Farmbench can boost business performance

Tuesday, 17 October 2023

If you want to improve farm profitability, put benchmarking at the top of your to-do list; Julie Clark explains why.

With global weather events increasing in frequency and the war in Ukraine continuing, volatility in commodity markets is unlikely to go away. Input costs have also been volatile and agricultural payment policy continues to change.

With so much outside of growers’ control, getting to grips with production costs and understanding break-even points is important. It will help you to know the price needed to make a profit and highlight ways to improve net margins.

Why benchmark?

An analysis of farm business data by AHDB and the Andersons Centre in 2018 identified eight key factors that differentiate top-performing farms (top 25%) from the rest (middle 50% and the bottom 25%).

Top-performing farms:

- Minimise overhead costs

- Set goals and budgets

- Compare performance with others

- Understand the market

- Focus on detail

- Have a mindset for change and innovation

- Continually improve people management

- Specialise

Benchmarking can help improve farm performance against several of these factors, including the first three bullet points.

Farmbench – our online benchmarking tool – compares your business’ performance figures against similar businesses. It can be used to help evaluate costs and identify business strengths and weaknesses.

Arable Business Groups

Farmbench powers numerous discussions at our Arable Business Groups (ABGs).

There are over 40 ABGs across the UK digging into production costs and improving members’ businesses. They consider all business matters, including environmental scheme options and pricing strategies.

Many growers (60% who submitted feedback forms after 2022/23 ABG meetings) intended to make changes because of the lessons learned at an ABG. The changes cited were varied but included marketing crops, buying inputs, machinery investments and closer cost monitoring.

Big data

Farmbench data is powerful, especially when anonymised data from multiple farms is analysed.

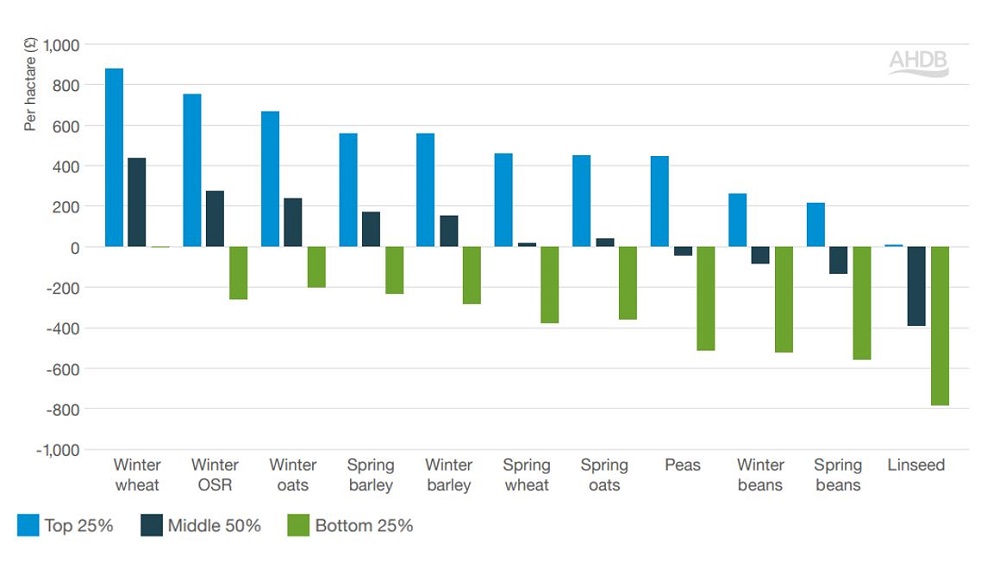

In the following analysis, we use conventional combinable crop enterprise performance results from Farmbench for five harvest years (2018–22).

Unsurprisingly, production costs per hectare increased for all crops over this period, with a large proportion of the rise in 2021 to 2022.

Overheads are a key driver of profitability (alongside yields).

In general, overheads – including a value for unpaid labour, a rental value of owned land, depreciation and finance charges – accounted for around two-thirds of the total cost of production.

The top 25% performance groups recorded the largest increase in overheads from 2021 to 2022 for all crops. Despite this, overheads in the top quartiles remained (on average) lower than the other performance groups.

Although production costs increased over the period, yields and output prices generally went up too. This helped improve full economic net margins. The top 25% had the greatest increases (as expected). For example, a rise of over £650/ha for winter wheat on the year increased the average net margin to over £1,600/ha in 2022.

The bottom 25% also recorded a relatively large increase in net margins for winter wheat in 2022 (of over £450/t). This took total net margins up to £550/ha – still just a third of what the top 25% achieved. Although this group benefited from higher wheat prices, relatively high production costs, lower yields and lower average sale prices held net margins back.

We will analyse harvest 2023 data shortly. However, significantly higher input costs and lower output prices will squeeze margins. That said, historic data shows that the top 25% of growers are likely to stay in the green for most crops.

Average net margins (by crop and performance group)

AHDB Farmbench

AHDB Farmbench

Figure 1. Five-year average (2018–22) net margins (£/ha) by crop and performance group

Get benchmarking

Arguably, there has never been a better time to benchmark. Farmbench helps you explore options to optimise income and mitigate cost increases.

From crop rotation changes, to locking into futures prices, to evaluating potential inputs and equipment investments, why not consider using Farmbench or joining an ABG?

Arable Focus

This article also features in the winter 2023 edition of Arable Focus (pp10–11).

Download the edition from the Arable Focus page

.jpg) AHDB

AHDB

Topics:

Sectors:

Tags: