Fertiliser prices ease with natural gas futures: Grain market daily

Friday, 10 March 2023

Market commentary

- UK feed wheat futures (May-23) closed at £216.00/t yesterday, down £4.00/t from Wednesday’s close. New crop futures (Nov-23) closed at £221.00/t, down £2.75/t over the same period.

- Global wheat markets continue to lose ground on growing expectations of an extended Black Sea deal allowing Ukraine to continue shipping grain, as well as competitive Russian supplies pressuring markets.

- US and European maize and soyabean markets were also under pressure yesterday though losses were limited by the severe ongoing drought in Argentina.

- Paris maize futures (Jun-23) closed at €260.25/t, down €1.75/t from Wednesday’s close.

- Chicago soyabean futures (May-23) were down $2.57/t over yesterday’s session, closing at $555.05/t.

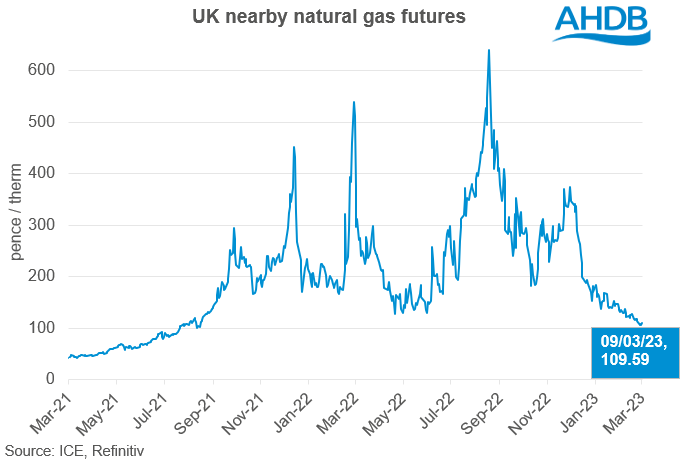

Fertiliser prices ease with natural gas futures

UK natural gas prices have continued to fall over the last couple of months. Despite the current cold spell, nearby ICE UK natural gas futures closed at 109.59p/therm yesterday, down 21.94p/therm from the same point in February, and down 263.99p/therm on the year. European natural gas prices have been coming down as a milder winter helped preserve gas stocks, and a formal agreement between EU states saw a voluntary 10% cut in gross electricity consumption. Domestic prices have also been declining due to increased imports of liquified natural gas (LNG) and dependence on renewables.

Alongside natural gas futures, fertiliser prices have also eased slightly. UK produced AN (34.5%) for spot delivery in February averaged £630/t. This is down £70/t (10%) from January’s price, and down £19/t (3%) from the same point last year. The average price for imported AN in February was £538/t, down 21% from January’s figure, and down 16% on the year.

Will UK natural gas futures continue to fall?

Looking ahead, the UK looks to become more dependent on alternative sources of energy, which could see demand for natural gas decline. According to the Energy and Climate Intelligence Unit (ECIU), renewably produced electricity this winter has replaced more than a third of the UK’s yearly gas demand for power generation. Without renewables, it’s thought that the UK would have to increase net gas imports by more than 22% (ECIU).

Another factor that could bring prices down moving forward are storage units, which have greater stocks than anticipated. European gas storage facilities are expected to end the winter season at a record of over 50% full. At the end of March last year, just 26% of European storage facilities were filled causing increased concerns over supplies (Gas Infrastructure Europe).

Having said this, analysts at energy consultancy firm Cornwall Insight, have said that despite the positive forecasts, there are still factors to consider that could add some support to natural gas prices. Imports of US LNG have risen significantly since the outbreak of war in Ukraine, but the US is under pressure to protect domestic consumers from climbing prices, which could result in less being exported. As mentioned in previous updates, there also remains a question mark over Chinese demand. With the country coming out of nearly three years of lockdowns, Chinese economic growth will almost certainly impact global energy demand and will be something to watch moving forward.

What does this mean for fertiliser prices?

With natural gas futures currently on the decline, it’s likely we will see fertiliser prices continue to fall slightly as well. However, with anticipated ongoing volatility in gas markets it’s also unlikely that we will see fertiliser prices back down to pre-war levels in the near future.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.