Funds’ mixed bets on the price of grains and oilseeds: Grain market daily

Friday, 7 February 2025

Market commentary

- UK feed wheat futures (May-25) ended yesterday at £189.90/t, up £2.65/t from Wednesday’s close. The Nov-25 contract gained £1.85/t over the same period, to close at £196.10/t.

- Domestic wheat futures closed higher yesterday following global grain markets. There was some additional support from a weakening in sterling against the euro and US dollar, after the Bank of England cut interest rates to 4.5% from 4.75%.

- Chicago wheat futures and Paris milling wheat futures (May-25) were up 2.44% and 1.16% respectively at yesterday’s close. Weather risk in the Black Sea region for the winter wheat and short covering position by speculators in Chicago supported prices.

- May-25 Paris rapeseed futures closed at €522.75/t yesterday, up €4.75/t from Wednesday’s close amid wider rises in the oilseed complex. Winnipeg canola futures (May-25) were up 1.4% yesterday, supported by the hope that tariff concerns were easing. Malaysian palm oil futures were also up driven by expectations of falling production, but limited demand from major importers restrained gains.

- The Buenos Aires Grain Exchange announced yesterday that only 17% of Argentina’s soybean crop is in good or excellent condition due to the unfavourable weather, compared to 31% last year.

Funds’ mixed bets on the price of grains and oilseeds

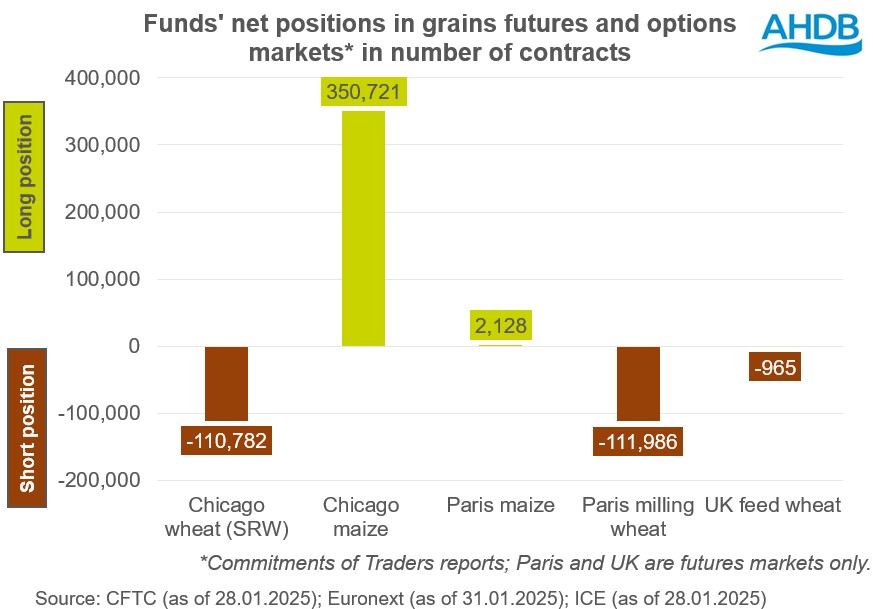

Since November 2024, managed money, often referred to as ‘the funds’, has increased its net-long position in Chicago maize futures and options contracts. This is according to data from the US Commodity Futures Trading Commission (CFTC).

Net-long positions can bring profits for this type of trader from future price rises, and indeed Chicago maize prices have tended to rise since December 2024. As a result, as of 28 January, net-long positions on Chicago maize were at a peak level of 350,721 contracts. This is only just below the number of net-long contracts held at this point in the 2020/21 and 2021/22 seasons. For the current 2024/25 marketing year, the global maize balance is tighter than in those seasons. Global production is lower than consumption in 2024/25 and global maize ending stocks are at a 10-year low of 293.3 Mt (USDA).

Conversely, managed money hold large net-short positions in Chicago wheat and Paris milling wheat futures, which can be seen as predicting a bearish outlook for wheat prices. Net-short positions are often used by this type of trader to profit from falling prices. For the UK feed wheat, the funds have net-short position of 965 contracts.

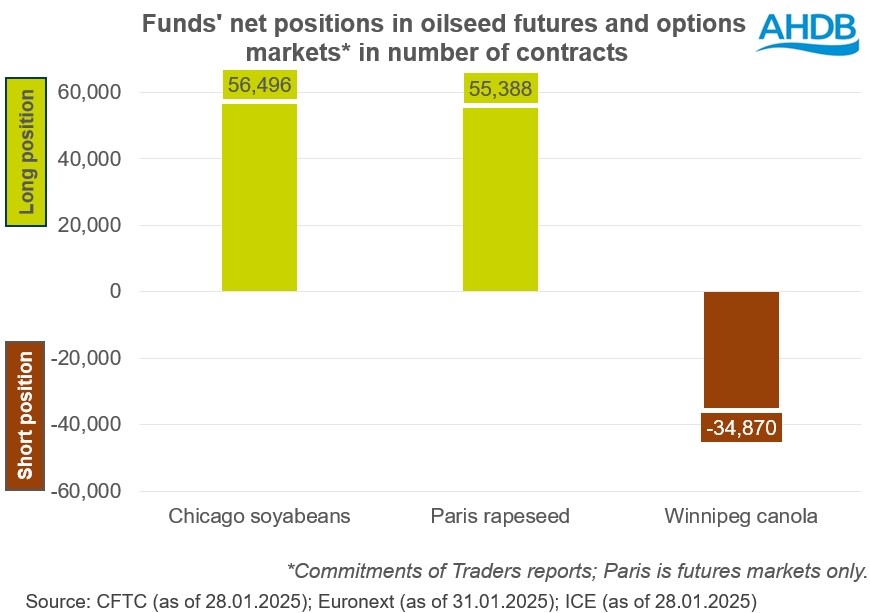

Within the oilseeds futures and options markets, the funds are mostly betting on rising prices through net-long positions. For Chicago soyabeans the net long is over 56,000 contracts and on Paris rapeseed (futures market only) the net-long is over 55,000 contracts. It should be noted that from September to December 2024 the funds were net short in Chicago soyabeans, and only at the beginning of 2025 did they switch to a net long position. Tighter global supply and demand for rapeseed continues to support prices, but Winnipeg canola is under pressure from the potential implementation of US import tariffs.

Looking ahead

One of the expressions of technical analysis "trend is your friend until it ends" and it's very difficult to predict potential changes in the direction of trend price movement. The position of speculative traders is one of the factors that could help in analysing the medium- and longer-term direction of prices.

Maize and soyabean prices arguably have the potential to rise further, as the funds’ net-long positions are still smaller than in recent years. Plus, the tighter global maize balances in the current season, the high level of soyabean crushing in the US and weather concerns in South America have all been supporting prices. Tariffs still pose a risk to US export demand, but the postponement of implementation for Mexico and Canada lessens the risk for now. Any support in the feed grain complex could be good news for UK farmers.

On the other hand, in Chicago and Paris wheat, the funds have large net short positions. In a situation of extreme weather risks, prices could rise. Should this happen, the funds will need to offset the current short position through buying contracts. A large volume of buying will accelerate any upward trend in prices.

The next important change in funds' position could be just before or after the next USDA WASDE report, out at 5pm on 11 February 2025.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.