Arable market report – 28 July 2025

Monday, 28 July 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

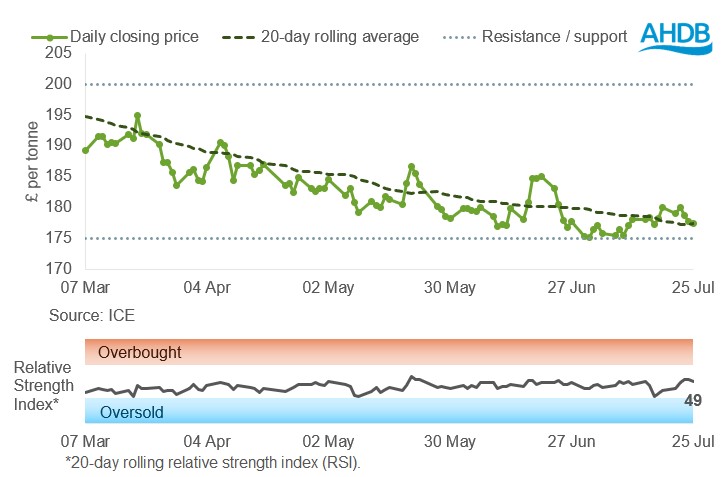

UK feed wheat futures (Nov-25)

UK feed wheat futures fell last week (Friday to Friday), closing near the 20-day moving average. The relative strength index (RSI) increased from 40 to 49, indicating momentum.

Prices may be on the way to finding further direction, but the market lacks a clear upward drive.

Find out more about the graphs in this report and how to use them

Market drivers

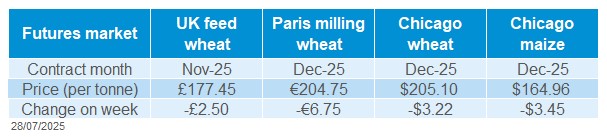

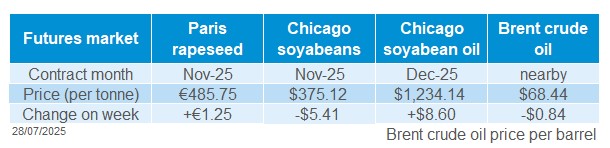

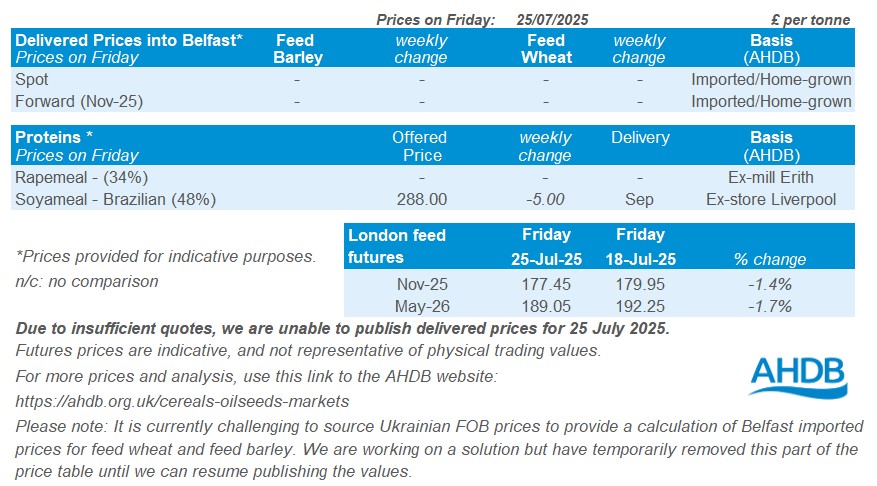

Global wheat futures eased last week (18-25 July), putting pressure on domestic prices. UK feed wheat futures (Nov-25) fell by £2.50/t (1.4%), closing at £177.45/t.

Paris milling wheat and Chicago wheat futures (Dec-25) also fell by 3.2% and 1.5% respectively.

The decrease in domestic feed wheat futures was smaller than that in Paris milling wheat futures, partly due to the weakest sterling-euro exchange rate in 20 months.

The ongoing harvesting campaign in the Northern Hemisphere continued to weigh on markets last week, offsetting support from a stronger-than-expected US weekly export sales report.

As of 21 July, FranceAgriMer reported that 86% of soft wheat had been harvested, compared to 37% in 2024 and a five-year average of 59% for the same period.

In contrast, the harvesting campaign in the Black Sea region is behind last year's pace.

The rate of wheat exports during this harvest period is a key factor in determining global prices.

So far, export volumes from the EU and the Black Sea region are currently below last year's figures, while US exports are broadly in line with both last season and the five-year average.

On the export side, the competition between the Black Sea region and EU is increasing due to the minimal price difference by origin.

