Arable Market Report – 9 February 2026

Monday, 9 February 2026

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

UK feed wheat futures (May-26)

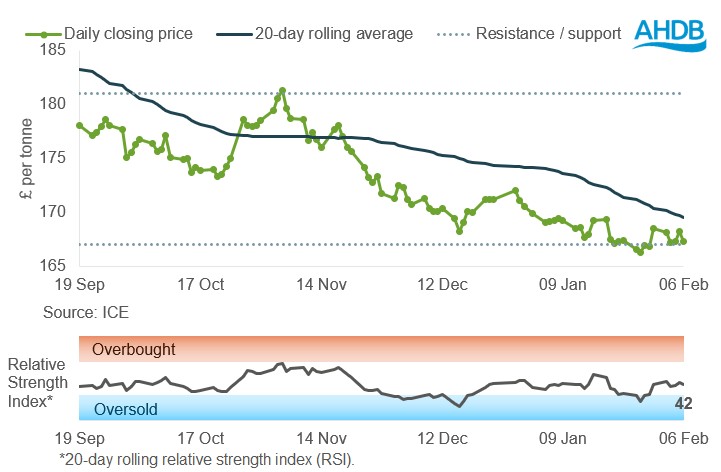

Figure 1. UK feed wheat futures prices, May-26 contract

May-26 UK feed wheat futures closed below the 20-day moving average at the end of last week.

Despite coming under pressure during the week, the nearest support level of £167/t is still in place, with the contract testing the £167/t support level, but didn’t close below this level.

The relative strength index (RSI) decreased from 43 on 30 January to 42 on Friday, moving back towards the oversold zone. The RSI currently does not indicate any notable price momentum.

Find out more about the graphs in this report and how to use them

Market drivers

May-26 UK feed wheat futures reversed the marginal gains from the week prior and closed at £167.30/t on Friday, down £1.15/t across the week (30 January to 06 February).

The domestic market shadowed the pressure on both Paris milling and Chicago wheat futures (May-26), which were both down 1.3% across the week.

Grain markets have marginally subsided across the week from the drop in crude oil prices and assessments over the recent cold weather snaps in both the USA and Black Sea.

Global grain markets remained focused on weather risks to winter crops in key producing regions, particularly in the USA and the Black Sea.

In the US Plains and parts of the Midwest, periods of cold weather and variable snow cover have maintained concerns over potential winterkill.

In Ukraine and southern Russia, episodes of low temperatures combined with patchy snow cover and ice crusts on existing snow continued to pose a threat to crop condition.

However, it was reported last week by Ukrainian state weather that the January weather conditions did not have considerable adverse impact on winter crops, despite the severe frost experienced.

Further to that, Russia’s deputy Prime Minister stated that Russian grain crops were in good condition, with data to suggest this (LSEG).

As of 05 February, 97% of grain crops were in a normal condition vs 87% for the same period in 2025.

The recent cold snap reported in Germany and Poland is providing some slight underpinning to European prices. However, global export competition among major wheat exporters remains intense, with the weakening of the euro against the US dollar across the week helping Europe’s competitiveness.

Another critical watchpoint for the grain market is that Argentina requires further rains over the next few weeks for their recently planted maize crop, especially in eastern parts of the country, to avoid major yield losses (Buenos Aires Grain Exchange).

The latest USDA World Agricultural Supply and Demand Estimates is scheduled to be released tomorrow at 17:00 GMT.

On a grain front, markets are not anticipating any major changes to 2025/26 global supply and demand, but if figures significantly deviate from expectations, we could see some movement in grain markets.

Table 1. Global grain futures prices

| Futures market | UK feed wheat | Paris milling wheat | Chicago wheat | Chicago maize |

|---|---|---|---|---|

| Contract month | May-26 | May-26 | May-26 | May-26 |

| Price (per tonne) | £167.30 | €190.50 | $198.03 | $172.74 |

| Change on week | -£1.15 | -€2.50 | -$2.57 | +$1.19 |

UK delivered cereal prices

May-26 UK feed wheat futures gained £1.35/t Thursday to Thursday to close at £168.20/t.

There was a marginal rise in delivered North-West bread wheat prices, with Feb-26 quoted at £190.00/t, up £0.50/t across the week (Thurs–Thurs). However, in Northants, bread wheat (Feb-26) was down £0.50/t over the same period, quoted at £179.00/t.

For feed wheat, there was pressure for East Anglia, with Feb-26 delivery quoted at £167.50/t, down £1.00/t across the week. But there were gains in Avonmouth (+£0.50/t) and Yorkshire (+£1.50/t) across the week for Feb-26 delivery, quoted at £176.50/t and £180.00/t, respectively.

Table 2. UK delivered cereal prices

| Delivery specification | N. West bread wheat | E. Anglia feed wheat | Yorkshire feed wheat | E. Anglia feed barley |

|---|---|---|---|---|

| Delivery month | Feb-26 | Feb-26 | Feb-26 | Feb-26 |

| Price (per tonne) | £190.00 | £167.50 | £180.00 | £156.50 |

| Change on week | +£0.50 | -£1.00 | +£1.50 | +£1.00 |

Rapeseed

Paris rapeseed futures in £/t (May-26)

