EU yield expectations split: Grain market daily

Tuesday, 22 July 2025

Market commentary

- UK feed wheat futures (Nov-25) closed at £179.00/t yesterday, down £0.95/t (-0.5%)

- Domestic feed wheat followed global markets lower. Chicago wheat futures (Dec-25) were down (0.7%) on the previous close as conditions in the US are generally beneficial for maize crops. Pressure also came from higher-than-expected maize yields in Brazil, suggesting production could exceed the USDA’s expectations (132 Mt, 2024/25) with some now forecasting 140 Mt

- Paris rapeseed futures (Nov-25) closed €2.50/t (-0.8%) down on the previous day at €480.75/t

- Conditions in Canada continue to dampen rapeseed prices as beneficial rain fell across the region. Winnipeg canola futures (Nov-25) fell to CAD$694.10/t yesterday, down 0.9% on Friday’s close and back below the CAD$700/t level

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

EU yield expectations split

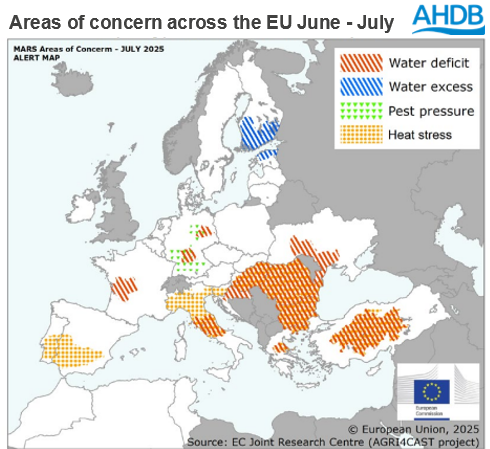

The latest EU MARS report (21 July) shows a split in yield expectations between winter and spring crops across Europe. Winter crops have performed well in the Baltics, Nordic countries, France, Spain and Ireland, largely due to sufficient water availability throughout the season. While Germany, Poland and Hungary anticipate average yields, with water deficits causing issues, as well as disease pressure in Germany.

Regional variance

Hot spells impacted much of Europe and coastal North Africa, sparing only the Baltic Sea region. Some southern areas experienced more than 25 days above 30 °C, and maximum temperatures reached 40 °C or higher across the southwest Iberian Peninsula.

In southern regions, particularly Türkiye and Italy, as well as southern Ukraine crops have been negatively impacted by heat and water stress. These have adversely affected both winter and spring crop development. Spring crops have fared the worst on the back of these conditions, with prolonged hot and dry weather posing notable risks to their growth.

In Romania, Bulgaria and Greece, the hot and dry weather minimally affected winter crops, as they were already close to maturity, but strongly reduced the available soil moisture for spring crops. Low reservoir and river levels also reduced the amount of water available for irrigation.

Although dry weather has posed issues across the EU, it has facilitated the start to winter crop harvest for many countries.

Meanwhile, across the Baltics, a rainfall surplus was observed since the start of June, complicating fieldwork. The excessive wetness may increase disease pressure and localised hypoxia, which if it persists, may negatively affect winter crop yields.

Yield variance

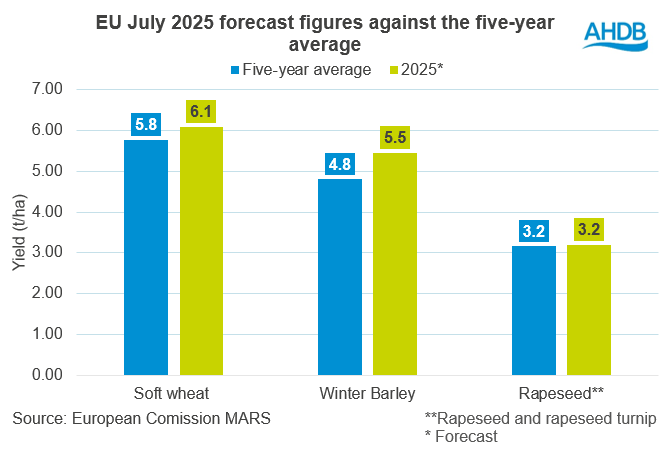

For cereal crops, including barley and wheat, yield expectations for 2025 see minimal changes since June and are forecast above the five-year average.

However, the grain maize yield prediction has been revised down from the June report by 4%, now at 7.2t/ha, but remains above its five-year average.

As for oilseeds, rapeseed remains steady on its June figure and above the five-year average.

Sunflower yields have been revised down by 8% since June and are now expected to yield 1.94t/ha, below the five-year average.

Looking ahead

While early winter crop harvests have begun under favourable conditions in many regions, ongoing heat and variable rainfall may increasingly challenge summer crop potential and complicate fieldwork. Overall, EU cereal yields are forecast above the five-year average, supporting a positive outlook for EU supplies, which is keeping pressure on EU and so UK prices. But regional variability remains high as late-season weather continues to shape final outcomes and conditions for maize and sunflowers need to be monitored.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.