Mixed regional wheat scores highlight uneven weather impacts: Grain market daily

Thursday, 3 July 2025

Market commentary

- UK feed wheat futures (Nov-25) moved up £1.30/t (0.74%) to £176.45/t yesterday from the previous day’s contract low.

- Domestic feed wheat futures tracked global gains, with Chicago wheat (Dec-25) rising 2.5% on renewed fund buying. Paris milling wheat (Dec-25) followed, edging up 0.4%, supported by US price strength and concerns about maize crops which are starting to reach a key development stage.

- The euro edged down by 0.1% against the US dollar after hitting its highest level since September 2021, last trading at €1=$1.1798 yesterday (LSEG). But with the dollar still relatively weak, attention now turns to US weekly export data amid improved competitiveness in global markets.

- Paris rapeseed (Nov-25) closed 1.4% up yesterday at €488.25/t following rises in Chicago soyabeans and soyabean oil, which closed 2.0% and 2.6% higher respectively (Dec-25). Prices were supported by optimism around the potential conclusion of talks between Vietnam and the US on tariff levels.

Mixed regional wheat scores highlight uneven weather impacts

Winter wheat crops across much of England are advancing rapidly toward harvest, driven by the hot, dry conditions that defined June. By comparing AHDB’s crop condition data with recent weather trends, we can begin to quantify the impact of this season’s warmth and dryness on yield potential across the UK.

Please note that the information from the crop condition report was captured up to Monday 23 June 2025 for AHDB by RSK ADAS Ltd.

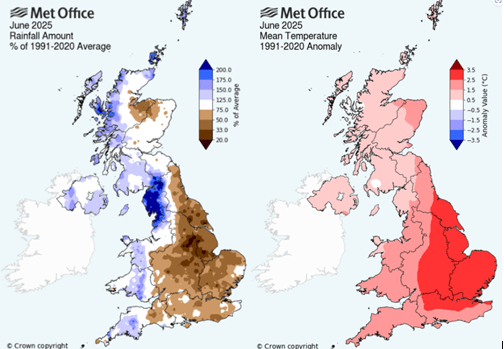

While total rainfall for June was close to the normal levels of rainfall, there was wide variation. Many areas of the UK saw below 50% of the 1991–2020 average, building on deficits from an already dry spring.

Meanwhile, mean temperatures exceeded long-term norms by over 2.5°C, and sunshine hours were higher than average. These conditions have accelerated development in some areas but also triggered early senescence, where crops begin to shut down prematurely due to stress, limiting the duration of grain fill.

Variation across the UK

Winter wheat in Scotland had 70% rated at ‘good’ to ‘excellent’, this is above its 2024 score (60%). Northern Ireland also had 95% of its winter wheat crop score at ‘good’ to ‘excellent’ condition, this well above the average for the rest of the UK. These countries benefited from rainfall in June at normal or above normal levels.

In the Eastern counties of England, which account for around 28% of UK wheat production, at the end of June 60% of winter wheat crops rated at ‘good’ to ‘excellent’. This parallels scores at the start of July 2024.

.png)

The East Midlands in particular shows signs of accelerated maturity and development indicators suggest crops here are among the furthest forward nationally. As crops are pushed quickly through growth stages, the risk of reduced grain size and lower specific weight increases. The dry conditions, especially on lighter soils, have limited root water access during the critical grain-fill period. Just 17% of winter wheat is rated as good to excellent in this region.

Meanwhile, the West Midlands and North West reported 10% and 30% winter wheat crops in good to excellent condition respectively. These regions suffered notably in the spring with the North West seeing temperatures 2.0°C higher than the long-term average and the West Midlands heavily impacted by water stress. Early senescence in these areas may be reducing yield potential even as crops appear visually mature.

Barleys spread in growth stages

Winter barley harvest has already begun in the most forward areas, particularly across the South and East. By late-June, over half the national winter barley area had reached the soft dough stage, and nearly 7% had progressed to grain hard, indicating combining was imminent in advanced fields. However, a spread in growth stages between areas, likely reflects the variation in planting dates. The Eastern counties see significant spread in growth stages indicating a slightly longer harvest period for the crop as it reaches maturity at different rates.

Looking ahead

While an early start to the harvest is now expected in many regions, the decisive influence of recent weather is already evident. In areas affected by early senescence, crops may reach maturity faster but are unlikely to achieve their full yield or quality potential. That said, there are pockets where well-timed rainfall and favourable temperatures helped support crop development, offering some resilience against broader seasonal stress.

We now wait for harvest to show us the impact on crop yields and quality. AHDB’s first national harvest progress report of 2025 is planned for release on Friday 11 July.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.