Below-average 2025 Russian wheat crop? Grain market daily

Friday, 25 October 2024

Market commentary

- Global wheat and maize futures continued to climb yesterday on stronger US maize exports. According to the latest USDA’s export data, US maize exports reached 999 Kt for the week ending 17 October. This was up 99% percent from the previous week and 4% from the prior 4-week average.

- UK feed wheat futures (Nov-24) lost £0.50/t to settle at £183.55/t, as pound sterling strengthens against the US dollar. Similarly, Paris milling wheat (Dec-24) declined by €2.25/t to close at €221.50/t, influenced by cheaper Black Sea exports.

- Beneficial rains in South America countered support from US soyabeans exports, causing Chicago soybean futures (Nov-24) to drop by 0.13% yesterday. Paris rapeseed futures (Nov-24) also fell by €1.25/t, closing at €508.50/t yesterday.

- The USDA reported soybean export sales of 2.15 Mt for the week ending October 17, which is near the high end of trade expectations (1.2 Mt – 2.4 Mt). Recent rainfall in Argentina’s agricultural heartland is expected to continue into November, supporting normal soybean planting (LSEG).

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB

Below-average 2025 Russian wheat crop?

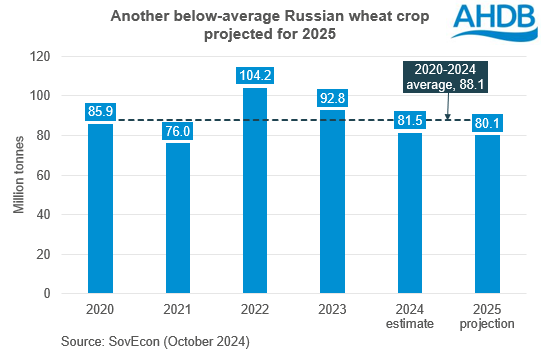

Early forecasts suggest the 2025 Russian wheat crop could be close to 2024 levels, and below the five-year average.

Despite a strong start, adverse weather this spring and summer curbed 2024 yields, especially in European parts of Russia. Estimates for the 2024 crop include 81.5 Mt from SovEcon, 82.0 Mt by the USDA, and the official Russian crop estimate of 83.0 Mt.

Drought this autumn delayed planting, reduced the planted area and meant a poor start for 2025 winter crops in parts of Russia. As a result, SovEcon’s projection for the 2025 crop is 80.1 Mt, while IKAR estimates a crop of 80.0 – 85.0 Mt. These are similar to, or even slightly below, estimates for the 2024 crop.

Crops in southern Russia have benefited from recent rain and more is expected this week. But the poor start leaves crops more vulnerable to adverse conditions going forward.

There are also ongoing risks to the 2025 wheat area in France, the EU-27’s largest producer and exporter from persistent wet weather. Data from FranceAgriMer shows that farmers in France had managed to plant 21% of the expected 2025 soft wheat (exc. Durum) area by 21 October. This is up from 10% a week earlier but, still a long way behind the five-year average for the time of year of 47%. Winter barley planting is also delayed at 38% complete vs 64% on average. More wet weather is projected for this week, which could again hamper progress, though there is some variation between forecasters.

Concerns about the 2025 wheat crops in key exporters fed into prices for the 2025 crop gaining ground relative to those for the 2024 crop. While rainfall in Russia and the US eased some of the concerns, 2025/26 wheat potential will still be closely monitored by the market. Stocks in major exporting countries are expected to decline again this season, which puts extra emphasis on the 2025/26 crop to perform.

Something to watch next week is the first 2025 US winter crop condition assessment from the USDA, due out Monday evening.

Closer to home and the weather is also providing challenges. Each autumn AHDB commissions a survey of agronomists to get an early look at potential areas for the coming harvest, known as the Early Bird Survey. We’re currently monitoring the weather outlook and will confirm an expected date for this autumn’s survey in the coming weeks. Our first look at 2025 crop conditions is planned for the end of November.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.