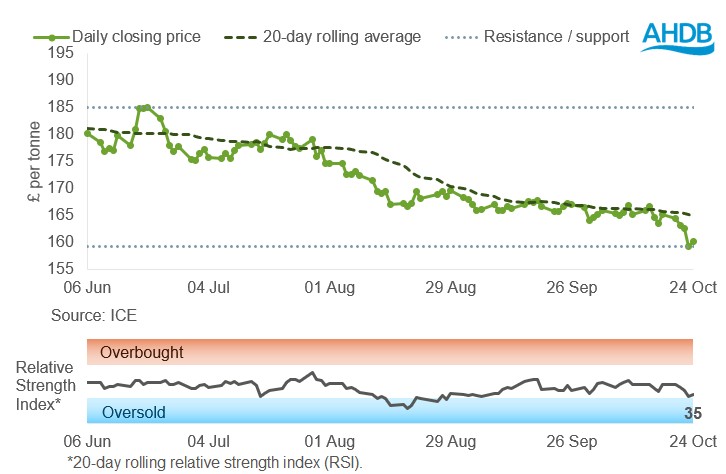

November 2025 UK feed wheat futures reached a new contract low of £159.25/t last week (17–24 October), which is now the new support level. Prices finished well below the 20-day moving average.

The relative strength index (RSI) fell from 46 to 35, approaching to the level of 30 is known as ‘oversold’ and it suggests prices may have fallen too quickly.

Find out more about the graphs in this report and how to use them.

Market drivers

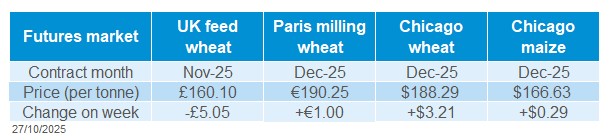

UK feed wheat futures (Nov-25) after significant pressure finished the week at £160.10/t down £5.05/t (3.1%) on the week. This is likely due to contracts nearing their last trading day, which has resulted in a fall in open interest. Support from the global market and a weaker sterling against both the US dollar and the euro did not have an impact on nearby UK wheat futures. However, the May-26 contract rose by £1.15/t on week, closing at £175.00/t.

Global grain futures saw support last week. Chicago wheat and Paris milling wheat futures (Dec-25) increased by 1.7% and 0.5%, respectively. Demand in the US physical market and a technical rebound from low levels supported Chicago wheat futures. The upside for Paris milling wheat futures was limited due to strong competition from the Black Sea region and potentially Argentina. Further to that, in a recent Algerian tender for 600 kt of milling wheat, France was not considered again due to diplomatic tensions between Paris and Algeria (LSEG).

Last week, the forecast for 2025 wheat production in Russia and Australia increased, which limited further gains in the market (IKAR, Reuters Poll). Reportedly yields in Western Australia are better-than-expected raising market expectations of production.

The International Grains Council (IGC) has increased its forecast for global wheat production in the 2025/26 season, upgrading crop outlooks for Russia, the United States and Argentina. However, the forecast for maize remains unchanged. The global carryover stocks of wheat and maize for the 2025/26 season increased by 5 Mt each, putting downward pressure on general price sentiment for the 2025/26 marketing year.

FranceAgriMer, estimated (to 20 Oct) that 57% of wheat and 73% of barley areas had been planted due to good weather conditions, compared to 20% and 36% respectively in the same week last year which saw heavy rainfall.

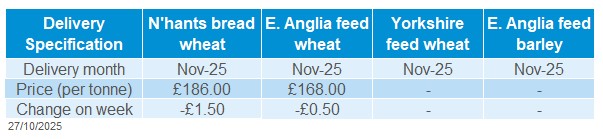

UK delivered cereal prices

Feed wheat delivered into East Anglia for November delivery was quoted at £168.00/t on Thursday, down £0.50/t from the previous week.

November delivery of bread wheat into Northamptonshire was quoted at £186.00/t, down £1.50/t from the previous week.

February 2026 delivery into the North West for bread wheat was quoted at £202.00/t on Thursday.

