December WASDE round up: Grain Market Daily

Wednesday, 11 December 2019

Market Commentary

- UK feed wheat futures (May-20) continued their decline yesterday, dropping a further £0.50/t to close at £146.00/t. UK markets have followed the general decline in global grain markets, pressured further by gains in the value of sterling.

- France’s farm ministry released its first forecast of grain and oilseed plantings yesterday. The results highlight a 5% reduction in the area planted to wheat, meanwhile the area planted to rapeseed is estimated to be down almost 27% on the five-year average.

- The latest milling wheat tender from Egypt’s state grain buyer (GASC) was won by a mix of European and Russian cargoes.

December WASDE round up

Yesterday evening the USDA released the December issue of the WASDE report. Also, UK export trade data for October was released.

Wheat

For wheat, globally the consensus is for decreased supplies, higher exports and lower ending stocks. Both Australia and Argentina have substantially reduced their production of wheat.

Medium term drought conditions have had adverse effects on their production. Australia’s production has been revised down by 1.1Mt to 16.1Mt. This could be their smallest crop since 2007/08.

Argentina has also been revised down, by 1.0Mt, to now have a projected production of 19.0Mt. In contrast both EU and Russian production is revised up 0.5Mt from updated harvest data.

Maize

Global maize production is forecast to increase despite poor yields in Canada, whose production has been revised down from 14.0Mt last month to 13.4Mt.

Global maize ending stocks have been revised up by 4.6Mt, to 300.6Mt, largely due to an increase in China’s production from 254.0Mt to 260.8Mt and a reduction in exports. This has taken the world production up to 1108.6Mt, from 1102.2Mt.

Oilseeds

Global oilseed production has been revised up by 3.3Mt to 574.6Mt. Increases in soyabean, sunflower and peanut production has offset the reduction in rapeseed and cottonseeds.

China’s soyabean production has been revised up by 1.0Mt to 18.1Mt. This increase has been forecast off increased planted area and yield. However, there has been a reduction in exports by 0.6Mt, mainly from Argentina reducing their exports.

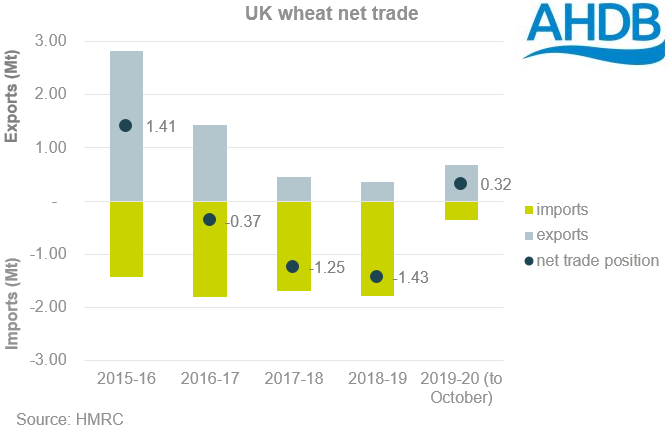

UK Trade Data

UK trade data showed that there is a large surplus of barley to be exported. So far this season, the UK has exported 964Kt of barley, 41% of the surplus available for free stock or export this season. This means there is still 1.36Mt to export from November to June.

For wheat, the UK has only exported 674Kt, 23% of the surplus available for free stock or export. This means that there is still 2.3Mt to be exported from November to June.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.