Arable Market Report - 30 September 2024

Monday, 30 September 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

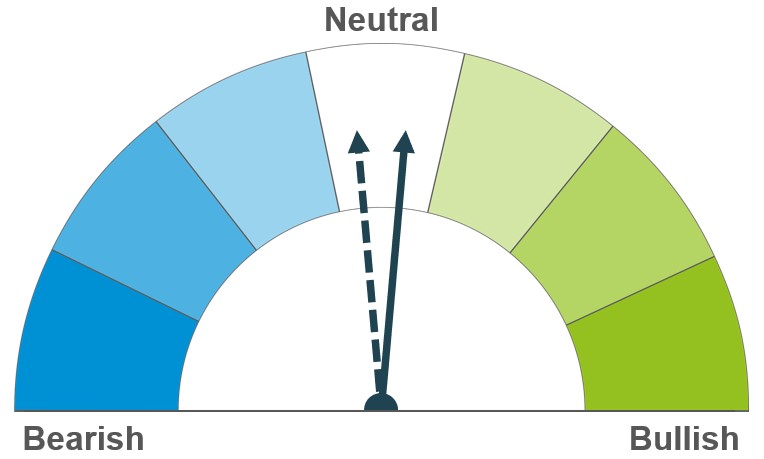

Grains

Wheat

More dry weather forecast for the Black Sea could offer support in the days ahead, though tonight’s US data will also be important to sentiment. Tight global wheat supplies continue to offer some support to prices longer-term.

Maize

US stock levels and weather are likely to influence market direction this week; larger than expected stocks could weigh, while smaller levels could support. The global outlook for the season remains one of sufficient supplies for now, though smaller EU crops and Brazilian weather cast some doubt.

Barley

European supplies look tighter than previously forecast, but demand is key to price direction compared to other grains.

Global grain markets

Global grain futures

Grain markets edged higher last week supported by short-covering, concerns about global supplies and a potential slowdown in wheat exports from the Black Sea. Over the week, speculative traders were reported as net buyers in Chicago wheat and maize futures last week (LSEG). This continues earlier short-covering, plus re-positioning ahead of the quarter-end.

Dry weather in key winter wheat growing areas in Russia and Ukraine has slowed planting and given rise to fears that the 2025 crop areas could decline. Meanwhile, the impact of heavy rain in parts of the EU is being monitored.

Meanwhile, there’s also potential for heavy rainfall in the US due to Hurricane Helene, which could slow maize harvesting and disrupt exports. The persistent dry weather in Brazil also poses a risk to the 2024/25 Safrinha maize area.

On Friday, the EU Commission again pared back its estimates of the EU-27 2024 soft wheat (-1.5 Mt to 114.6 Mt), barley (-0.9 Mt to 50.4 Mt), and maize (-1.5 Mt to 60.1 Mt) crops. This tightens the supplies compared to what was previously expected, though wheat and maize imports are still running at a faster pace than the EU forecasts for the season.

However, slower than expected US export sales and ongoing Black Sea shipments capped market gains last week. The USDA announced new export sales for 159 Kt of US wheat in the week ending 19 September, below market expectations for 200 – 600 KT (LSEG). New maize export sales totalled 0.54 Mt compared to expectations of 0.60 – 1.30 Mt.

Looking ahead, at 4pm today, the USDA releases information on grain stocks on 1 September. The market is expecting large year-on-year rises for maize (+36%) and wheat (+12%) (LSEG).

