Economic worries swamp fundamental news: Grain Market Daily

Friday, 13 March 2020

Market Commentary

- May-20 Paris rapeseed futures fell €11.00/t yesterday to close at €356.75/t, the lowest price for the contract since April 2019.

- Cheaper crude oil reduces the incentive to include biodiesel in transport fuels, and so potentially demand for veg oils and therefore oilseeds. Any slowdown in the global economy would also reduce fuel demand, and thus biodiesel demand.

- Despite falls in Chicago wheat and maize futures, UK wheat futures were cushioned by sterling and the euro weakening against the US dollar. A ban on travel from much of the EU to the US triggered the latest currency moves.

Economic worries swamp fundamental news

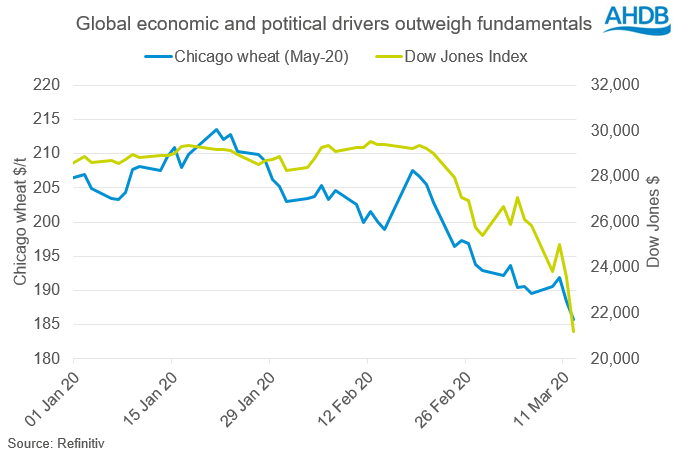

Global macro-economic worries continue to be the dominant factors driving market sentiment for not just oilseed but also grain markets. Global stock markets fell again yesterday due to continuing worries about the economic impact of measures to combat the coronavirus, COVID-19, pandemic.

These factors dwarfed any impact from stories about changes to market fundamentals on grain and oilseed prices in recent days, including:

- Dry weather watch for Argentinian soyabeans

After a good start, conditions have turned drier and several organisations have raised concern about the potential impact on yields this week. More warm, dry weather is forecast for the week ahead. On Wednesday the Rosario grain exchange trimmed its forecast for the 2019/20 Argentine soyabean crop by 3.5Mt from February to 51.5Mt, now 5Mt smaller than last year. The Buenos Aries Grain Exchange yesterday reduced its prediction from February, down 2.5Mt to 52.0Mt.

- French spring barley planting lags

Wet weather has persisted in France, hampering spring barley planting. Planting was 34% complete as at 9 March, advancing just 2% in a fortnight. This time last year 96% of crops were in the ground. Continued delays could limit the barley area, though better weather is on the cards for the week ahead.

- EU wheat area trimmed

European consultancy, Strategie Grains cut its projection for the wheat area planted in the EU-27 & UK for harvest 2020. The area was reduced by 0.2Mha to due to the impact of the wet weather in northern Europe. This could mean 2020 wheat output could be lower than previously expected.

In other times these supply factors might have caused some price reaction, but this week they have been completely swamped by news about the wider global economic and political situation. Any future influence on prices from similar news is likely to be reduced or minimised until the macro situation stabilises.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.