Cattle and sheep feed demand remains strong: Grain market daily

Thursday, 5 June 2025

Market commentary

- Nov-25 UK feed wheat futures fell £0.30/t yesterday, to close at £179.50/t. The May-26 contract was slightly supported however (up £0.05/t), ending the session at £191.00/t

- Domestic wheat futures did not follow global price movement yesterday, as sterling strengthened against both the US dollar and euro. Paris milling wheat and Chicago wheat futures (Dec-25) gained 0.6% and 1.1% respectively

- Paris rapeseed futures (Nov-25) ended at €483.24/t yesterday, back €0.25/t from Tuesday’s close. This followed pressure in Winnipeg canola, with Canadian farmers planting the spring crop into dry soils, leading to good progression

Cattle and sheep feed demand remains strong

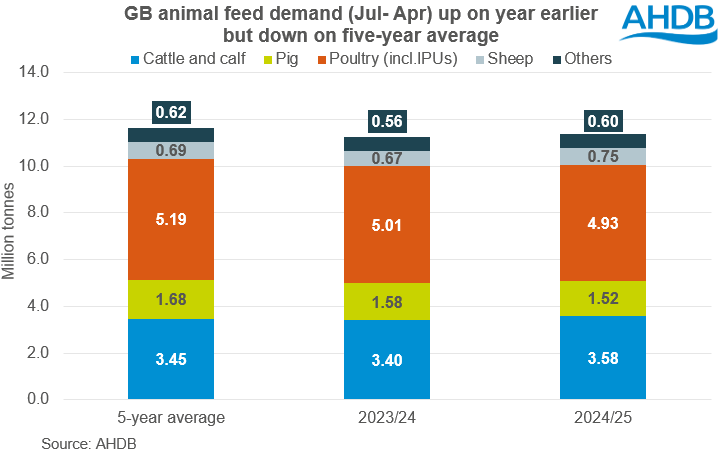

Earlier today, AHDB released the latest GB animal feed production data, including figures up to the end of April 2025. The data shows that this season to date (Jul–Apr), total production of GB animal feed, including by integrated poultry units (IPUs), has reached 11.4 Mt. This is up marginally (+1.4%) on the year, and up 2.2% on the previous five-year average.

The key driver of this climb in feed demand is the cattle sector, and to a lesser extent the sheep sector. Cattle and calf feed demand has seen a 5% rise this season so far, with climbs in both dairy and beef feed production, with improved beef and milk prices supporting growth in 2024/25.

What does this mean for cereals demand?

Despite a 2.2% increase in total feed production, on the back of more competitively priced alternative proteins, we are seeing a lower rate of cereal inclusion this season. As such, total cereals usage (excl. maize used by IPUs) is relatively unchanged on the year (+0.2%).

In terms of cereal splits, maize usage has remained firm throughout the season so far, with usage by GB compounders up 37% (109 Kt) on 2023/24 levels. As maize imports priced competitively earlier in the season, large quantities were bought forward and, as such, firm imports and usage have continued as we head towards the end of the season.

As could be expected, the uptick in maize usage, as well as the lack of domestic supply, has seen wheat used by GB compounders drop back 3% (89 Kt) year-on-year.

Looking ahead, in the short term we could see some increase in demand for cereals on the back of a more positive cattle and sheep outlook. However, the price relationship between cereals and alternative raw materials will be key to overall usage. Additionally, price movement of imported maize against domestic wheat will be something to watch in the new season.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.