Arable Market Report – 31 March 2025

Monday, 31 March 2025

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

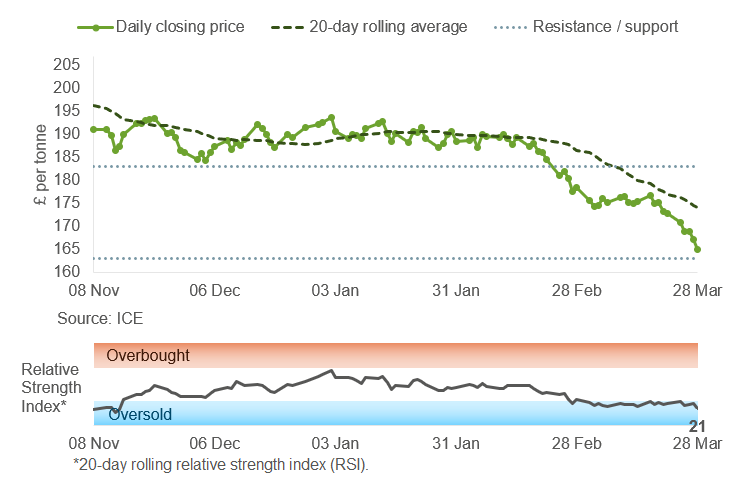

With May-25 UK feed wheat futures closing below the recent support levels for three consecutive weeks, the previous support and resistance levels no longer hold. With the Relative Strength Index (RSI) in the oversold zone, prices could now find support around £163/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

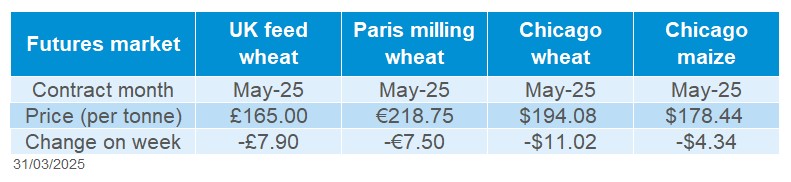

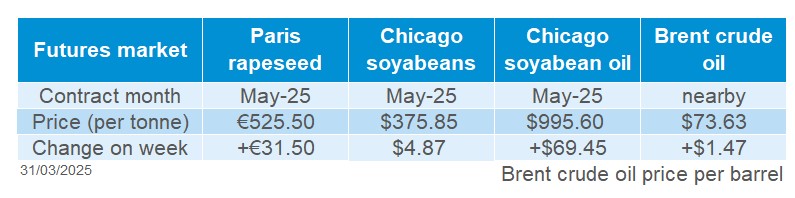

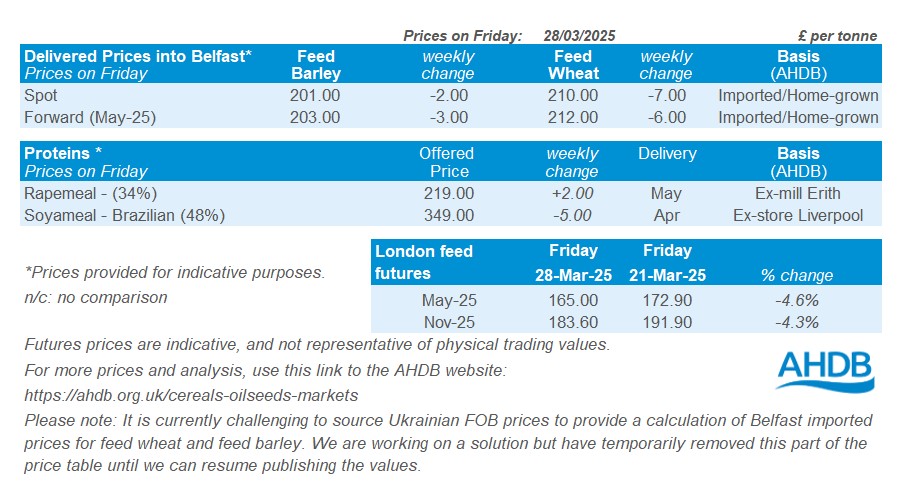

UK feed wheat futures (May-25) dropped to a new low last week (Friday to Friday), ending at £165.00/t, down £7.90/t from the previous week. The Nov-25 contract fell £8.30/t, settling at £183.60/t on Friday.

Domestic wheat markets tracked the global price decline, with pressure from ongoing negotiations surrounding the Ukraine war, favourable weather forecasts in key producing regions, and weak global export demand.

Ongoing talks, brokered by the US, for a ceasefire between Russia and Ukraine are impacting market direction at the moment. While the resumption of the agreement to ensure safe passage for ships in the Black Sea is uncertain, news of a potential resolution is putting pressure on wheat prices.

Beneficial rainfall is forecast for key producers, including the US, Russia, Romania, and Bulgaria. Following dry conditions, the rain is expected to ease concerns about crop stress and improve the outlook for harvest.

US wheat export sales for the week ending 20 March were reported at 100.3 Kt, down from 248.8 Kt last week and 65% lower than the four-week average. Net export sales of maize also fell to 1.03 Mt, remaining unchanged from the prior four-week average.

Chicago wheat speculators increased their net short position in futures and options contracts to 92,587 as at 25 March. This suggests that the speculators are anticipating falling wheat prices.

Russia's IKAR consultancy has increased its 2025 wheat crop forecast to 82.5 Mt, up from 81.0 Mt, due to better weather conditions for the winter crop.