UK focus

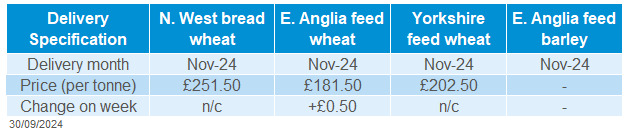

Delivered cereals

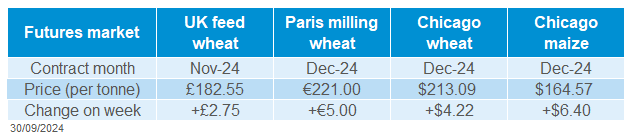

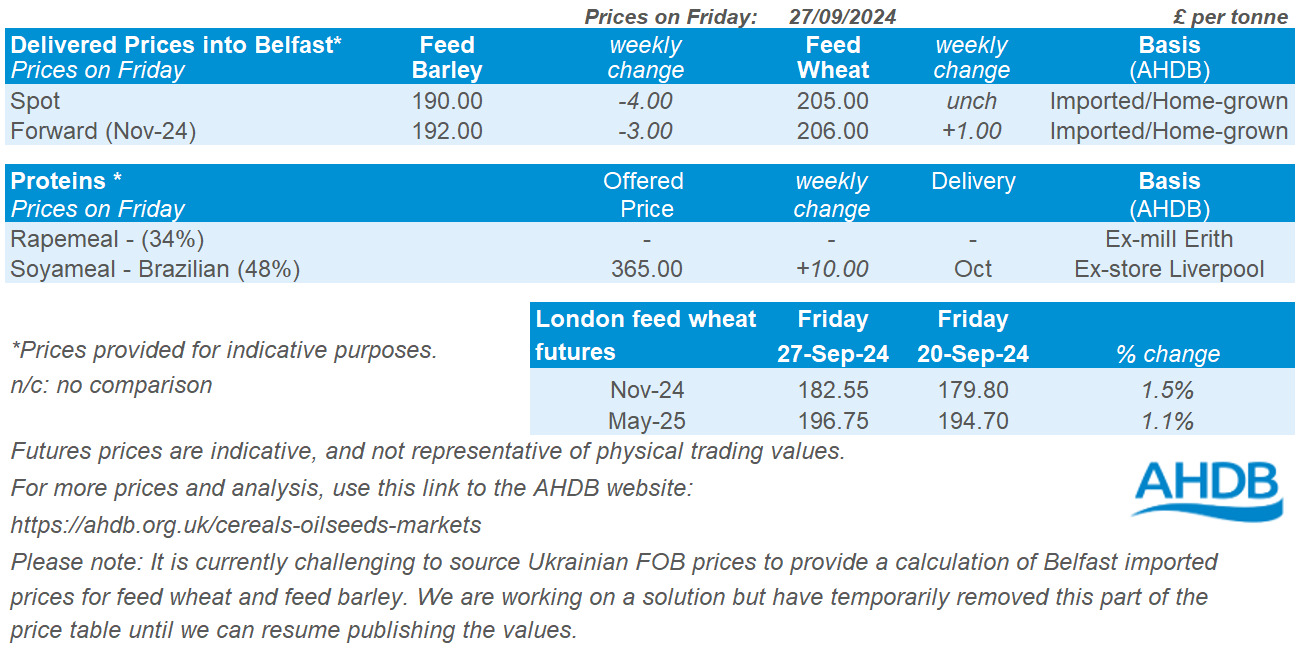

UK feed wheat futures for November 2024 gained £2.75/t over the week (Friday to Friday) to close at £182.55/t, tracking Chicago wheat and Paris Milling wheat futures prices. Similarly, the contract for May 2025 closed at £196.75/t, up £2.05/t over the same period.

Domestic delivered feed wheat prices also followed futures up Thursday to Thursday. Feed wheat delivered into East Anglia for October delivery was quoted at £180.50/t on Thursday, up £0.50/t on the week. October delivery of bread wheat into Northamptonshire decreased by £0.50/t, quoted at £241.50/t. The spread between bread wheat and feed wheat fell week-on-week, partly because of a stronger sterling, which means a more competitive quote for imported milling wheat.

The latest AHDB UK cereals supply and demand estimates, published on Thursday, offers a look at last season’s (2023/24) full season statistics. However, this year, an adjusted figure has been used for the wheat and barley end of season stocks. The end of season stocks for wheat and barley now sit at 2.987 Mt and 1.228 Mt respectively. For wheat, this closing stocks figure is the highest since at least 1999/2000. Read more in last week's analysis of wheat figures.

The UK 2024 harvest is now into its closing stages.

