Harvest 2025 into the latter stages: Grain market daily

Friday, 22 August 2025

Market commentary

- Nov-25 UK feed wheat futures gained £2.15/t yesterday closing at £169.30/t, with the May-26 contract up £2.20/t to £180.50/t. UK futures found support from rises in Paris wheat futures after the euro retreated against the US dollar. This will aid the competitiveness of European wheat into export markets

- This support came despite the International Grains Council (IGC) increasing its estimates of 2025/26 global maize production by 23.2 Mt and wheat production by 2.7 Mt. Expectations for stronger demand helped reduce the impact on global grain stocks

- Nov-25 Paris rapeseed futures closed at €476.75/t (approx. £412.50/t) yesterday, up €4.75/t from Wednesday’s close. The main support came from vegetable oil prices and disappointing early results in the European sunflower seed harvest (Argus Media). The drop in the value of the euro was also likely a factor

- Chicago soy oil futures rose yesterday on speculation that some refineries in the US may not be granted an exemption for biofuel targets. This could boost demand for the vegetable oil in the USA

Harvest 2025 into the latter stages

While there has been good progress in the past fortnight, AHDBs latest harvest progress report shows harvest 2025 remains challenging with extreme variability in yields.

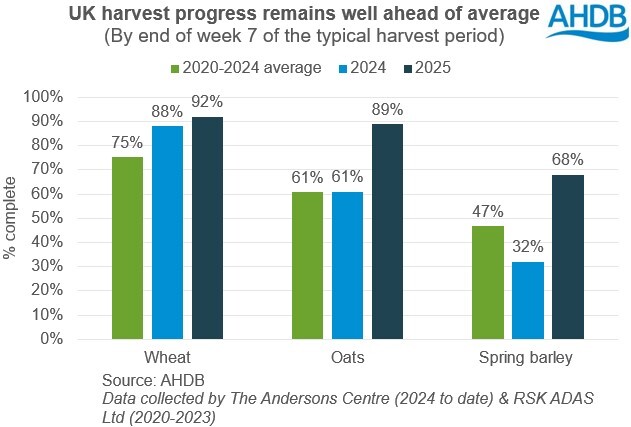

We have seen notable jumps up in progress since the last report (as at 08 August), with most progress in the past week. Progress for all crops remains well ahead of the five-year average.

The UK wheat and oat harvests are now into their closing stages at 92% and 89% complete respectively by 20 August. The main areas remaining are northern England, Scotland and Northern Ireland for both crops, plus South West England for wheat.

An estimated 71% of the key Scottish spring barley crop remains to be cut (as of 20 August), with just under a third (32%) of spring barley remaining for the UK in total.

The winter barley and winter oilseed rape harvests had already wrapped up by the previous report (data up to 6 August).

However, the report also highlights the continuing extreme variability in yields this year. There is significant variation in yield between and within farms, regions and across the UK, which means this survey is unlikely to reflect all individual farm circumstances.

The combination of lower yields for many growers and falling grain prices throughout the year points to significant financial challenges for arable farms.

So far, the survey suggests the UK average yield for wheat at 7.3t/ha, 5% below the five-year average but some 9% below the 10-year average. Similarly, the average for oats is 10% below the five-year average and 13% below the 10-year average.

After some promising early reports, the average spring barley yield is now just 1% above both the five-year and ten-year averages, albeit with significant variation amongst contributors.

Increased variability in quality

Variability in quality for oats and spring barley has also increased as harvest has progressed north. While winter oat quality has generally been good, spring oats have struggled more, with both lower yields and specific weights reported.

Over the past fortnight, there have been reports of spring barley crops not making malting quality, largely due to high screening levels. Some particularly high screening levels have been reported for Scotland.

In the South of England nitrogen levels are high, whereas there have been very few issues to date with nitrogen levels in Scotland.

Wheat quality, as reported by trade, remains largely positive, with high protein levels and specific weights in UK Flour Millers Group 1 samples. For some, Hagberg Falling Number (HFN) levels did decline slightly after heavy rain in early August.

Where next?

The full report can be read here, and our next report is currently scheduled for Friday 5 September. However, given the variability, it may take a while before we get a final picture on UK yields and quality this year.

The next insight into potential UK supplies in 2025/26 comes on Thursday (28 August), when Defra releases its estimates of the cereal and oilseed rape areas in England. Look out for highlights in Thursday’s Grain market daily.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.