Could a tighter EU grain balance support UK prices? Grain market daily

Thursday, 31 July 2025

Market commentary

- UK feed wheat futures (Nov-25) closed up £1.00/t (0.6%) at £176.95/t yesterday. The May-26 contract was up £0.55/t (0.3%) on the previous day closing at £188.50/t

- The price of domestic feed wheat moved in line Paris futures prices. Paris milling wheat futures (Dec-25) gained 0.4%, while Chicago wheat (Dec-25) fell 1.1%. The Federal Reserve held interest rates steady for the fifth consecutive meeting and a stronger US dollar put pressure on Chicago wheat futures on yesterday’s close

- Paris rapeseed futures (Nov-25) fell €3.25/t (0.7%) to close at €482.75/t. Winnipeg canola and Chicago soyabeans futures (Nov-25) also fell yesterday, by 0.8% and 1.4% respectively

Could a tighter EU grain balance support UK prices?

Grain prices ordinarily come under pressure during the harvest period due to an increase in supply.

During this time, it can be difficult to identify factors supporting prices. However, could a tightening wheat and maize balance in the EU offer some bullish sentiment?

EU grain balance

Last week, the EU Commission updated its forecasts for grain production in the region for the 2025/26 season.

Compared to the June forecast, the Commission decreased wheat (including durum wheat) and maize production by 0.6 Mt and 4.5 Mt, respectively, while increasing barley and oat production.

Compared to last year, wheat production in the EU-27 is forecast to be significantly higher due to adverse weather throughout the growing season for harvest 2024.

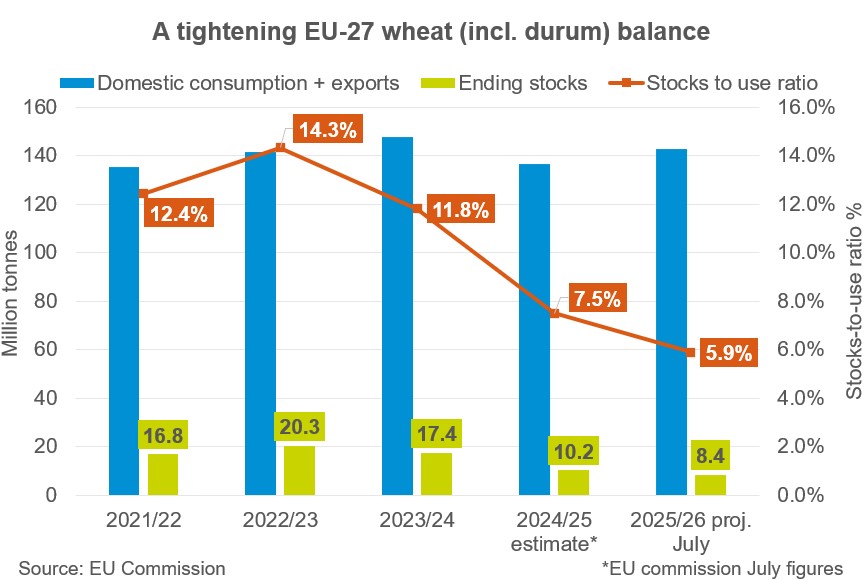

However, the stocks-to-use-ratio for EU wheat this season is at a low level of 5.9% (four-year average is 11.5%).

To calculate this ratio, we divide ending stocks by domestic consumption and exports (to third countries), expressing the result as a percentage.

This lower ratio in 2025/26, is due to lower opening stock levels, coupled with a forecast increase in domestic consumption and exports.

At the same time, the forecast maize stocks-to-use ratio in the EU for the 2025/26 season is low, at 18.2%, compared to an average of 24.0% over the past four years.

EU trade data

As of 27 July, this season, EU soft wheat exports have totalled 803.3 Kt, down from 2.24 Mt at the same time last season.

Despite the slow start to exports in the current season, estimated EU wheat exports remained unchanged at 30.7 Mt last week, which is 23% higher than in 2024/25.

EU maize imports totalled 555.4 Kt in the 2025/26 season, down from 2.1 Mt in the same period the previous year.

The latest EU Commission data forecasts maize imports of 18.3 Mt in the 2025/26 season, which is a 7% decrease compared to the previous season.

Looking ahead

Although an ample grain supply is forecast for the EU in the 2025/26 season, the wheat and maize stock-to-use ratio is lower. This could make Paris grain futures more sensitive to bullish news in the future.

However, currently, the EU's slow wheat exports, and the ongoing harvesting campaign in the Northern Hemisphere are putting pressure on Paris wheat futures, as is price competition with the Black Sea region.

A tighter wheat balance in the 2025/26 season could support 2026 crop prices.

Currently, Paris milling wheat futures (Dec-26) are at a €21.25/t premium to Dec-25 futures (as at yesterday’s close).

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.