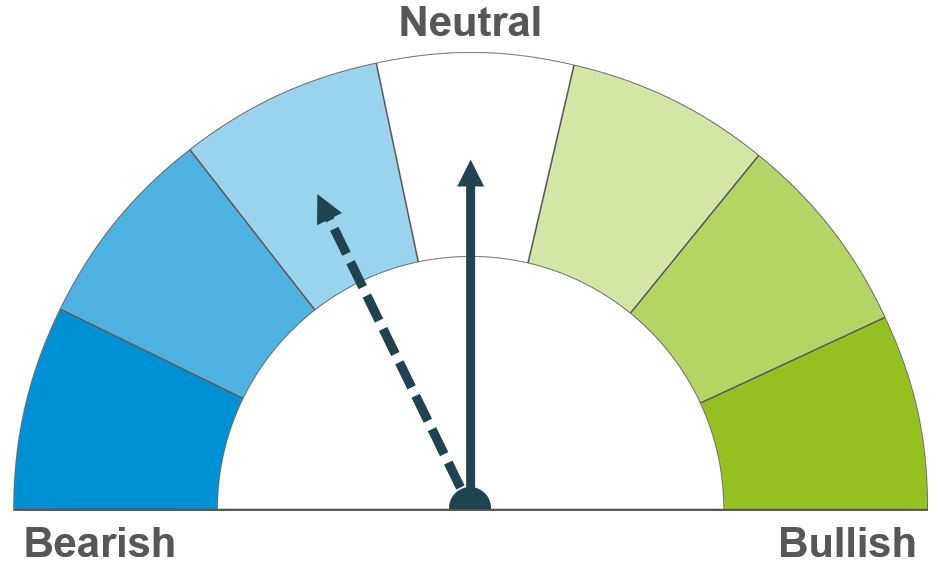

Oilseeds

Rapeseed

Rapeseed prices will continue to be influenced by the overall market sentiment and movements within the oilseed sector. However, the smaller harvest expected from major producers could provide support long term.

Soyabeans

Unfavourable weather conditions in key producing countries, along with strong global demand, are currently supporting prices in the short term. However, the forecasted ample global supply, despite these weather concerns, could keep prices subdued in the long term.

Global oilseed markets

Global oilseed futures

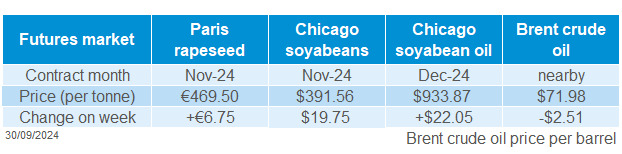

Global oilseed prices rose last week (Friday-Friday), with Nov-24 Chicago soyabean futures gaining $19.75/t or 5.31% to reach a two-month high of $391.56/t on Friday. Delays soyabean planting in Brazil due to dryness, news of Chinese stimulus measures and stronger demand, including increased US exports, lent support to prices. Though forecast rains in Brazil and repositioning ahead of the month and quarter close capped gains.

The USDA reported net sales of 1.57 Mt of US soyabeans for the 2024/25 crop in week ending 19 September. This was down 10.3% from last week but up from 621 Kt for that week last year and five-year average of 1.34 Mt. The main buyers were China (869.7 Kt), undisclosed destinations (245.3 Kt) and the Netherlands (137.0 Kt).

Brazil, the world’s largest producer and exporter of soyabeans, is experiencing planting delays due to the drought in key producing states. Despite the prolonged dryness, Conab's preliminary forecast is for Brazil's soyabean production to reach 166.3 Mt in the 2024/25 season, up 12.8% from last season.

Also, during the week, soyabean prices received support from the damage caused by Hurricane Helene to crops and infrastructure along the Gulf coast. This is expected to slow down soyabean harvesting in the US. The USDA crop progress report, due out later today, will provide insight.

In Argentina, the oilseed workers' union at one of the country’s largest ports announced a strike on Saturday. Argentina is a top export of soya meal and soya oil; a disruption of activities at the port could affect exports and in turn support soyabean prices.

Benchmark Malaysian palm oil futures rose by 2.6% last week, continuing an upward trend for three consecutive weeks. This increase is due to strong demand from India, driven by domestic consumption and restocking prior to the festive season, and supply concerns in major palm oil-producing countries.

Rapeseed focus

UK delivered oilseed prices

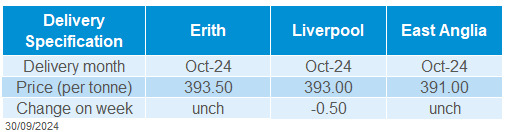

Rapeseed futures followed the wider oilseeds complex last week (Friday-Friday). Nov-24 Paris rapeseed futures rose by €6.75/t to close at €469.50/t. The May-25 contract also gained €12.25/t to end the session at €481.25/t.

Delivered rapeseed prices into Erith for November was quoted at £395.00/t on Friday, unchanged from last week. Meanwhile, delivery for May was quoted at £405.00/t rising £3.00/t over the same period. A rise in Sterling during the week made imports more competitive, and as such, domestic gains were limited.

For the fifth month in a row, Strategie Grains cut its estimate for the 2024/25 EU rapeseed harvest.The latest report projects a further decline of 1.2% to 16.7 Mt, with much of the downward revision attributed to Germany. This figure is also 16.5% lower than last year’s harvest. Consequently, the consultancy has predicted a further increase in EU rapeseed prices. This is due to a significant deficit emerging in both the EU and global sunflower seed, rapeseed and vegetable oil balance sheets.

Following several weeks of dryness in major crop regions, LSEG has reduced its forecast for the Australian rapeseed production to 5.58 Mt, down by under 1% from the previous update. Some beneficial rains are expected in the affected regions over the next ten days, which could help ease the impact of the dry weather.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.