Could weather concerns support wheat prices? Grain market daily

Tuesday, 10 June 2025

Market commentary

- Nov-25 UK feed wheat futures fell £1.55/t yesterday to close at £178.50/t. Domestic futures generally followed the global wheat market

- Chicago wheat and Paris milling wheat futures (Dec-25) both decreased by 1.8% and 1.2% respectively. Global wheat futures are under pressure due to improved crop conditions and favourable weather forecasts in the US, as well as higher production estimates in Russia

- Nov-25 Paris rapeseed futures gained €3.50/t to €495.00/t, continuing to be supported by concerns over Ukraine’s crop. Meanwhile, Chicago soya bean futures Nov-25 were lower at yesterday’s close

Could weather concerns support wheat prices?

The approaching wheat harvesting campaign in the Northern Hemisphere is putting pressure on global wheat prices. Generally speaking, this year's wheat crop appears to be in better condition than last year's in the US and EU (USDA, FranceAgriMer).

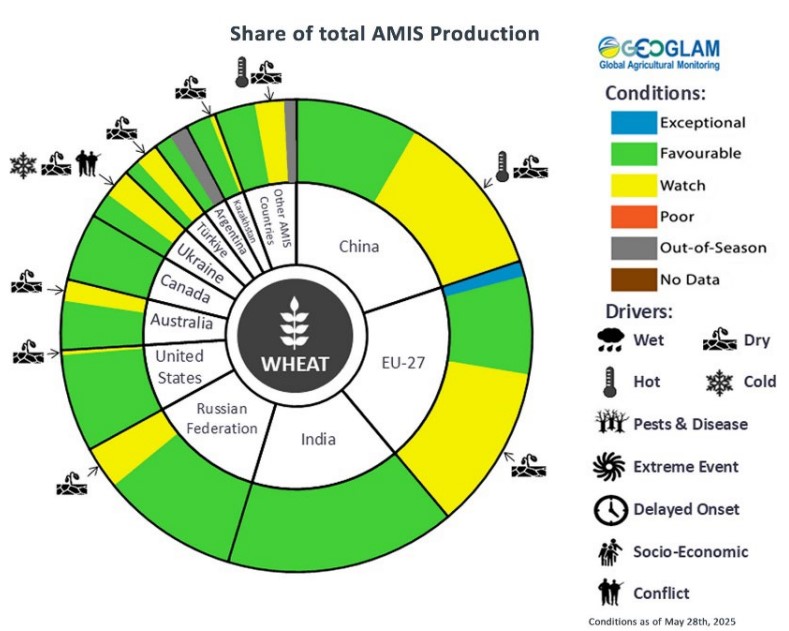

However, according to last week's AMIS Crop Monitor, some regions were at risk of adverse weather conditions as of 28 May. Market participants are paying close attention to northern and central Europe, China, Turkey and the Black Sea region and Australia.

The EU and the Black Sea region are important because of their potential for wheat exports. Meanwhile, China and Turkey are of interest due to their potential for increasing wheat imports.

Indeed, the last week's report from FranceAgriMer showed a decrease in soft wheat crop conditions in France, though they are still higher than last year's historically unfavourable conditions.

Conversely, yesterday's USDA crop progress report showed an improvement in winter and spring wheat crops conditions, with more crops rated as 'good' or 'excellent' as of 8 June compared to the previous week.

For now, global market participants seem to be feeling more optimistic about weather-related concerns, as evidenced by the recent downward pressure on wheat prices. The funds have a large net short position in both Chicago and Paris wheat futures. Net short positions are generally used by the funds to profit from falling markets.

Domestic feed wheat futures Nov-25 have been in a downward trend since February 2025 due to the pressure in global markets.

Looking ahead

Although the upcoming harvesting campaign in the Northern Hemisphere is currently putting pressure on the market, weather forecasts for the next month are an important factor to watch.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.