Rapeseed

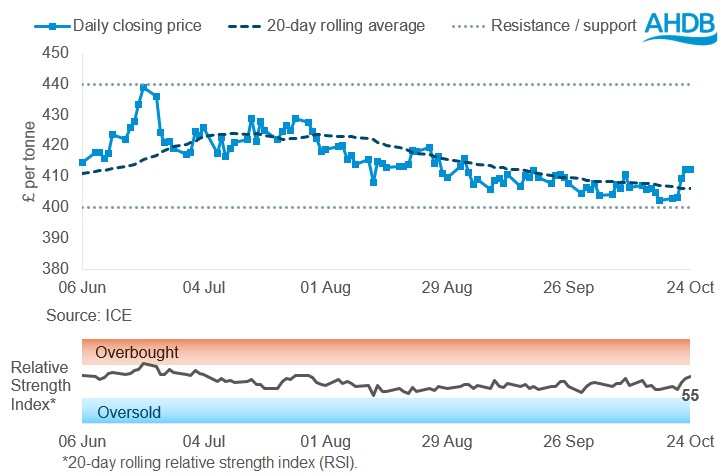

Paris rapeseed futures in £/t (May-25)

Paris rapeseed futures (May-26) in £/t traded above the 20-day SMA (simple moving average) last week (17–24 October) also above the support level of £400/t.

The relative strength index for this week is 55 up from 40 the previous week, this indicates an increase in market momentum.

Find out more about the graphs in this report and how to use them.

Market drivers

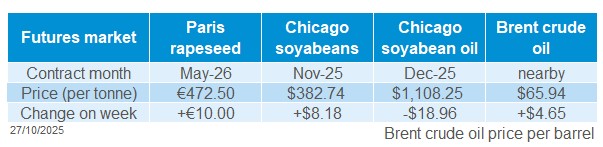

Global soya bean and rapeseed futures moved upwards last week. The upwards movement was supported by crude oil prices as the US placed sanctions on two of Russia’s largest oil companies combined with a positive outlook for US-China relations who have now agreed a framework for a trade deal, ahead of their meetting in South Korea this week. Chicago soya bean futures (May-26) finished the week up 1.9%. While Paris rapeseed futures (May-26) moved up €10.00/t (2.2%) to finish at €472.50/t.

Abiove (Brazilian Association of Vegetable Oil Industries) released its forecast for the 2025/26 Brazilian soya bean crop, estimated at 178.5Mt, in-line with what government and ag agencies are forecasting. This would make it another record year for production as the country continues to increase its planted area. Soya bean planting in Mato Grosso (to Oct 24), Brazil’s top soya bean-producing state, has reached 60.1% of the estimated area for the 2025/26 season, this state is expected to produce near 30% of production. Light rains look to keep planting moving well over the next week.

Canola harvest finishes up in Canada, with an estimated 20Mt crop for the 2025/26 marketing year, this is up from the previous year of 19.2Mt (StatCan). A key watchpoint of the coming week for the oilseed market is when the Canadian Prime minister Carney meets with President Xi of China at the APEC summit, given China recent lack of buying of Canadian canola from the tariffs China imposed earlier this year.

In Ukraine, analyst ASAP Agri cut its forecast for the countries 2025 sunflower seed production from 11.4 Mt to 10.8 Mt. Rains during the harvest period have impacted quality and progress as well as lower than expected yields following the impacts of a dry spring and summer. Supply is now tighter than expected across the EU and Black sea regions and sunflower oils discount to soy oil has now closed (oilworld.biz).

UK delivered rapeseed prices

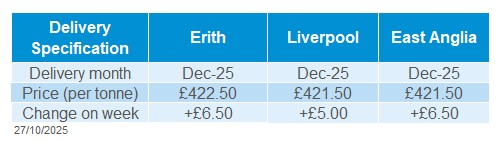

Domestic delivered prices followed the upward movement in Paris rapeseed futures.

Delivered rapeseed into Erith for December delivery was quoted at £422.50/t, up £6.50/t from the previous week. While December into Liverpool and East Anglia were at £421.50/t, gaining £5.00/t and £6.50/t week-on-week, respectively.

Extra information

AHDB released its Early Balance Sheet last week which provides the first look at wheat and barley supply and demand for this season.

The drop in estimated imports outweighs the rise in production and decrease in total domestic consumption, leading to a tighter wheat balance sheet in 2025/26.

Similarly for barley, the drop in availability (driven by a fall in production) outweighs the drop in consumption, leading to a much tighter balance sheet in 2025/26.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.