Global wheat prices need export momentum: Grain market daily

Friday, 29 August 2025

Market commentary

- UK feed wheat futures (Nov-25) closed down £1.00/t (0.6%) at £168.40/t yesterday. The May-26 contract fell £1.30/t yesterday, closing at £179.05/t.

- UK feed wheat futures fell yesterday, following Paris milling wheat futures. Paris milling wheat futures (Dec-25) decreased by 0.8%, while Chicago wheat futures (Dec-25) gained 0.9%. Chicago wheat futures were partly supported by firm exports and a weaker US dollar, while Paris milling wheat futures came under pressure from rising wheat production forecasts in the EU and Russia.

- Paris rapeseed futures (Nov-25) significantly decreased by €10.50/t (2.2%) to close at €465.50/t. Winnipeg canola futures (Nov-25) also fell yesterday, by 2.3%.

- Increasing forecasts for rapeseed production in the EU and canola production in Canada put pressure on futures yesterday.

Global wheat prices need export momentum

At the start of the 2025/26 wheat season, the influx of grain meant there was a need for wheat exports from the Northern Hemisphere to pick up pace to limit pressure on prices. Throughout the season, a slower export rate could disrupt the balance between global supply and demand, potentially leading to higher ending stocks for the 2025/26 season. So, what is the latest update on global exports so far?

- As of 21 August, US wheat exports for the 2025/26 season (starting in June) were higher than last year's figures and the five-year average. The main reason for this was the weaker US dollar, which resulted in more competitive prices.

- As of 24 August, EU exports of soft wheat for the 2025/26 season (starting in July) totalled 2.18 Mt, compared to 4.15 Mt for the same period in the previous season. Though please note that the export data for France, Bulgaria and Ireland is incomplete for the 2025/26 marketing year.

- According to information from the Ministry of Agrarian Policy and Food as of 27 August, Ukraine had exported 2.26 Mt of wheat for the 2025/26 season, which was 33% lower than the 3.39 Mt exported during the same period in the 2024/25 season. The main reason for that was a delayed harvesting campaign.

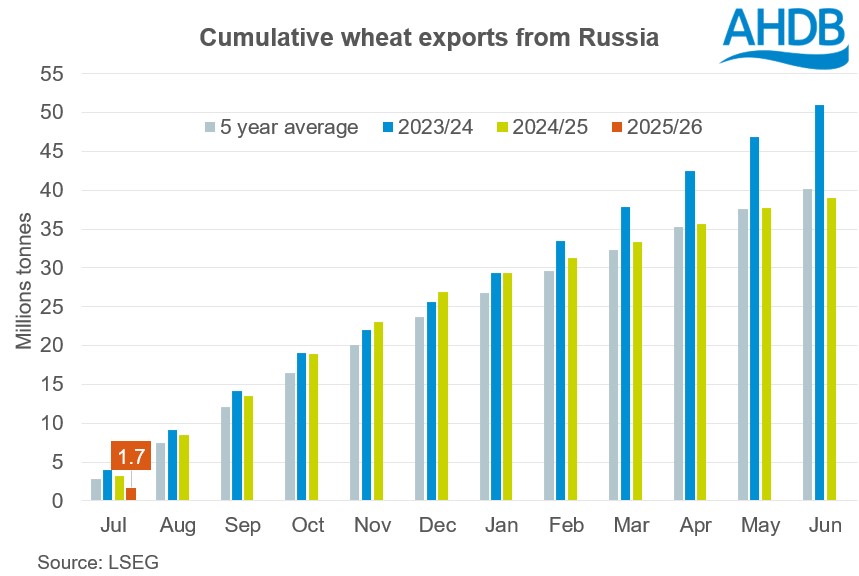

- Increased estimates of wheat production and exports by Russian consultancy agencies could put additional pressure on prices. However, exports have been slow for the start of the 2025/26 season. In July 2025, Russian wheat exports totalled 1.7 Mt, which was 47% lower than in July 2024 and 40% lower than the five-year average.

Looking ahead

Global wheat importers are relatively inactive, waiting for prices to fall further amid pressure from the harvesting season. However, sellers are generally unwilling to sell at current prices also.

To provide some support for the price of wheat, the market needs fresh driving factors, such as an accelerated pace of exports. Therefore, demand from key importers over the coming weeks will be something to watch out for.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.