Natural gas and fertiliser update: Grain market daily

Friday, 11 November 2022

Market commentary

- UK feed wheat futures (May-23) closed at £273.00/t yesterday, down £3.75/t from Wednesday’s close. New crop futures (Nov-23) were down £4.60/t over yesterday’s session, closing at £254.50/t

- Chicago wheat (May-23) closed at $307.51/t, down $0.83/t. Paris milling wheat (May-23) was down €1.75/t over the session, closing at €326.75/t. Domestic markets felt more pressure as sterling strengthened, ending the session up 1.2% and 3.1% against the euro and US dollar respectively

- Global wheat markets felt some pressure yesterday as Wednesday’s World Agricultural Supply and Demand Estimates (WASDE) estimated world wheat ending stocks up by 280Kt to 267.82Mt. Find out about the latest WASDE revisions

- Paris rapeseed (May-23) lost €5.75/t over yesterday’s session, closing at €636.25/t. This price movement tracked the wider oilseed complex

Natural gas and fertiliser update

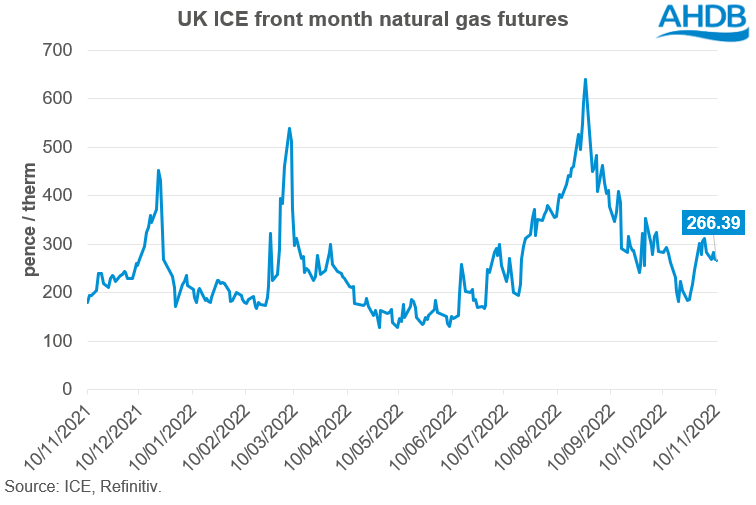

UK natural gas prices have been steadily falling since their peak at the end of August. Prices over the last few weeks have been volatile and remain reactive to news surrounding the conflict in the Black Sea region.

Over the last week UK natural gas prices are generally under pressure from increased Norwegian imports, the potential of new energy deals, and strong wind power output.

Yesterday, nearby ICE UK natural gas futures closed at 266.39p/therm, up 86.41p/therm on the year (10 November 2021).

However, as we head into winter and demand for energy rises, could we see a change in overall price direction over the next few weeks?

As western relations with Russia continue to be unstable, it’s unsurprising that the overall decline is starting to slow down. Analysts believe if the weather turns colder over the next few weeks, we could see energy demand start to pick up which could add some support, if realised.

Something else to consider is the availability of liquid natural gas (LNG). As a result of limited pipeline imports to Europe from Russia, the continent is increasingly reliant on LNG. According to the BBC, European LNG imports in January-September 2022 were already 23% higher than the 2021 total imports, though increasing reliance could mean higher prices as supplies are limited globally.

Looking ahead, the UK is currently thought to be in the final stages of an LNG deal with the US, which could secure around 10 billion cubic metres of gas. The UK government is also pursuing deals with Norway and Qatar. If these sources of LNG are secured, energy price rises in the winter could be capped. These deals, and winter weather conditions will impact energy prices greatly, and will remain a watchpoint going forward.

What does this mean for fertiliser prices?

As natural gas makes up around 60-80% of fertiliser production costs in Europe it’s important to consider the impact energy prices will have on fertiliser costs. As is well known, the rising natural gas costs led some fertiliser manufacturers to halt or reduce production. CF industries paused their domestic ammonia production at its Billingham site in August, and as a result, the UK has become more dependent on imported nitrogen fertiliser.

As natural gas prices have been declining over the last couple of months, the price of imported ammonium nitrate has moved sideways, suggesting that global demand for fertiliser remains strong. Octobers imported AN price sits at £870.00/t, no change from September, and up 48% on the year.

Discussions around the Ukrainian export deal could also see Russia exporting more of their own fertiliser and grain. This, combined with volatile gas prices and uncertainty around domestic natural gas supply, will be something to monitor regarding fertiliser price direction.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.