Cost of production anticipated to climb for 2026 crops: Grain market daily

Wednesday, 13 August 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £169.30/t yesterday, down £2.15/t from Monday’s close. The May-26 contract fell £2.30/t over the same period, ending the session at £181.15/t.

- Domestic wheat futures followed global markets down, with Chicago wheat and Paris milling wheat (Dec-25) down 1.8% and 1.3% respectively. Ongoing harvest pressure, as well as an increased Russian production estimate from Sovecon (now at 85.2 Mt vs 83.3 Mt previously) put pressure on prices yesterday. Later on in the day, after European markets closed, further pressure came from a sharp increase in the US maize crop estimate made in the USDA’s latest World Agricultural Supply and Demand Estimates.

- Paris rapeseed futures (Nov-25) closed at €466.50/t yesterday, down €7.00/t from Monday’s close. The May-26 contract fell €6.75/t over the same period, closing at €473.50/t. European rapeseed followed movement in Winnipeg canola futures, with the Nov-25 contract back 4.5% over yesterday’s session.

Cost of production anticipated to climb for 2026 crops

As harvest progresses and even comes to an end for some growers in the UK, focus is beginning to turn to next year’s crops. So, what changes can we expect in cost of production for harvest 2026?

- Full economic cost of production for 2023 and 2024 is averaged from validated Farmbench data. For harvest 2025, Defra’s Agricultural Price Index (API) is largely used as an indication of the change in prices, alongside projections for labour, rent and interest rates. For 2026, individual projections are made for each set of inputs, based on market conditions at this point in time.

- This analysis focuses on the middle 50% performing farms (based on full economic net margin). The crops included are all referring to feed quality.

- Full economic cost of production includes variable costs and overhead costs. Overheads include machinery and equipment, labour, property and energy, administration, rental value (including an imputed rent on owned land) and finance costs. Variable costs include seed, fertiliser, crop protection and other costs such as agronomy fees and levy.

- Fertiliser costs are estimated over a May to September buying period. Seed costs are estimated over a June to August buying period. All other costs are averaged over the growing season (October to September).

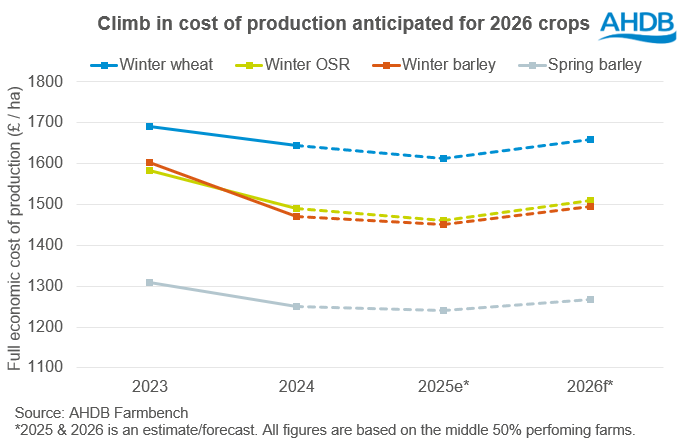

Initial estimates of 2025 and forecasts for 2026, suggest that while we have seen a slight fall back in cost of production over the last few years (following the extreme high in 2023), an increase in cost is expected for 2026 crops.

For winter wheat, a 3% yearly climb in full economic cost of production is expected for the 2026 crop at £1659/ha. Meanwhile, cost of production for winter OSR, winter barley and spring barley, is estimated at £1509/ha, £1495/ha and £1268/ha respectively.

Rising variable costs

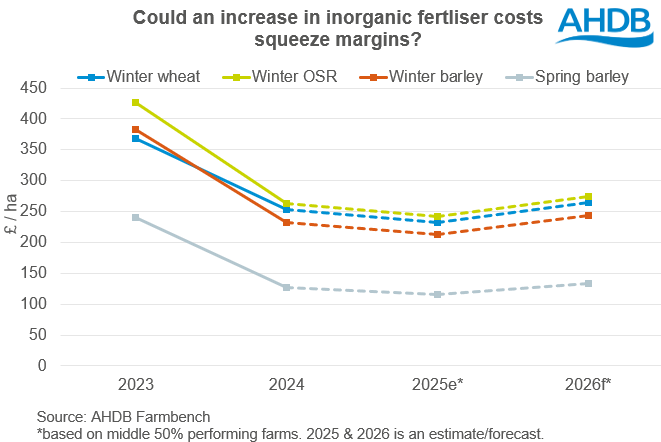

The key factor driving the anticipated climb in cost of production for harvest 2026, is the rise in fertiliser price.

Looking at AHDB’s latest fertiliser prices, the cost of UK produced AN (34.5% N) in May and June this year, compared to the same period last year, had increased by 14%. Recent analysis showed that natural gas futures remained elevated into July. With a lag time, but clear correlation between natural gas and fertiliser prices, it’s likely fertiliser prices will stay at current levels throughout the key buying period (May to September).

On the other hand, little change is currently expected in terms of overall crop protection or seed costs.

More stability for overheads

While variable costs look to be on the rise, current forecasts suggest there is more stability for overheads.

There are anticipated increases in rental value, administration costs, and labour. However, a decline in cost for machinery and equipment (on the back of cheaper fuel), property and energy costs, and finance costs, means total overheads are forecast at just a small increase on 2025 levels.

Of course, the impact that this forecast increased cost of production has on net margins, will depend greatly on the price of grains or oilseeds at the time of sale, as well as yield. Look out for more analysis on this over the coming weeks.

Farmbench is an online benchmarking tool that allows you to compare your farm to similar businesses. It helps you to identify where you can improve efficiency and increase profits.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.