Higher milk prices, but are they enough?

Wednesday, 11 May 2022

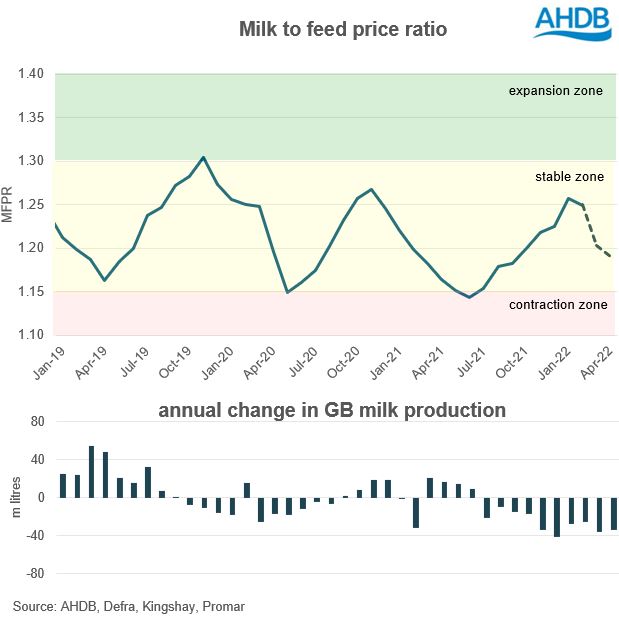

The Milk to Feed Price Ratio (MFPR) is a commonly used indicator of profitability on farms, but also provides a signal on the direction of milk production. With milk prices moving up steadily since the middle of 2021, the MFPR[1] has been low but relatively stable (1.15-1.26). The recent wave of milk price increases are in line with improved market returns, but are also aimed at stemming further drops in milk production. However, it is up for debate if they are enough to incentivise a reversal of the current trend in production.

Historically, when the MFPR is in the range 1.16-1.30, milk production has remained relatively stable. When it exceeds 1.30, we typically see an increase in milk production, with periods of contraction once the MFPR is at 1.15 or below.

Despite the average MFPR remaining in what we call the ‘stable’ zone, milk production has been contracting since July 2021. This will be due to pressures on margins arising from other input costs, notably fuel and fertilisers, and a shortage of labour.

It‘s also likely that many farmers will be facing concentrate costs which are higher than the published average, particularly for those who didn’t secure supplies at the relatively lower prices available earlier in 2021.

For March and April, estimated prices for dairy concentrates[2] have moved up considerably, and this is starting to push the MFPR lower even though milk prices have moved higher in that time.

Assuming a conservative increase of 15% on the estimated April concentrate cost of £318/tonne, likely to hit farmers later in the year when feed purchases increase, the GB milk price would need to be in the region of 44ppl on average to maintain the April MFPR of 1.19. An even higher price would be needed to trigger expansion however, given the additional cost pressures facing dairy farms this year, and to overcome concerns over labour availability and the impact of reduced BPS payments.

With global feed ingredients markets looking to be highly volatile through 2022, and likely into 2023, it will be vital that milk prices remain at a level that supports cash flows- and confidence – on farms.

[1] Based on the Defra average milk price (GB) and average concentrate costs (sourced from Kingshay and Promar)

[2] Based on prices for feed ingredients used in the manufacture of concentrates.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.