EU sow prices remain low in recent weeks

Wednesday, 11 November 2020

By Bethan Wilkins

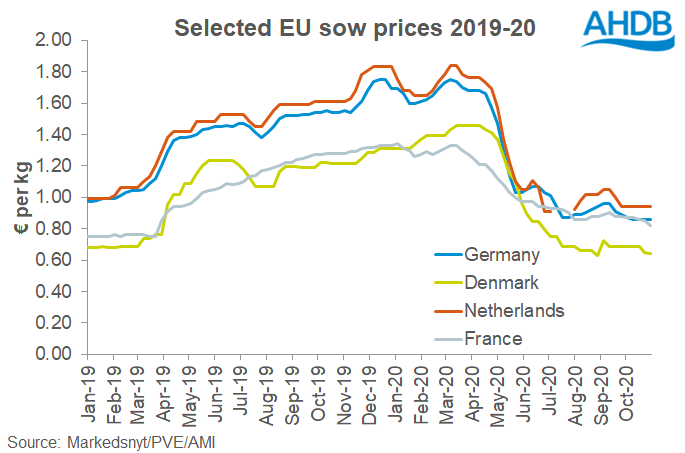

Unusually, EU cull sow prices have not followed quite the same trend as the finished pig market in recent weeks. Despite some volatility, prices have been broadly flat since the summer. In contrast, finished pigs recorded a sharp drop in mid-September, following the discovery of African Swine Fever in the German wild boar herd.

There are still signs Germany’s ASF developments (and growing backlog of finished pigs on farm) have affected the sow market. The German M1 sow price was showing some uplift at the start of September, peaking at €0.96/kg in the middle of the month. These gains have since been lost, taking prices back to €0.86/kg in the latest week ended 1 November. This is similar to prices at the end of July.

Sow prices did fall disproportionately in late summer, with limited processing capacity affecting the sow market more, as the more valuable finished pigs were prioritised. This is probably why prices have now merely moved back in line with levels seen earlier this year, rather than falling further, as has been the case for finished pigs. Sow meat is also traded more within the EU market so will be less directly affected by Germany’s loss of the Chinese export market.

Demand for manufacturing meat is typically boosted in the run up to Christmas. However, with coronavirus restrictions in place across Europe, the outlook for Christmas demand is uncertain. The likelihood of support from this trade is, therefore, probably low. Around the holiday season itself, some manufacturers typically shut down for a period; this may lead to further pressure on quotes as 2020 draws to a close.

Prices outside of Germany have largely followed a similar trend, which would be expected given that Germany is the main EU market for sow meat. Like the German price, the Dutch quote also showed a peak in mid-September, but has since fallen back to summer levels. French and Danish prices showed less of a September peak, remaining relatively stable until the latest week when there has been a slight decline.

With most British sows destined for the German market, reports indicate that sow prices here have been stable too, but at a low level. For British producers, the outlook for sow prices now has added uncertainty, as we still don’t know whether trade with the EU will remain tariff-free after the UK leaves the customs union at the end of this year. In March 2019 we examined the potential impact of this here; however, sow prices are now lower than when this analysis was conducted. A reduced tariff quota does exist for carcase imports into the EU, which if used, would keep sow prices positive. Outside of this, producers may need to pay to have sows slaughtered, in order to keep the trade viable and avoid higher disposal costs. We will look at this in more detail if a no-deal situation presents itself.

The income from cull sow sales does not make up a very large portion of the income for producers, especially farrow-to-finish operations. But, with feed prices rising and finished pig prices also falling, the potential for further devaluation in cull sows would certainly be an unwelcome development for the industry.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.