The USDA's export sales report for the week ending 17 July showed net wheat sales of 712.2 kt, exceeding the top of trade expectations. Maize export was at 733.9 Kt, sitting at the upper end of estimates.

In a notable geopolitical development, the US and EU presidents announced a new trade deal in western Scotland over the weekend.

As part of the agreement, the US will apply a 15% import tariff on selected EU goods. The implications for grain and oilseed markets will be watched closely this week.

There is still a risk of adverse weather conditions for grains in the Northern Hemisphere.

Rain during harvest in Germany could affect wheat quality, while spring wheat conditions in the US and maize conditions in the EU are key areas to watch in the near future.

Meanwhile, the USDA rated 74% of the US maize crop as being in good to excellent condition as of 20 July. This represents an increase on last year's figure of 67% and is the highest rating at this stage since 2016.

The possibility of US maize production reaching a historically high level of 400 Mt in the 2025/26 season is a key factor in global supply outlooks.

UK delivered cereal prices

Feed wheat delivered into East Anglia for November delivery was quoted at £176.50/t on Thursday, unchanged on the week.

October delivery of bread wheat into the North West was quoted at £224.50/t, down £1.50/t on the week.

Rapeseed

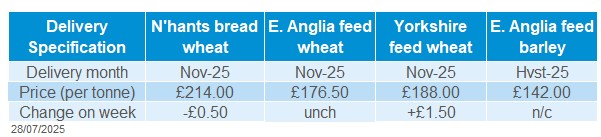

Paris rapeseed futures in £/t (Nov-25)

Last week (Friday–Friday), Paris rapeseed futures (in £/t) finished just above the 20-day moving average, closing at just over £423/t.

The relative strength index (RSI) increased this week from 39 to 56 showing an increase in momentum in the market.

Find out more about the graphs in this report and how to use them

Market drivers

Our second harvest progress report was released on Friday 25 July, capturing results up until the 23 of July.

The UK oilseed rape harvest is 54% complete, lagging behind last year’s pace, but average yields are strong at 3.76t/ha, 21% above the five-year norm, with notable gains in Eastern and South Eastern regions.

Quality is reportedly good, with oil content averaging 45%.

On the markets, Paris rapeseed futures (Nov-25) closed at €485.75/t on Friday, up €1.25 (0.3%) on the week after dipping to €480.75/t on Monday before recovering towards the end of the week.

In contrast, US soyabean prices continued to face downward pressure over the past week amid weather concerns.

Across the Midwest, traders feared intense heat could damage yields, but midweek showers helped ease crop stress. Chicago soybeans (Nov-25) closed 1.4% lower from Friday to Friday.

The US soyabean crop was rated at 68% in good or excellent condition as at 20 July.

This is down 2 percentage points on the previous week and in line with the same point last year but remains well above the 5-year average of 60%.

Markets await outcome of US-China trade talks held in Stockholm on Monday 28 July.

This will be a key watch point, with soyabeans on the agenda, as China is a key export destination for the US, accounting for 53% of the value of all soyabean exports 2020-2024 average (USDA).

In Canada, canola futures have continued to trade between CAD$690/t and CAD$700/t struggling to break past this bound since early July.

Canadian weather remains beneficial for crop development and support previously seen in the wider oilseed complex has also subsided.

The EU reported soyabean and rapeseed imports were down 32% and 36% respectively on a year ago.

According to European Commission projections for 2025/26, imports of rapeseed are expected to fall to 5.8 Mt (-22.2%) amid stronger production domestically and little growth in demand.

Soyabean imports are expected to remain firm at 14.2 Mt suggesting the pace of imports will pick up into 2025/26 season, a watch point going forward.

On Friday Russia, one of the worlds top producers and exporters of sunflower oil suspended floating duty rates on sunflower oil and meal until 31 August in aid to boost exports and help local producers.

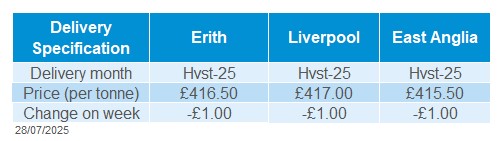

UK delivered rapeseed prices

Rapeseed to be delivered in August into Erith on the harvest contract was quoted at £416.50/t on Friday, down £1.00/t on the week.

Liverpool and East Anglia delivery in August were quoted at £417.00/t and £415.50/t respectively, also both down £1.00/t on the week.

Extra information

We released our second harvest progress report on Friday 25 July, showing a mixed picture across the country.

While oilseed rape yields are up, wheat yields are down, highlighting regional variability and the impact of the recent weather conditions.

The Welsh Government has published the final set of proposals for the Sustainable Farming Scheme (SFS), the new means of support for Welsh farmers.

Ergot management guidance - Kristina Grenz discusses options to tackle ergot in contaminated grain at harvest.

Help shape the future of UK farming, join AHDB’s Cereals & Oilseeds Sector Council and make your expertise count. Applications close on 30 July 2025.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.