Does an oil bounce offer short-term rapeseed support? Grain Market Daily

Wednesday, 29 April 2020

Market Commentary

- UK feed wheat futures (Nov-20) continued their decline yesterday, falling a further £1.65/t, to £163.25/t. The declines follow improved rainfall across Europe and the Black Sea. Rainfall is expected to return to normal levels in the key wheat-growing region of Southern Russia.

- A couple of weeks ago we looked at rice markets as a potential driver of wheat prices. The situation for rice remains tight with logistical challenges and blocks on exports from key nations. Chicago rough rice futures (nearby) continue to exhibit strength, gaining $55.21/t in April so far.

Does an oil bounce offer short-term rapeseed support?

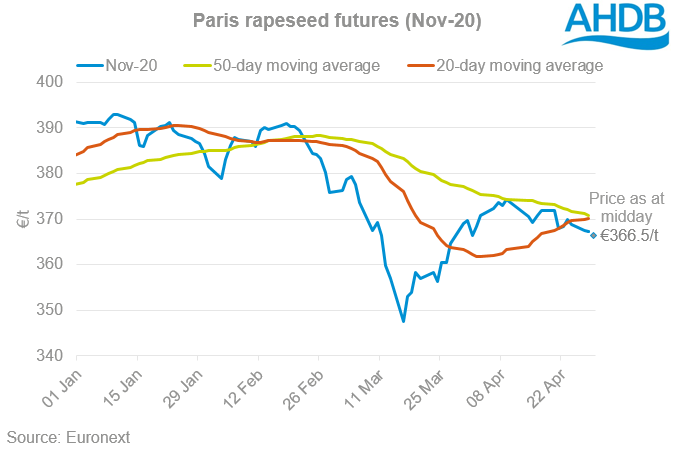

Following a run of declines across the oilseed sector, there could be some short-term support for OSR prices on the horizon, stemming from improved crude and vegetable oil prices.

Rapeseed prices gained early this morning, before falling back to €366.50 at midday. It is worth noting that in spite of recent weakness in oilseed rape prices Nov-20 futures are currently trading ahead of the average of the previous five new crop contracts at this point in the season.

Crude oil

Having continued to move lower in recent weeks, nearby Brent Crude oil futures have seen small gains across the past two days. Crude oil futures gained with US crude stocks increasing by 10 million barrels in the week to 24 April, less than analysts’ expectations of 10.6 million barrels. Furthermore, US gasoline stocks fell by 1.1 million barrels, whilst a Reuters poll of analysts expected a 2.6million barrel rise.

While still trading at just $21.48/barrel, we could see a slight resurgence in the price of oil as global funds look to take advantage of low fuel prices.

Vegetable oils

The support for crude oil has also filtered into the vegetable oil market, with Malaysian palm oil futures and Chicago soya oil futures both recording gains. Further support could come for vegetable oils, over and above the support from crude oil, with the world’s largest palm oil producer FGV Holdings expecting palm oil output to continue falling in the wake of the global pandemic.

As China seeks to ease its lockdown measures, demand for vegetable oils could well increase offering further support, while Malaysian plantations remain closed.

Oil meals

While oil has seen some temporary support, meal values remain weak, with global meat output limited. A number of meat processing plants have ceased production in the US, in the wake of coronavirus.

That said, on Tuesday Donald Trump issued an edict, mandating that meat-processing plants should remain open. This may support soyameal prices in the short-term provided throughput increases in the plants.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.