Fertilisers continue to rise in price: Grain market daily

Thursday, 24 April 2025

Market commentary

- UK feed wheat futures (May-25) closed yesterday at £163.90/t, down £3.65/t from Tuesday’s close. The Nov-25 contract ended the session at £183.90/t, up £0.35/t over the same period

- Old crop domestic futures dropped yesterday, following the fall in US wheat prices. May 2025 Chicago wheat futures fell by 1.4%, due to improved weather forecasts in the northern hemisphere and a stronger US dollar

- May-25 Paris rapeseed futures closed at €515.25/t yesterday, losing €11.00/t from Tuesday’s close. The Nov-25 contract gained €0.75/t over the same period, ending at €474.00/t. European rapeseed futures (old crop) diverged from the wider vegetable oil complex which saw gains yesterday. Winnipeg canola and Chicago soya bean oil futures (May-25) both increased by 0.5% and 0.7% respectively

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Fertilisers continue to rise in price

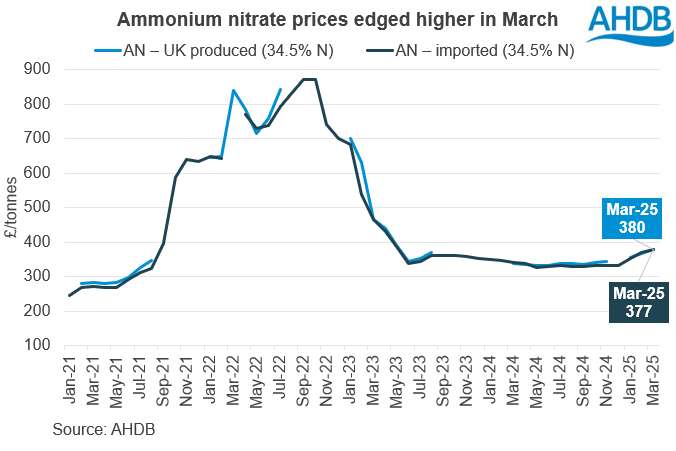

Nitrogen fertiliser prices climbed once again in March, making it the third month in a row they have risen, according to the latest GB fertiliser prices.

UK-produced ammmonium nitrate (AN) with a 34.5% nitrogen content averaged £380/t for spot delivery. This represents an increase of £13/t compared to February and £41/t higher than the same period last year. Imported AN came in slightly lower at £377/t, but still up £8/t from February and £35/t higher than last year. Other fertilisers, such as UAN, MOP, and DAP, also saw price increases, though modest compared to AN. Granular urea saw a slight decrease of 1%.

Gas prices play a big part in the cost of making nitrogen fertiliser. Although natural gas prices have eased since reaching recent highs in January, they remain high compared to historical averages.

UK nearby natural gas futures closed at 83.6p/therm yesterday, down 36% from January, but still above the April 2024 average of 72.2p/therm. Similarly, in Europe, nearby gas futures have also fallen 36% since January to €34.2/MWh yesterday, though this remains higher than the April 2024 average of €29.0/MWh.

.png)

The drop in gas prices is mainly due to forecasts of milder weather, which is expected to lower heating demand. Concerns about refilling EU gas storage are also easing, with levels currently at 37.5% full (Gas Infrastructure Europe) after heavy withdrawal during winter. Increased imports are expected over the next months to help hit the required target before November.

So, why are fertiliser prices still high even though gas prices have dropped? Some manufacturers cut back on production when energy costs were higher, causing a temporary shortage. Plus, export restrictions and currency fluctuations are contributing factors.

What does this mean for UK growers?

For UK growers, rising fertiliser prices mean higher production costs. To manage this, growers may need to explore cheaper or alternative fertiliser options. AHDB have several resources to help growers assess costs and make informed decisions, such as Nitrogen fertiliser calculator and Fertiliser outlook 2025.

Looking ahead, if gas prices keep falling as reserves build, fertiliser prices might drop in the coming months, which is crucial for winter planning. However, growers need to monitor price trends closely and adjust their fertiliser plans for the long term.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.