Mixed market expectations for USDA’s first 2024/25 forecasts: Grain market daily

Thursday, 9 May 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £212.80/t yesterday, down £1.80/t from Tuesday’s close, and tracking global grain price movement.

- Global wheat futures direction was influenced by improved weather forecasts in Russia and the US, as well as caution ahead of the USDA’s May WASDE report due out tomorrow (LSEG).

- New crop Paris rapeseed futures (Nov-24) gained €2.25/t yesterday to close at €487.75/t.

- European rapeseed futures moved in a different direction to Chicago soyabean futures (Nov 24) which settled $5.51/t lower closing at $445.66/t yesterday. This pressure was based on expectations that the upcoming USDA report would show historically healthy global supplies (see more below), while forecasts for drier weather in the US Midwest could allow for accelerated planting (LSEG).

- AHDB released data on cereals usage for animal feed and human and industrial consumption in March today, along with data on grain stocks held at the end of February by Merchants, Ports and Co-operatives. Defra also released the results of a survey of on-farm cereal stocks in England and Wales. Analysis will follow tomorrow.

Mixed market expectations for USDA’s first 2024/25 forecasts

Tomorrow night (5pm BST) the USDA releases its first predictions for global grain and oilseeds supply and demand in 2024/25.

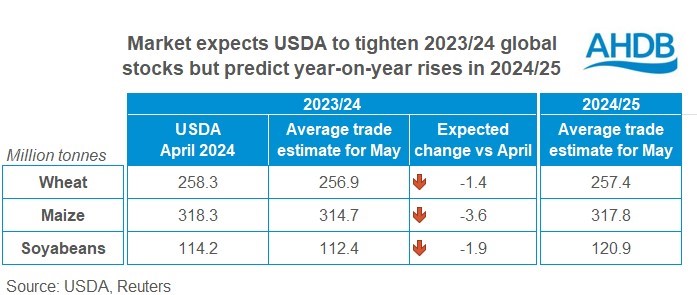

A poll by Reuters shows that the market expects the USDA to forecast global end of 2024/25 stocks for wheat, maize and soyabeans above revised 2023/24 levels (LSEG). Reuters polls a range of market participants and forecasters, and as expected there’s often a range of views.

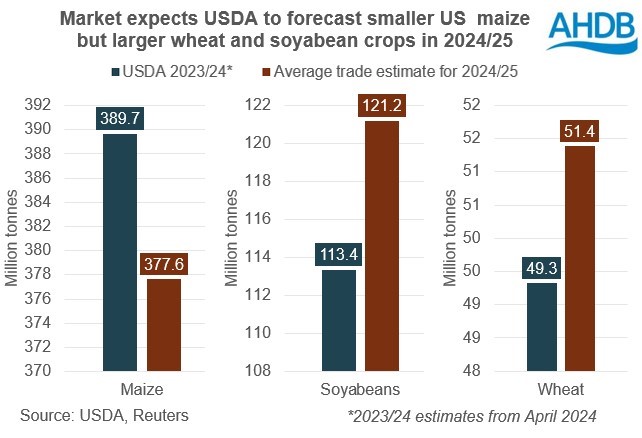

For the first 2024/25 predictions, all those polled expect the USDA to show a year-on-year rise in soyabean stocks. But for wheat there’s sharply contrasting opinions. Some participants expect year-on-year rises in global wheat stocks, while others, such as StoneX, predict global wheat stocks to tighten considerably.

Those polled also widely expect the USDA to predict higher US soyabean and wheat production and US stocks in 2024/25. But for maize, while a smaller US crop is expected, there’s a range of views about what this could mean for US stocks.

2023/24

The USDA will also update its figures for 2023/24. While the focus is often initially on the new crop figures, old crop updates can impact carry-over stocks and be influential.

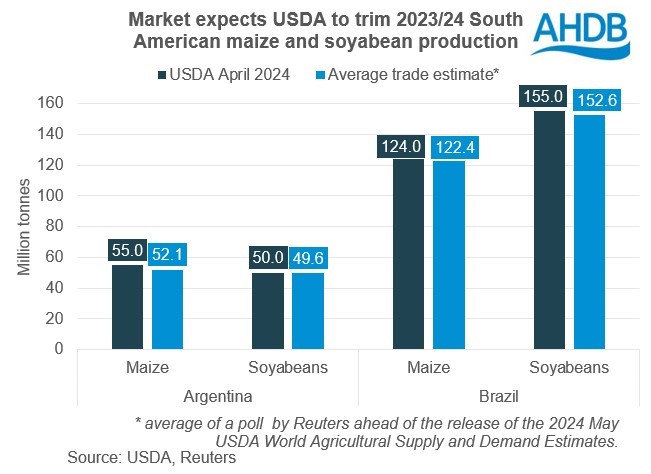

The key areas of interest here are South American maize and soyabean production. There’s currently a wide gap between the USDA’s estimates and local forecasters (LINK). For maize, this gap could mean the difference between a well-supplied global maize market and a more tightly supplied one.

The market is expecting the USDA to trim its forecasts for Brazilian and Argentinian production. However, expectations would still be some way above local forecasts. For example, the Reuters poll shows the market is expecting the USDA to cut the Argentinian maize crop from 55.0 Mt to 52.1 Mt. But yesterday the Rosario Grain Exchange cut its forecast to 47.5 Mt.

The South American crop expectations likely factor into the expected cuts to global maize and soyabean stocks at the end of 2023/24. Global wheat stocks are also expected to tighten.

Market impact

This range of views and uncertainty opens the door for unpredictable reactions to tomorrow’s report, and volatile prices. While largely theoretical at this stage in the season, the USDA’s predictions can often set the tone for the coming months. Look out for highlights in Monday’s Market Report, and more coverage in Tuesday’s Grain market daily.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.