Futures falling, Is May-21 the option? Grain Market Daily

Tuesday, 28 January 2020

Market Commentary

- Coronavirus continues to have a strong impact on commodity and stocks markets. Global grain and oilseed markets continue to lose ground on the uncertainty around the knowledge of the virus.

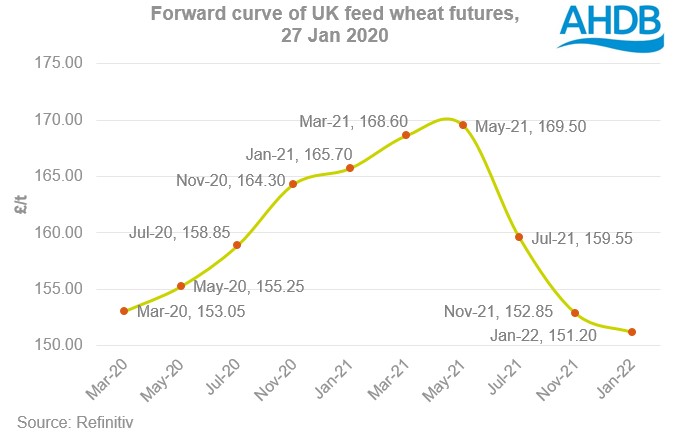

- UK feed wheat futures continued to fall yesterday, losing ground with the global market. Old crop (May-20) UK feed wheat futures have lost £3.45/t since last Thursday, to close yesterday at £155.25/t. Meanwhile, Nov-20 feed wheat futures have lost £3.50/t over the same period, to close at £164.30/t.

- Paris rapeseed futures also continue to lose ground, falling alongside the vegetable oil and crude oil markets. Since reaching a high of €416.50/t on 10 January, May-20 rapeseed futures have lost €16.50/t closing at €400.00/t yesterday.

Futures falling, Is May-21 the option?

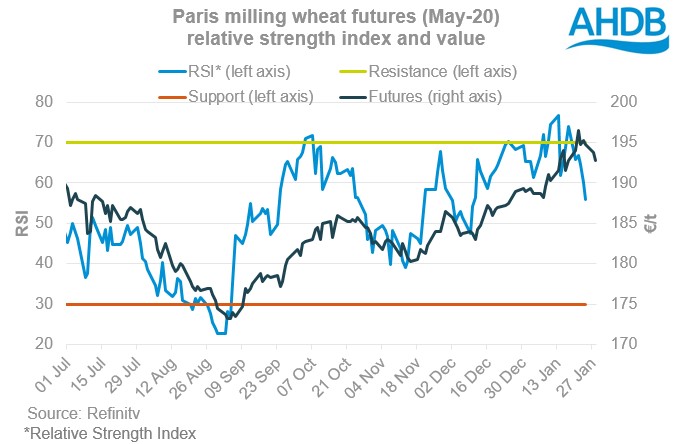

Wheat futures have lost some considerable ground in the past few days. Old crop (May-20) futures, have lost £3.45/t since last Tuesday. A large part of the recent fall stems from the fact that global wheat markets had somewhat overcooked themselves. Paris milling wheat futures broke through the top band of the relative strength index (RSI) last Thursday and have subsequently fallen. A similar pattern is seen in new crop (May-20) Paris futures, with the market breaking through the top band of the RSI on 14 January before losing ground.

So, with old and new crop wheat trending weaker, how do you secure most value for your new crop wheat?

If storage is no object May-21 UK feed wheat futures could prove a handy tool. The new-crop contract has similarly fallen back in the past couple of days, but crucially remains near to £170.00/t, closing yesterday at £169.50/t.

Options could well play an important role in any decisions you make regarding the contract. The price of a put option for the May-21 contract with at £169.50 currently stands at £12.40/t (Refinitiv).

Assuming a basis to new crop of £4.00/t, using a put option at £169.50/t would guarantee you an ex-farm price (basis East Anglia) of £153.10/t for May-21 (pricing in the cost of the option at £12.40/t). This then becomes your baseline for making sales, if the physical market rises above this value you are “in the money”, if it falls below you have a secured price of £153.10/t.

Using a put option can essentially act as an insurance premium. Particularly given the uncertain outlook for the new crop. If the market were to fall on stock build up from the old crop market, or looking ahead, fall on the back of big expectations of the 2021/22 crop, then a put option would give you the chance to guarantee a minimum income later in the season.

As we’ve said in the past, using options and trading futures is not without risk and should only be done with full knowledge of the market.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.