New-crop wheat prices ahead of average as planting gets underway: Grain market daily

Tuesday, 14 September 2021

Market commentary

- UK feed wheat futures (Nov-21) contract traded in a very tight range of £1.50/t throughout yesterday. It closed at £183.00/t, unchanged from Friday.

- Statistics Canada have cut their 2021 wheat and canola production estimates this morning. All wheat is now pegged at 21.7Mt. Canadian canola production is estimated at 12.8Mt, the smallest crop since 2008. These estimates come in below the USDA’s prediction in last week’s report by 1.3Mt and 1.2Mt respectively.

- France has also cut its soft wheat production estimates. The Farm Ministry now pegs 2021 wheat production at 36.1Mt, down from last month’s estimate of 36.7Mt but up from 2020’s poor harvest.

- US grain exports are well back from usual trade as ports struggle with damages caused by storm Ida. Hurricane Nicholas is now apparent but is expected to cause less damage than Ida, although will bring heavy rainfall. This could delay the recovery of already struggling ports.

New-crop wheat prices ahead of average as planting gets underway

With the 2021 US wheat harvest almost complete, autumn/winter planting is now getting underway. As at the 12 September, US winter wheat planting for harvest 2022 was 12% complete. This is ahead of both last year and the 5-year average by three and four percentage points respectively.

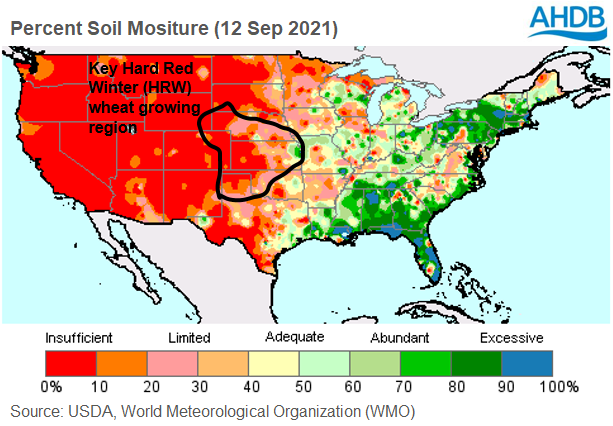

Current conditions are dry following a hot summer. Much of the central plains, where a lot of winter wheat is grown, is marked as having “limited – insufficient” soil moisture according to the World Meteorological Organization (WMO).

Dry conditions at this time of year are not too uncommon and should allow fieldwork to progress at pace. This said, rain will be required to get the crops growing. Last week, the US drought monitor suggested that the key Hard Red Winter (HRW) wheat growing regions, marked on the map above, are at a short-term risk of drought. Short term means typically less than six months, and if confirmed, this would be detrimental to autumn planted crops establishment and development. The 60-day precipitation outlook also shows a high probability of below average rainfall.

What does this mean?

This outlook could offer some support to prices. Yesterday, the new-crop (Dec-22) Chicago wheat futures contract closed at $257.08/t. This is $61.98/t above the previous 5 contracts average at the same point in the year. The contract recently dropped following bearish news of large ending stocks from the latest USDA world agriculture supply and demand estimates (WASDE) report.

Good planting pace often also pressures prices. But, with limited rain on the horizon and already dry soils, there could be some underlying support in the short-medium term.

UK new-crop prices are also relatively high. Nov-22 UK feed wheat futures closed yesterday at £174.50/t. This is £27.27/t above the previous 5 contracts average at the same point in the year.

As the UK planting programme is underway soil moistures will be one to watch here too. But even if autumn planting goes well, and into good conditions, UK markets could also find support from US markets, so will be one to keep an eye on.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.