How seasonal is current price pressure? Grain market daily

Tuesday, 5 August 2025

Market commentary

- UK feed wheat futures (Nov-25) closed up slightly (£0.05/t) at £174.60/t yesterday. The May-26 contract was also up £0.05/t yesterday, closing at £186.60/t

- The price of domestic feed wheat futures changed slightly yesterday due to uncertainty in the global market and currency fluctuations. Paris milling wheat futures (Dec-25) increased by 0.8%, while Chicago wheat (Dec-25) remained unchanged. The Bank of England's interest rate decision will be announced on Thursday, 7 August, which could impact exchange rates at the end of the week

- Paris rapeseed futures (Nov-25) increased by €1.25/t (0.3%) to close at €476.25/t. The Winnipeg canola futures market was closed yesterday. Meanwhile, Chicago soyabean futures (Nov-25) increased by 0.5%

How seasonal is current price pressure?

The harvest volume in the Northern Hemisphere, coupled with the slow demand for exports from the EU and the Black Sea region, is putting pressure on the wheat market. Paris rapeseed futures are also beginning to establish a downward trend.

So, is this level of pressure normal for this point in the season? And what can we expect in the coming months?

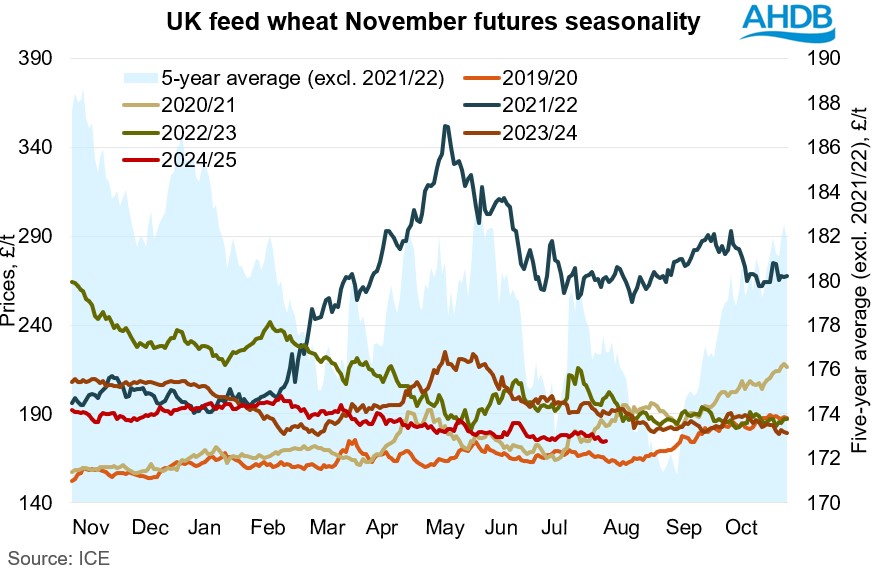

The price of UK feed wheat futures for November is currently the lowest it has been at this point in the harvest cycle for four years, with the 2019/20 period lower than the current level.

The seasonal chart for the last five years shows that prices usually decrease in August due to ample supply. While in September, prices ordinarily stabilise and attempt to establish an upward trend.

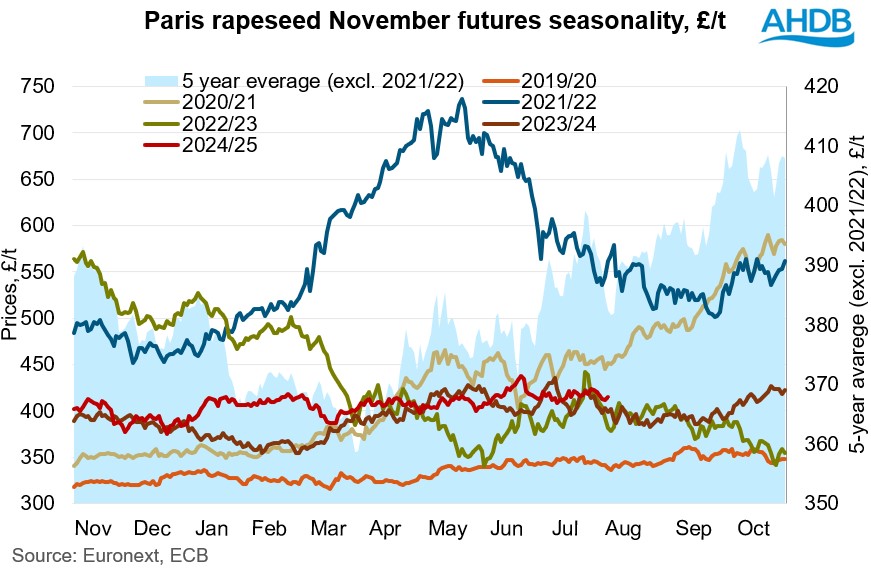

Conversely, the price of Paris rapeseed futures for delivery in November reached a two-year high at the start of August. Though during the 2020/21 and 2021/22 periods, the price was significantly higher than the current level.

If prices were to follow seasonal trends, rapeseed futures may stabilise in September before attempting to establish an upward trend in October.

Looking ahead

Historical data from seasonal charts of UK feed wheat and Paris rapeseed futures indicates that prices typically fall in August.

However, over the next month prices usually begin to stabilise as the market assesses supplies and demand potential over the season.

Given the current high level of geopolitical and economic risk, it is also important to note that seasonal price movements could differ significantly from historical figures.

Over the coming weeks, focus will also begin to turn to conditions in the Southern Hemisphere as crops enter their key development stages.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.