Later today (31 March), the USDA will release its quarterly stocks and planting intention reports. Expectations point to a year-on-year rise in wheat stocks and maize planting intentions.

Meanwhile, further developments are expected regarding the US tariffs on Canada, Mexico, and China, which take effect on 2 April.

UK delivered cereal prices

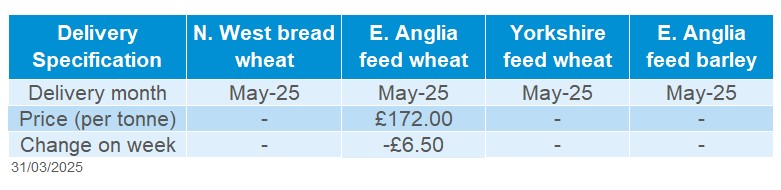

Domestic delivered wheat prices fell in line with global prices from Thursday to Thursday. Feed wheat delivered into East Anglia for May 2025 fell £6.50/t to £172.00/t, while bread wheat delivered to Northamptonshire for May 2025 was quoted at £195.50/t, down £8.50/t.

Rapeseed

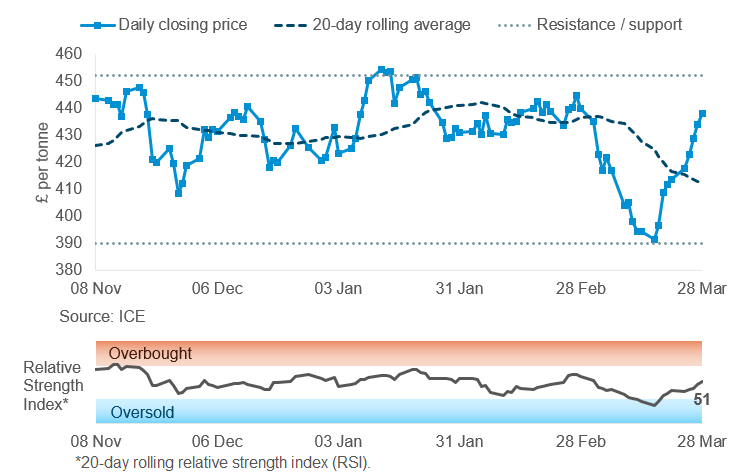

A rally in May-25 Paris rapeseed futures, saw prices climb firmly above the 20-day moving average last week (Friday to Friday). The price chart shows that futures may find a resistance level at £452/t.

Find out more about the graphs in this report and how to use them here.

Market drivers

May-25 Paris rapeseed futures closed at £438.05/t on Friday, up £24.25/t on the week. New crop (Nov-25) futures finished on Friday at £407.83/t, up £9.95/t. The spread between old crop and new crop rapeseed prices widened again.

Old crop Paris rapeseed futures rose last week, mainly due to limited supply in the EU physical market. For new crop futures, good winter crop conditions and favourable weather forecasts limited support.

Winnipeg canola futures (May-25) gained by 7.3% over the last week (Friday to Friday). However, the canola market is awaiting news on US tariffs. The spread between Paris rapeseed and Winnipeg canola futures could encourage more canola imports from Canada into the EU.

May-25 Chicago soyabeans and soyabean oil futures rose 1.3% and 7.5% respectively (Friday-Friday). US net export sales of soyabeans were reported at 339 Kt by the USDA for the week ending 20 March, lower than the previous week and at the low level of trade estimates. For soyabean oil, US net export sales were higher than estimated and this supported soybean prices late last week.

A positive factor for Chicago soyabean oil could be a higher biodiesel blend in the US, which is currently under discussion.

Today, the USDA's prospective plantings and grain stocks reports will be published, which could have a significant impact on prices and will be a key focus for market participants.

Palm oil prices have been affected by lower production and export demand, resulting in higher ending stocks. The nearby Malaysian palm oil futures are currently higher than next month’s, meaning that global oilseeds could see some pressure over coming months from these heavy supplies.

UK delivered rapeseed prices

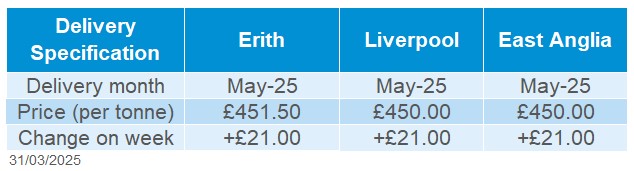

Rapeseed to be delivered into Erith in May was quoted at £451.50/t on Thursday, up £21.00/t from the previous week. Delivery to East Anglia in May was quoted at £450.00/t, also gaining £21.00/t. In a volatile market, please note that the survey is usually conducted mid-late morning on Friday, so can show different trends from Paris futures closing prices.

The difference between rapeseed old crop (May) and new crop (Nov) prices delivered at Erith on Thursday is £33.50/t.

Extra information

On Thursday, AHDB released the latest UK cereals supply and demand estimates for 2024/25. A key change was the drop in domestic wheat consumption, mainly due to a fall in usage by the bioethanol sector. However, fewer imports and higher exports left wheat ending stocks relatively unchanged (up12 Kt) from January’s estimate.

The latest AHDB crop development report, published on Friday, shows that as could be expected, the condition of UK winter cereal crops is much improved from this time last year. Spring weather has also been highly favourable so far, with excellent conditions for drilling.

The Chancellor of the Exchequer, Rachel Reeves, delivered the Spring Statement on 26 March 2025, updating Parliament and the nation on the economy, public finances and economic objectives. Read more analysis on the Spring Statement and its impact on farming.

Northern Ireland

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.