July pig prices: growth continues as SPP hits 225p

Thursday, 10 August 2023

As pig prices continue to reach new heights, we look into the prices for July, the pork costs of production (COP) for Q2, and how it got there.

Key trends

- SPP hits 225p for the first time.

- APP averages 223p throughout the month.

- Net margins from cost of production at +£22 per head.

- Feed costs, pig price, and building costs remain key watch points in cost of production.

Market update

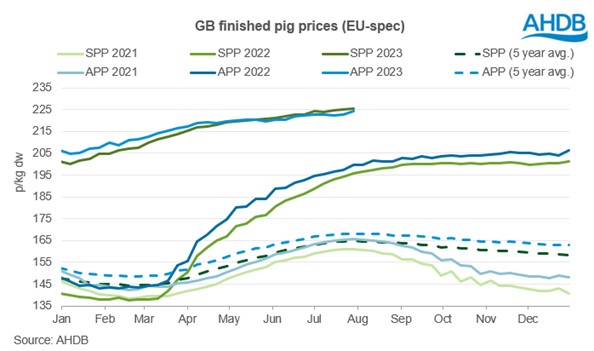

The EU-spec SPP hit new highs during July, averaging 225.0p and reaching 225.4p for the week ending 29 July.

Prices rose 2.1p compared with the previous month, as weekly gains averaged 0.3p. The first week of the month saw a minor decline, however, this was balanced out by a jump of 0.82p in the second week.

The SPP ended the month almost 30p up from the same period in 2022, and over 60p up from the 5-year average.

The EU-spec APP averaged 223.0p for the four weeks ending 29 July, an increase of 1.1p compared with the previous four-week period.

Despite a fall of 0.4p in the second week, the final week of the period more than made up for lost ground, increasing 1.7p to end the month at 224.3p. This has closed the gap between the APP and SPP, with the SPP now only 1.1p above the APP.

GB estimated slaughter saw an average of 153,400 pigs slaughtered per week in July, giving a monthly total of 613,400 head.

July saw a fall of only 1,800 head from June, but a 118,500-head fall from July 2022.

Carcase weights for the SPP recovered from their hot June losses, averaging 88.9 kg, an increase of 370 g. For the week ending 29 July average weights had returned to sit above 89 kg.

Cost of production

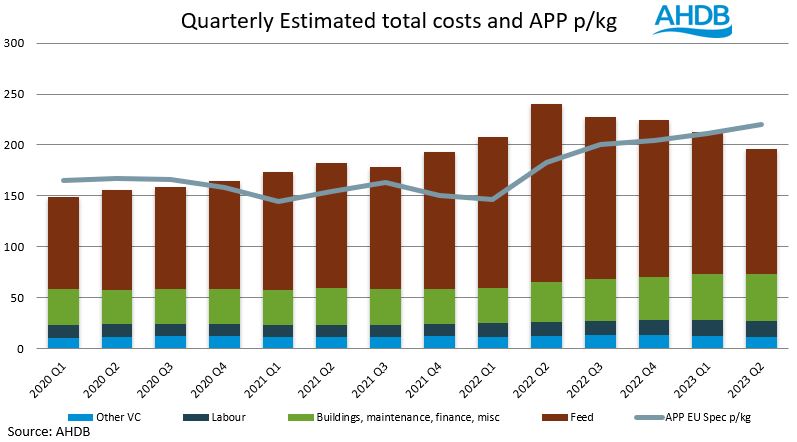

The estimated cost of production for Q2 (Apr–Jun) in 2023 was 196p/kg, as feed costs fell and pig prices rose. This led to net margins of £22 per head, and +25p/kg – the first positive net margin in ten consecutive quarters.

Falling feed costs throughout the quarter brought welcome news for producers, from highs seen over the past year.

Throughout the last ten quarters since positive net margins, feed costs have risen from around 100p/kg in Q3 2020 to a peak of 175p/kg in Q2 2022, as the war in Ukraine pressured global feed prices. Feed costs now sit at an estimated 123p/kg for Q2 2023, down 52p year on year.

Pig prices have also supported the growth in net margins, as the APP has grown by 65p since the last period of positive net margins. The APP averaged 165p/kg in Q1 of 2020 and sat at 221p/kg for Q2 of 2023. Prices have seen significant growth over the past year, with a 38p increase from Q2 of 2022, as production falls and domestic supplies become tighter.

Another major driver increasing the cost of production during the previous ten quarters was building costs. The cost of building materials such as concrete and steel saw significant price increases following the global pandemic. A second challenge for building costs arose in the form of increased interest rates and finance costs. This has been especially true since the latter half of 2022, with costs moving from 39p in Q2 2022 to 46p in Q2 2023. Overall building costs have risen 12p since the last positive net margin figure recorded in Q3 2020.

These three areas remain key watch points for the cost of production and where net margins will lie in the future.

The pig price is still historically high, but gains are slowing, meaning any changes to input costs, especially feed and interest rates, will impact net margins for better or worse.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.