How low can wheat go? Grain market daily

Wednesday, 11 January 2023

Market commentary

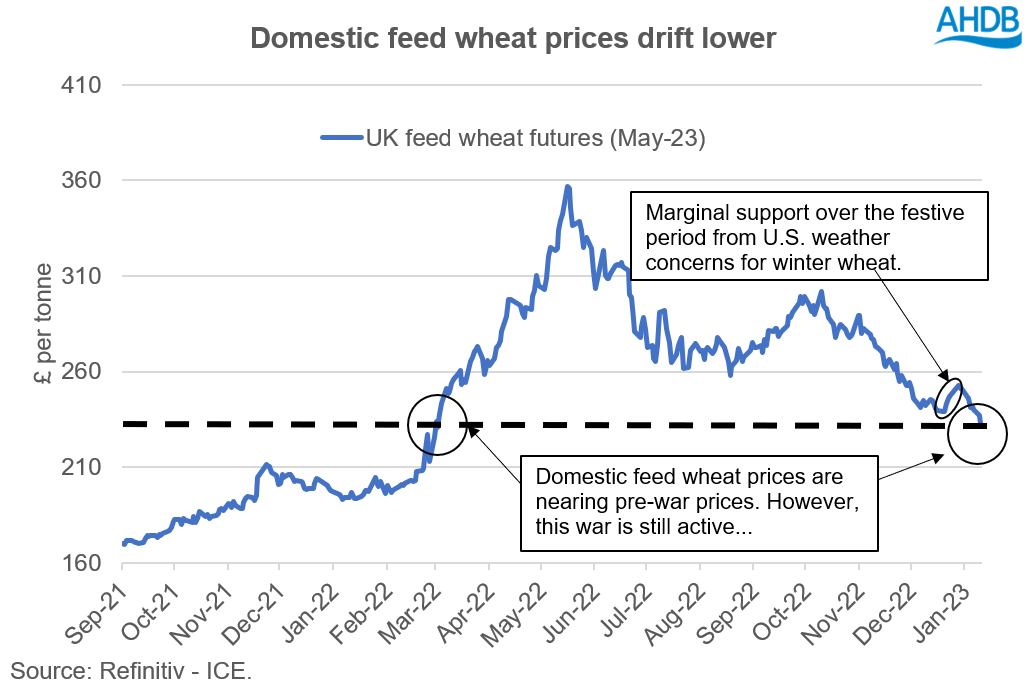

- UK feed wheat futures (May-23) closed yesterday at £233.00/t, down £4.00/t from Monday’s close. The Nov-23 contract closed at £226.50/t, down £2.20/t over the same period.

- Domestic prices followed both the Chicago and Paris wheat markets down yesterday. With the US market closing lower from weak demand and a firmer US dollar.

- Wheat markets continue to be pressured by competitive Black Sea supplies. It has been reported that Egypt’s state grain buyer, GASC, has provisionally booked 60Kt of Russian wheat in an international tender yesterday.

- Paris rapeseed futures (May-23) closed at €568.25/t yesterday, down €3.50/t from Monday’s close. The contract followed the respective Chicago soyabean contract down, as demand for U.S. soyabeans is slow, with the arrival of South American supplies to the market.

How low can wheat go?

Pressure continues for grain markets with nearby Paris milling wheat futures closing at a near 11-month low yesterday. Lacklustre demand for U.S. wheat, combined with large Black Sea supplies is continuing to pressure grain markets.

This pressure has filtered into domestic markets too. May-23 UK feed wheat futures, have now lost all what was gained over the festive period (off the back of the extremely cold/dry weather in the US), closing yesterday at £233.00/t, the lowest level since March 2022.

Despite the active war still on going in Ukraine, the renewal of the export deal, along with competitive Black Sea supplies, seems to have pressured wheat markets, but what could happen going forward…

So where now for prices?

The war in Ukraine is now factored into markets and is acting as a price floor as such, with the export corridor extended to the end-March. However, if there are issues with this being extended further, we could be in a similar situation that we were in the autumn. Markets were re-supported from September to November last year, over anxieties that the export corridor wouldn’t be renewed. This remains a watch point over the next few weeks.

Currently, the big market driver from the Black Sea region is Russia’s export campaign. Russia still has this record wheat crop to export which continues to be competitive in international tenders. However, with increasing insurance rates and vessel costs, could this pose an issue for Black Sea exports? This will remain a watch point.

As for weather, concerns over the impact of the recent cold snap in the U.S. and the ongoing drought, have dwindled over the past week. While the impact of these conditions is yet to be fully understood, it is thought that it may not be as bad as initially expected. Furthermore, the U.S. winter wheat area for harvest 2023 is expected to increase to a seven-year high in this Thursday’s USDA report (Refinitiv). US weather and crop conditions remain a watch point.

In the EU, soft wheat production is expected to rise for harvest 2023. Across Europe temperatures are currently abnormally warm for the time of year, and widespread rains are on-going for the most part, favouring crop development.

For demand there are questions, as we globally have soaring inflation with interest rates rising to try and curb this, leading to expectations of recessional behaviour. This, combined with rising COVID-19 cases in China, is leading to concerns around global demand.

With UK feed wheat futures (May-23) this afternoon trading at £231.75/t (13:00), there is a lot of parameters that could make this price higher or lower in the coming months. The bearish factors such as recessionary concerns, a large EU crop and Black Sea exports could continue to weigh on wheat markets. However, there are some possible bullish factors too, such as the impact of extreme conditions on the US crop, as well as possible uncertainty around whether the grain corridor is renewed in March. What should be caveated here is that prices are likely to remain high in a historical context, with the ongoing war in Ukraine underpinning markets and rising input costs globally.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.