Breakeven yields; an alternative way to view profit margins: Analyst Insight

Thursday, 10 June 2021

Market Commentary

- The November-21 UK feed wheat futures contract lost £2.50/t yesterday, to close at £176.95/t. Since the start of June, the contract looks to be trading within the channel between £176.00/t and £180.00/t. Similarly, the May-22 contract lost £2.50/t yesterday, to close at £181.60/t.

- French analytical firm FranceAgriMer increased forecasts for French 2020/21 ending stocks for wheat and barley, both increased by 100Kt to 2.7Mt and 1.1Mt respectively. This is a result of lessened animal feed manufacturing demand and increased availability.

- For vegetable oil markets, Malaysian Palm oil futures have dropped 2.3% since Tuesday following expectations of poor June export data. Demand for Palm oil has reduced as a result of the coronavirus pandemic heavily affecting India, the main Palm oil importer.

Breakeven yields; an alternative way to view profit margins.

Beating a forecast 2021/22 UK average wheat yield by 1.0t/ha could net an average farm business a gross margin per hectare 88.6% higher than if the average yield was achieved.

This is based on the price of Nov-21 futures yesterday, and excludes the value of straw, storage costs and subsidy payments. This difference alone highlights the importance of a solid marketing plan, to enable unexpected yield shortfalls to still return profit.

What is the average expected yield?

In April, the USDA Foreign Agricultural Service forecast the average UK wheat yield at 8.3t/ha, which if realised would be 4% above the five-year average. The bright, warm start to June coupled with the wet May, may well put crops in good standing to reach north of this forecast yield.

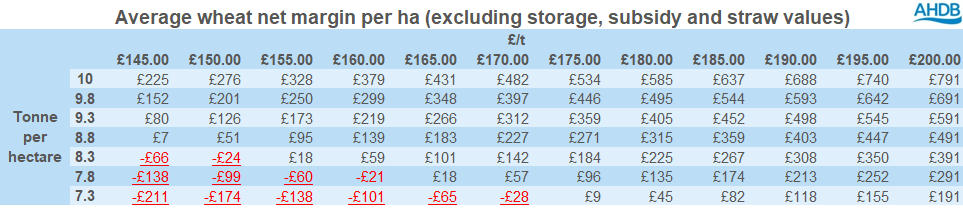

As we are all aware, yield is a key parameter for production figures that can assist with profit margins. The below table shows a yield of 8.8t/ha is still just profitable at £145.00/t sell price. However, achieve the forecast average of 8.3t/ha and a net loss is pencilled in at that sell price.

Crop yields and gross margins

Knowing the cost of production is a vital figure to add to any farm business plan, enabling marketing strategies to be tailored towards specific profit goals. It also enables examining of variable and overhead costs to streamline costs and benefit profit margins.

The table below is produced from a basic cost of production (using AHDB FarmBench data) and includes average winter wheat variable and overhead costs, without strict storage costs and subsidy payments. FarmBench can be signed up to here.

How much tonnage is pure profit?

The breakeven yield of a crop offers another way for growers to look at gross margins.

Using four-year average variable (£493.00/ha) and overhead costs (£776.00/ha) from FarmBench analysis, a basic cost of production can be produced. From this, using yesterday’s UK Nov-21 close price of £176.95/t, a breakeven tonnage of 7.17t/ha is seen, with tonnage above this then the profit.

In this case, should the wheat price fall to £150.00/t then the breakeven yield rises to 8.46t/ha, notably above the USDA FAS forecast yield of 8.3t/ha.

As you can see, the 7.17t/ha breakeven yield forms a large proportion of the forecast 2021/22 wheat yield. Even if 8.3t/ha is an easy target to pass for some and 9.0t/ha+ is the achievable average farm yield, any domestic wheat price declines will push up the breakeven yield figure. Warm dry June weather will help crop yields no doubt, but a higher than expected domestic production figure will pressure UK wheat prices.

This high breakeven yield stresses the importance of selling the ‘profit tonnage’ at the best possible value. The optimal end-market is different for each farm business, dependant too on individual risk appetite. But, premiums can be gained through specific quality requirements or proximity to end-location. Possessing knowledge of future price direction is key to determine optimal selling points, selling forward could help margins too.

It also emphasises the significance of on-farm wastage, in the form of storage, drying or machinery setups. Any tonnage saved by improving this aspect will contribute to margins.

The phasing out of the Basic Payment Scheme is something key to note for farmers, with annual reductions until 2028 hitting returns for farm businesses. The more environmentally focused replacement, known as ELMS, will bring payments based on ecological requirements. It is unclear how the new ELMS scheme will stack up against BPS for payments received. However, any reduction in payments can bring into focus the emphasis on not just growing a profitable crop, but also a sound grain marketing plan.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.