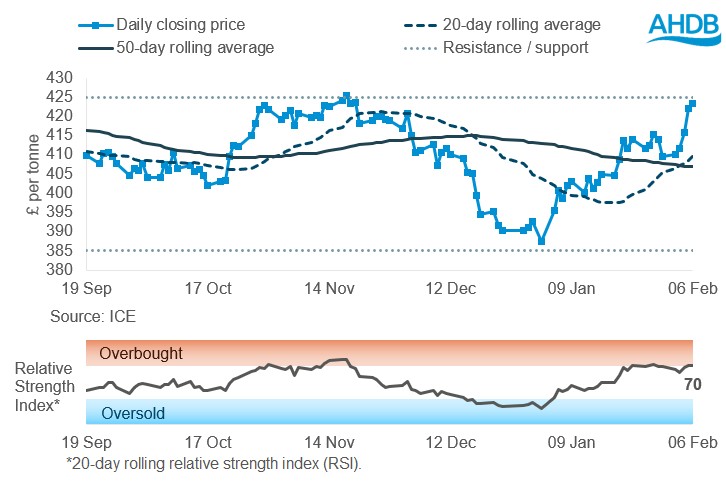

Figure 2. Paris rapeseed futures prices, May-26 contract, in £/tonne

May-26 Paris rapeseed futures in £/t gained 3.4% last week, to £423.32/t, a slightly bigger increase than in euros due to sterling decreasing against the euro.

As a result of this movement, prices approached the nearest resistance level of £425.00/t.

The relative strength index (RSI) remained on the edge of being overbought, moving from 69 to 70 Friday–Friday.

Find out more about the graphs in this report and how to use them

Market drivers

Paris rapeseed futures prices ended last week higher, supported by notable gains in soyabean futures.

The May-26 contract ended the week 3.2% higher at €487.75/t, while the Nov-26 contract gained 2.6% to €470.50/t.

Chicago soyabean futures and Winnipeg canola futures (May-26) increased by 4.8% and 1.8%, respectively.

Last week, the Chicago futures price rallied after President Trump implied that China would purchase an additional 8 Mt of US soyabeans in the current season. This is on top of the approximately 12 Mt that have already been booked since the agreement was reached in late October.

There was also some support for the vegetable oil complex from a proposed rule announced by the US Department of the Treasury, which governs how biofuel makers can access a tax credit for low-carbon transport fuels.

On the other hand, StoneX's latest forecast revealed that Brazil's soybean production is projected to reach 181.6 Mt in the 2025/26 season, a 2.3% increase from its figures in January.

Meanwhile, the consultancy firm Patria AgroNegocios reports that Brazilian farmers had harvested 16.6% of the area planted for the 2025/26 season by Friday, surpassing the 9.8% harvested at the same time last year (LSEG).

According to Safras & Mercado, Brazil's 2025/26 soyabean sales equate to 34.9% of the expected output, compared to 42.4% at the same time last year.

Canadian canola stocks totalled 15.6 Mt on 31 December, up 18.1% from a year earlier, according to StatsCan figures. This could put pressure on Winnipeg canola futures.

The agricultural consultancy APK-Inform has revised its forecast for Ukraine's 2026 rapeseed harvest downwards to 3.73 Mt, from a previous estimate of 3.88 Mt. The firm has also reduced its outlook for Ukraine's rapeseed exports for the 2026/27 season (July–June) to 2.70 Mt, from 2.96 Mt.

However, it is difficult to estimate the impact of the recent extremely low temperatures in Ukraine on the development of the winter rapeseed crop.

Attention is now turning to the World Agricultural Supply and Demand Estimates report from the USDA due on Tuesday (10 February).

Ahead of the report, the consensus among global analysts is that 2025/26 global soyabean stocks will be increased marginally, but US stocks will be slightly lowered.

Other key areas to watch are soyabean production in Brazil and Argentina.

Table 3. Global oilseed and oil futures prices

| Futures market | Paris rapeseed | Chicago soyabeans | Chicago soyabean oil | Brent crude oil |

|---|---|---|---|---|

| Contract month | May-26 | May-26 | May-26 | nearby |

| Price (per tonne) | €487.75 | $414.70 | $1,231.05 | $68.05 |

| Change on week | +€15.00 | +$19.01 | +$39.24 | -$1.27 |

*Brent crude oil price per barrel

UK delivered rapeseed prices

Rapeseed to be delivered to Erith in February was reported at £439.00/t in Friday’s survey, up £8.00/t from the previous week.

The price for November delivery (the 2026 crop) gained by £6.00/t to £417.00/t.

A year ago (06/02/25), harvest 2025 delivery into Erith was reported at £433.00/t, with November 2025 at £422.00/t.

Table 4. UK delivered rapeseed prices

| Delivery specification | Erith | Liverpool | East Anglia |

|---|---|---|---|

| Delivery month | Feb-26 | Feb-26 | Feb-26 |

| Price (per tonne) | £439.00 | £438.50 | £438.00 |

| Change on week | +£8.00 | +£7.00 | +£8.00 |

Extra information

On Thursday 5 February, we published UK cereal usage data for December, covering human and industrial consumption, as well as GB animal feed production.

Compared to the previous season, the volume of home-grown and imported wheat milled from July to December (including for bioethanol production) decreased by 3.6% and 26.2%, respectively.

Brewers, maltsters and distillers’ barley usage for the season to date (July–December) was down 18.5% on the same period in 2024/25.

HMRC will publish trade data for December on 12 February.

Northern Ireland

Table 5. Delivered prices into Belfast*

| Delivery specification** | Feed barley – spot | Feed barley – forward | Feed wheat – spot | Feed wheat – forward |

|---|---|---|---|---|

| Delivery month | Spot | May-26 | Spot | May-26 |

| Price (per tonne) | £197.50 | £200.50 | £197.50 | £199.50 |

| Change on week | n/c | n/c | -£2.00 | -£1.00 |

*Prices provided for indicative purposes

**Basis is imported/home-grown

n/c: no comparison

unch: no change in price compared to last week

Sign up to receive the latest information from AHDB

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.