Prospects for dairy market prices – what does the rest of the year hold?

Thursday, 28 May 2020

By Patty Clayton

Prices paid for milk to farmers are ultimately determined by the market value of manufactured dairy products. The loss of demand for dairy from the foodservice sector, and the fact that this coincided with the seasonal peak in milk production in the Northern Hemisphere, had a huge impact on EU and UK dairy product pricing in recent months.

The expectation that demand will return in the second half of the year, albeit on a gradual basis, means there may be some improvements in market values for dairy products in the second half of the year. However, any build-up of product inventories or reduced consumer buying due to low economic growth may limit this recovery.

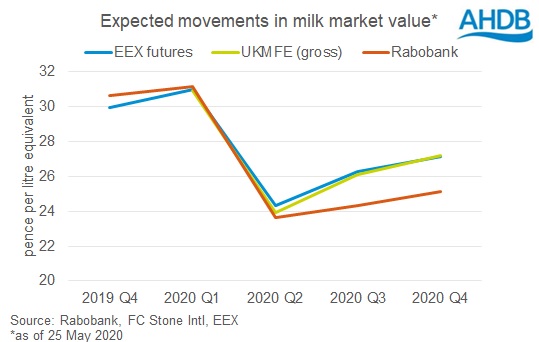

Using price quotations from Rabobank, EEX futures contracts and the FC Stone Intl UK Milk Futures Equivalent (UKMFE), we’ve looked at how the market value of milk for butter and skim milk powder (i.e. the AMPE equivalent) is expected to move in through the remainder of the year.

The second quarter of 2020 sees the largest impact on dairy product pricing due to the significant drop in both butter and SMP prices in April. As such, the AMPE equivalent values from EEX, FC Stone and Rabobank fell by between 22% and 24% between Q1 and Q2.

In the second half of the year, all three sources show a slow recovery in product values, although they remain below pre-Covid levels at the end of the year. The two EU based series show a quicker recovery, possibly reflecting the change in sentiment due to the opening of PSA, easing of lockdown conditions and concerns over the current dry weather impacting milk production in some key regions.

These outcomes are based on assumptions around demand levels, the rate at which markets recover, milk production growth through the year and the level of stock build-up – all of which remain uncertain.

The main assumptions underlying the outlooks are:

- Increased product inventories resulting from seasonally increased milk deliveries across the EU and lower market demand.

- EU milk deliveries in Q1 2020 were 1.0% higher year-on-year, with production in April expected to remain elevated. Growth for the remainder of the year is expected to be lower at 0.7% (revised down from 0.9%) as a result of lower farmgate milk prices and dry weather conditions in some key producing countries.

- A phased return of foodservice demand in the second half of the year, limited by the continuing impacts of social distancing and the hit to consumer incomes from lower economic growth. Demand levels at the end of the year are expected to reach 80% of previous levels.

- Lower import demand volumes due to lower economic growth in key importing nations (China, US) and reduced purchasing power in oil-dependant countries.

The potential impact on yields of drought conditions in the UK, and other key dairying regions in the EU, could prompt a quicker recovery than currently expected, as product availability would be lower.

Alternatively, delays to the reopening of the foodservice and hospitality sectors, or weaker consumer demand, could delay any price recovery.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.