OSR rises despite crude hitting an 18 year low: Grain Market Daily

Tuesday, 31 March 2020

Market Commentary

- Brent crude oil futures closed at an 18 year low yesterday due to falling demand but increased production. Global oil demand is expected to contract at least 20% due to the coronavirus pandemic (Refinitiv), while increased production from Russia and Saudi Arabia is also due to be available to the market from next month.

- US maize futures fell in response, with the May-20 contract down $1.57/t from Friday’s close to $134.64/t. Maize and oil prices are linked as Peter discussed in last week’s Analyst’s Insight, due to the large amount of maize used to produce ethanol, which is blended into road transport fuels.

- UK May-20 feed wheat futures closed at £157.55/t yesterday, down £1.75/t from Friday’s close. Maize sets the floor price to global grain prices, so the decline in maize prices dragged UK wheat prices lower.

OSR rises despite crude hitting an 18 year low

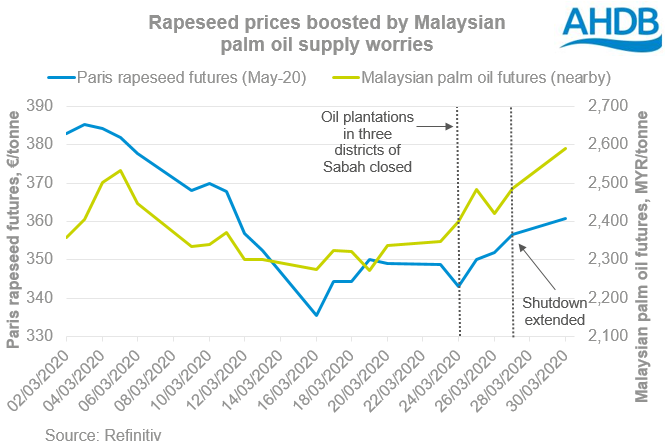

Paris rapeseed futures rose yesterday as the coronavirus temporarily curbs Malaysian palm oil production, despite Brent crude oil futures falling to an 18 year low.

Yesterday, Paris rapeseed futures (May-20) closed at €360.75/t, up €4.25/t from Friday’s close. This followed gains in palm oil prices.

Malaysian palm oil futures (nearby contract) gained 4% after production of palm oil in parts of the country’s top producing state, Sabah, was stopped until 14 April. Last week, some plantation workers tested positive for the coronavirus and the state government closed plantations in three districts of Sabah until 31 March to try to control the virus. Yesterday the shutdown was extended until 14 April and to six districts.

In contrast, nearby Brent crude oil futures fell $2.34/barrel yesterday to $22.59/barrel, the lowest price since 2002. Oil prices have fallen sharply in recent weeks, due lower demand but higher production.

Global oil demand is expected to shrink by at least 20% due to the coronavirus pandemic (Refinitiv). Meanwhile, major oil producers, Russia and Saudi Arabia are both increasing their output as part of a wider dispute, as Anthony covered here. The higher output will be available to the market from next month.

The price of crude oil often influences rapeseed prices, due to the amount of vegetable oils, including rapeseed oil, being used to produce bio-diesel. Yesterday the likely drop in palm oil production proved a bigger influence on vegetable oil and so rapeseed prices, than crude oil.

Volatility in both crude oil and palm oil prices will influence rapeseed prices in the weeks ahead, along with crop condition information. This morning it emerged that Russia and the US have agreed to talks about energy prices, which seems to be offering some support to crude oil prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.